Blank 1040 Tax Form 2012

What is the Blank 1040 Tax Form

The Blank 1040 Tax Form, often referred to as the IRS Form 1040, is a standard federal income tax form used by individuals to report their annual income and calculate their tax liability. This form is essential for U.S. taxpayers, as it serves as the primary document for filing personal income taxes. The form captures various sources of income, deductions, and credits, allowing taxpayers to determine their tax obligations accurately. Understanding the structure and purpose of the Blank 1040 Tax Form is crucial for effective tax filing.

Steps to Complete the Blank 1040 Tax Form

Completing the Blank 1040 Tax Form involves several key steps to ensure accuracy and compliance with IRS regulations. Here’s a simplified process:

- Gather Documentation: Collect all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: List all sources of income, including wages, interest, dividends, and any other taxable income.

- Claim Deductions and Credits: Identify applicable deductions and credits to reduce your taxable income.

- Calculate Tax Liability: Use the IRS tax tables to determine the amount of tax owed based on your taxable income.

- Sign and Date: Ensure you sign and date the form before submission, as an unsigned form is considered invalid.

How to Obtain the Blank 1040 Tax Form

Obtaining the Blank 1040 Tax Form is straightforward. Taxpayers can access the form through several methods:

- IRS Website: Download the form directly from the official IRS website, where the latest version is always available.

- Local Libraries: Many public libraries offer printed copies of tax forms during tax season.

- Post Offices: Some post offices stock tax forms, including the Blank 1040.

- Tax Preparation Services: Professional tax preparers often provide copies of the form as part of their services.

Legal Use of the Blank 1040 Tax Form

The Blank 1040 Tax Form is legally binding when completed and submitted according to IRS guidelines. It is essential for taxpayers to ensure that all information provided is accurate and truthful. Misrepresentation or errors can lead to penalties, including fines and interest on unpaid taxes. The completed form must be filed by the designated deadline to avoid additional penalties. Understanding the legal implications of submitting the form is crucial for compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Blank 1040 Tax Form are critical for taxpayers to observe. Generally, the deadline for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers can also file for an extension, which typically allows an additional six months to submit the form, but any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Blank 1040 Tax Form. These methods include:

- Online Filing: Many taxpayers choose to file electronically using tax software or through a tax professional, which can expedite processing and reduce errors.

- Mail: The form can be printed and mailed to the appropriate IRS address based on the taxpayer's location and whether a refund is expected.

- In-Person: Some taxpayers may opt to file in person at designated IRS offices, especially if they have questions or need assistance.

Quick guide on how to complete blank 1040 tax form

Complete Blank 1040 Tax Form effortlessly on any gadget

Online document management has gained popularity among organizations and individuals. It presents an ideal eco-conscious alternative to traditional printed and signed materials, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle Blank 1040 Tax Form on any gadget using airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to modify and electronically sign Blank 1040 Tax Form with ease

- Locate Blank 1040 Tax Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Select your preferred method to submit your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Blank 1040 Tax Form and ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct blank 1040 tax form

Create this form in 5 minutes!

How to create an eSignature for the blank 1040 tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

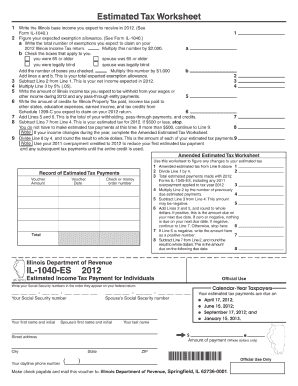

What is il 1040 es and how does it work?

Il 1040 es is an IRS form that helps taxpayers request an extension for filing their individual income tax return. This form allows you to estimate your tax liability and make payments to avoid penalties. By using airSlate SignNow, you can easily eSign and send your il 1040 es documents securely and efficiently.

-

How can airSlate SignNow help with filing il 1040 es?

With airSlate SignNow, you can streamline the process of completing and submitting your il 1040 es form. The platform enables you to fill out and eSign your documents online, signNowly reducing the time spent on paperwork. Additionally, you can track the status of your documents and ensure timely submission.

-

Is airSlate SignNow affordable for submitting il 1040 es?

Yes, airSlate SignNow is a cost-effective solution for handling your il 1040 es. The platform offers competitive pricing plans tailored to different needs, ensuring you can manage your document signing without breaking the bank. This makes it a great choice for individuals and businesses alike.

-

What features of airSlate SignNow assist with il 1040 es filing?

AirSlate SignNow provides features such as customizable templates, secure eSignature capabilities, and real-time tracking, which are all beneficial when working with il 1040 es. These tools enhance the user experience and simplify the process of preparing and submitting your tax forms.

-

Can I integrate airSlate SignNow with other software for my il 1040 es?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting and tax software, making it easy to manage your il 1040 es within your existing workflow. This integration helps streamline your document processes and improves overall efficiency.

-

What benefits do I gain from using airSlate SignNow for il 1040 es?

Using airSlate SignNow for your il 1040 es offers numerous benefits, including enhanced security for your sensitive tax information and improved efficiency in document management. The platform's user-friendly interface also ensures that you can quickly navigate through the eSigning process, making tax time less stressful.

-

Is electronic filing allowed for il 1040 es?

Yes, electronic filing is permitted for il 1040 es forms, and using airSlate SignNow simplifies this process. You can fill out your form online, eSign it instantly, and submit it directly to the IRS. This not only saves time but also helps ensure that your submission is accurate and timely.

Get more for Blank 1040 Tax Form

- Preliminary operating plan template for conditional form

- Enrollment form usable mutual insurance company

- Licensee reporting form state of california dca ca

- Health facility reporting form 8058 health facility reporting form 8058

- 6 form dcs document cover sheet basic information

- Ptosb17 03 13 form

- Inz1178 form

- Delaware state fire school registration form delaware state fire school registration form

Find out other Blank 1040 Tax Form

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document