M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn Form

What is the M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn

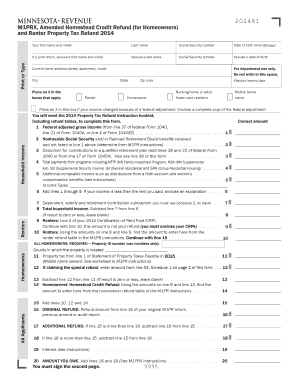

The M1PRX, Amended Property Tax Refund Return, is a specific form used in Minnesota for taxpayers who need to amend their previously filed property tax refund returns. This form allows individuals to correct errors or make adjustments to their initial submissions, ensuring that they receive the accurate refund amount they are entitled to. It is essential for taxpayers to understand the purpose of this form, as it plays a crucial role in the property tax refund process.

Steps to complete the M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn

Completing the M1PRX form involves several key steps:

- Gather necessary documentation, including your original property tax refund return and any supporting documents that justify the amendments.

- Carefully fill out the M1PRX form, ensuring that all information is accurate and matches the supporting documents.

- Review the completed form for any errors or omissions before submission.

- Submit the form either electronically or via mail, depending on your preference and the guidelines provided by the Minnesota Department of Revenue.

Legal use of the M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn

The M1PRX form is legally binding once it is completed and submitted according to the regulations set forth by the Minnesota Department of Revenue. To ensure that the amendments are recognized, it is crucial to adhere to the legal requirements for eSignatures and document submission. Utilizing a reliable electronic signature platform can enhance the legal validity of your submission, providing you with the necessary compliance with state regulations.

Required Documents

When preparing to file the M1PRX, it is important to have the following documents on hand:

- Your original property tax refund return.

- Any relevant receipts or documentation that support the changes you are making.

- Identification information, such as your Social Security number or taxpayer identification number.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the M1PRX is crucial to ensure timely processing. Typically, the amended return must be filed within three years of the original filing date. Keep track of any specific deadlines set by the Minnesota Department of Revenue to avoid penalties or delays in receiving your refund.

Form Submission Methods (Online / Mail / In-Person)

The M1PRX can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Minnesota Department of Revenue website, which may require creating an account.

- Mailing the completed form to the appropriate address as specified in the instructions.

- In-person submission at designated Minnesota Department of Revenue offices, if available.

Quick guide on how to complete m1prx amended property tax refund return minnesota revenue state mn

Complete M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn effortlessly on any device

Online document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn with ease

- Find M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important parts of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you would like to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1prx amended property tax refund return minnesota revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1PRX, Amended Property Tax Refund Return in Minnesota?

The M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn is a document used by residents to correct errors on their previously filed property tax refund returns. It allows taxpayers to amend their original claims for refunds they may be eligible for. Utilizing this form correctly can ensure you receive the maximum refund available under Minnesota state law.

-

How do I complete the M1PRX, Amended Property Tax Refund Return?

To complete the M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn, you need to gather your previous tax documents and follow the guidelines provided by the Minnesota Department of Revenue. Fill out the form with the corrected information and submit it to the appropriate tax authority. If you need assistance, consider using airSlate SignNow to streamline the eSigning and submission process.

-

What features does airSlate SignNow provide for handling M1PRX submissions?

airSlate SignNow offers a user-friendly platform that allows you to send, eSign, and track your M1PRX submissions easily. With customizable templates and real-time notifications, you can manage your amended returns efficiently. Additionally, its compliance with security standards ensures that your sensitive tax information remains protected.

-

Is there a cost associated with using airSlate SignNow for the M1PRX process?

Yes, airSlate SignNow is a cost-effective solution for managing your documents, including the M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn. While there is a subscription fee, the platform's features can save you time and enhance your document handling experience, making it an excellent investment for businesses and individuals alike.

-

How quickly can I expect to receive my refund after submitting the M1PRX?

The processing time for the M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn can vary, typically ranging from 8 to 12 weeks. Once your form is submitted, you can track its status through the Minnesota Department of Revenue's website. Using airSlate SignNow can help accelerate your submission process, potentially reducing your wait time.

-

What integrations does airSlate SignNow offer that can assist with the M1PRX return?

airSlate SignNow integrates seamlessly with various platforms, including CRM systems and cloud storage services, which can simplify your workflow for completing the M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn. These integrations allow you to import necessary information directly from your existing systems, minimizing errors and improving efficiency.

-

Can I save my M1PRX application draft in airSlate SignNow?

Yes, airSlate SignNow allows you to save drafts of your M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn. This feature gives you the flexibility to complete the form at your convenience before finalizing and eSigning. You can return to your saved draft at any time, ensuring you can gather all necessary information without pressure.

Get more for M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn

Find out other M1PRX, Amended Property Tax Refund Return Minnesota Revenue State Mn

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile