Form 4790 United States Importers Cigarette Sales to 2024-2026

What is the Form 4790 United States Importers Cigarette Sales To

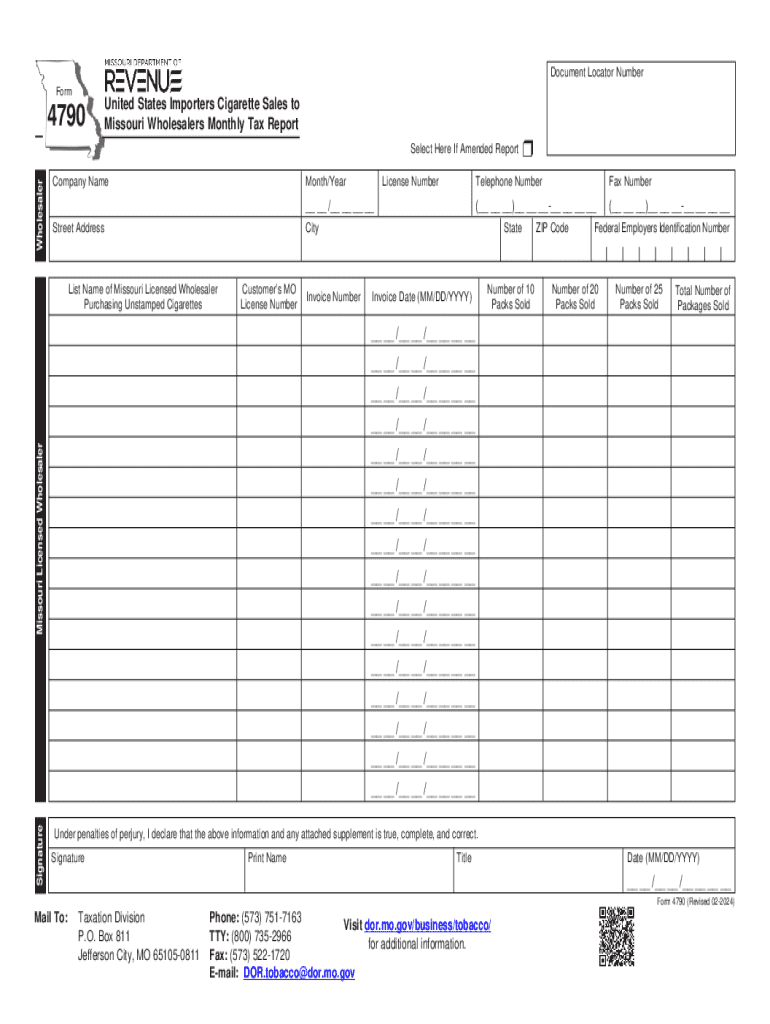

The Form 4790 is a crucial document for businesses involved in the importation of cigarettes into the United States. This form is specifically designed for importers to report their sales of cigarettes to various entities. It serves as a means to ensure compliance with federal regulations governing tobacco products, including taxation and distribution. By accurately completing this form, importers can provide necessary information to the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) and other relevant authorities.

How to use the Form 4790 United States Importers Cigarette Sales To

Using the Form 4790 involves several key steps. First, importers must gather all relevant sales data, including quantities sold, the identity of the purchasers, and the dates of transactions. This information should be entered accurately into the designated fields of the form. It is essential to ensure that all data matches supporting documentation, such as invoices and shipping records. Once completed, the form must be submitted to the appropriate regulatory agency to fulfill legal obligations.

Steps to complete the Form 4790 United States Importers Cigarette Sales To

Completing the Form 4790 requires careful attention to detail. The following steps outline the process:

- Gather all necessary sales documentation, including invoices and shipping records.

- Fill in the importer’s details, including name, address, and contact information.

- Enter the total quantity of cigarettes sold during the reporting period.

- Provide details about the purchasers, including their names and addresses.

- Review the completed form for accuracy before submission.

Legal use of the Form 4790 United States Importers Cigarette Sales To

The legal use of the Form 4790 is essential for compliance with federal laws regarding tobacco imports. Importers are required to submit this form to report their cigarette sales accurately. Failure to do so can result in penalties, including fines and potential legal action. It is important for businesses to understand the legal implications of their reporting obligations and to maintain proper records to support their submissions.

Filing Deadlines / Important Dates

Timely filing of the Form 4790 is critical to avoid penalties. Importers should be aware of specific deadlines for submission, which can vary based on the reporting period. Typically, forms must be filed quarterly or annually, depending on the volume of sales. Keeping track of these deadlines ensures that businesses remain compliant with federal regulations and avoid any disruptions in their operations.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form 4790 can lead to significant penalties. These may include fines imposed by federal authorities, as well as potential legal consequences for failing to report sales accurately. Importers should be diligent in their record-keeping and ensure that all submissions are complete and accurate to mitigate the risk of penalties.

Create this form in 5 minutes or less

Find and fill out the correct form 4790 united states importers cigarette sales to

Create this form in 5 minutes!

How to create an eSignature for the form 4790 united states importers cigarette sales to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4790 United States Importers Cigarette Sales To?

Form 4790 United States Importers Cigarette Sales To is a document required for reporting cigarette sales by importers in the United States. This form helps ensure compliance with federal regulations and provides necessary information to the authorities. Understanding this form is crucial for businesses involved in the importation of cigarettes.

-

How can airSlate SignNow help with Form 4790 United States Importers Cigarette Sales To?

airSlate SignNow simplifies the process of completing and submitting Form 4790 United States Importers Cigarette Sales To by providing an easy-to-use platform for eSigning and document management. Our solution allows you to fill out the form electronically, ensuring accuracy and compliance. Additionally, you can track the status of your submissions in real-time.

-

What are the pricing options for using airSlate SignNow for Form 4790?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the completion and submission of Form 4790 United States Importers Cigarette Sales To, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing Form 4790?

With airSlate SignNow, you gain access to features such as customizable templates, secure eSigning, and document tracking specifically for Form 4790 United States Importers Cigarette Sales To. These features streamline the process, reduce errors, and enhance collaboration among team members. Our platform is designed to make document management efficient and effective.

-

Are there any integrations available with airSlate SignNow for Form 4790?

Yes, airSlate SignNow offers various integrations with popular business applications that can enhance your workflow when dealing with Form 4790 United States Importers Cigarette Sales To. These integrations allow you to connect your existing tools and automate processes, making it easier to manage your documentation and compliance needs.

-

What are the benefits of using airSlate SignNow for Form 4790?

Using airSlate SignNow for Form 4790 United States Importers Cigarette Sales To provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform ensures that your documents are securely stored and easily accessible, allowing you to focus on your core business activities. Additionally, the eSigning feature speeds up the approval process.

-

Is airSlate SignNow secure for handling Form 4790?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Form 4790 United States Importers Cigarette Sales To is handled with the utmost care. We utilize advanced encryption and security protocols to protect your sensitive information. You can trust our platform to keep your documents safe and secure.

Get more for Form 4790 United States Importers Cigarette Sales To

- Ju 110100 notice of hearing washington form

- Wa declaration blank form

- Ju 110300 subpoena washington form

- Washington subpoena form

- Wa subpoena form

- Washington motion declaration 497430044 form

- Ju 110410 order for change of judge washington form

- Ju 120100 petition for review of out of home placement washington form

Find out other Form 4790 United States Importers Cigarette Sales To

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document