Sls Subordination Requirements Form

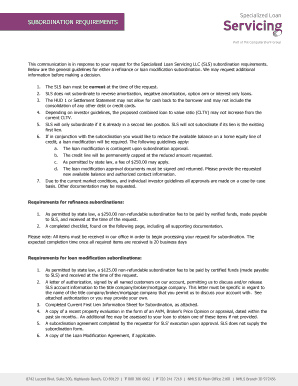

What are the SLS subordination requirements?

The SLS subordination requirements refer to the specific conditions and documentation needed for a lender to subordinate its lien position on a property. This process is crucial in real estate transactions, particularly when refinancing or obtaining new loans. Subordination allows a new lender to take a higher priority over an existing loan, which can be essential for securing additional financing. Understanding these requirements is vital for both borrowers and lenders to ensure compliance and facilitate smoother transactions.

How to use the SLS subordination requirements

Utilizing the SLS subordination requirements involves several key steps. First, identify the existing loan and the lender involved. Next, gather all necessary documentation, including the original loan agreement and any amendments. It is essential to communicate with the current lender to obtain their consent for subordination. Once all parties are in agreement, complete the required forms and submit them for processing. This ensures that the new lender can proceed with their financing while maintaining legal compliance.

Steps to complete the SLS subordination requirements

Completing the SLS subordination requirements involves a systematic approach:

- Review the existing loan documents to understand the terms and conditions.

- Contact the current lender to discuss the subordination process.

- Gather all necessary documentation, including the original loan agreement and any supporting documents.

- Complete the subordination request form accurately, ensuring all information is correct.

- Submit the form along with any required documentation to the current lender for approval.

- Follow up with the lender to confirm the status of the subordination request.

Key elements of the SLS subordination requirements

Several key elements define the SLS subordination requirements. These include:

- Documentation: Comprehensive paperwork is essential, including the original loan agreement and any amendments.

- Approval from existing lenders: The current lender must consent to the subordination, which often involves their review of the new loan terms.

- Priority of liens: Understanding how the subordination affects the priority of liens is crucial for all parties involved.

- Compliance with state regulations: Each state may have specific laws governing subordination, which must be adhered to.

Legal use of the SLS subordination requirements

The legal use of the SLS subordination requirements ensures that all transactions comply with relevant laws and regulations. This includes adherence to federal and state laws governing real estate financing and the proper execution of documents. Utilizing a reliable eSigning platform can enhance the legal standing of the documents involved, as it provides secure and verifiable signatures that meet legal standards. Ensuring compliance with these requirements protects all parties and facilitates smoother transactions.

Who issues the SLS subordination requirements?

The SLS subordination requirements are typically issued by the lending institution currently holding the mortgage or lien on the property. These requirements may also be influenced by state laws and regulations that govern real estate transactions. It is important for borrowers to consult with their lender to obtain the specific requirements necessary for their situation, as these can vary based on the lender's policies and the nature of the loan.

Quick guide on how to complete sls subordination requirements

Prepare Sls Subordination Requirements effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle Sls Subordination Requirements on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based task today.

The easiest way to edit and eSign Sls Subordination Requirements without hassle

- Locate Sls Subordination Requirements and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to secure your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate reprinting documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Sls Subordination Requirements and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sls subordination requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the SLS subordination requirements in airSlate SignNow?

The SLS subordination requirements refer to the guidelines set forth for proper prioritization of documents during the signing process. airSlate SignNow adheres to these requirements, ensuring that all your signing tasks are effectively managed according to established protocols. This enhances the security and validity of your documents.

-

How does airSlate SignNow ensure compliance with SLS subordination requirements?

airSlate SignNow implements robust security measures and workflow configurations to ensure compliance with SLS subordination requirements. Our software facilitates an organized signing process, which mitigates risks associated with document handling and helps maintain your organization’s compliance standards.

-

What pricing plans does airSlate SignNow offer for meeting SLS subordination requirements?

airSlate SignNow offers several pricing plans tailored to meet different business needs while ensuring compliance with SLS subordination requirements. These plans vary based on features and user capacity, allowing businesses of all sizes to find a suitable option that aids in efficient document management.

-

What features does airSlate SignNow provide to support SLS subordination requirements?

airSlate SignNow provides several features that aid in meeting SLS subordination requirements, including document templates, reusable forms, and powerful signing workflows. These tools simplify the e-signing process while ensuring that priority and roles are effectively managed for compliance.

-

Can airSlate SignNow integrate with other software to manage SLS subordination requirements?

Yes, airSlate SignNow seamlessly integrates with various third-party applications that facilitate the management of SLS subordination requirements. This integration allows for enhanced workflows, making it easier to sync data and maintain organization in document handling.

-

How does airSlate SignNow benefit businesses concerned with SLS subordination requirements?

By using airSlate SignNow, businesses can efficiently manage their document signing processes while adhering to SLS subordination requirements. The platform's user-friendly interface and robust features help reduce turnaround times and increase operational efficiency, contributing to better business performance.

-

Is there customer support available for questions regarding SLS subordination requirements?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any inquiries related to SLS subordination requirements. Our knowledgeable team is available to guide you through compliance issues and ensure you're making the most of our platform.

Get more for Sls Subordination Requirements

Find out other Sls Subordination Requirements

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile