Form it 2658 NYS Attachment to Form it 2658 Report of Estimated Personal Income Tax for Nonresident Individuals Year 2024

Understanding the Form IT 2658 NYS for Nonresident Individuals

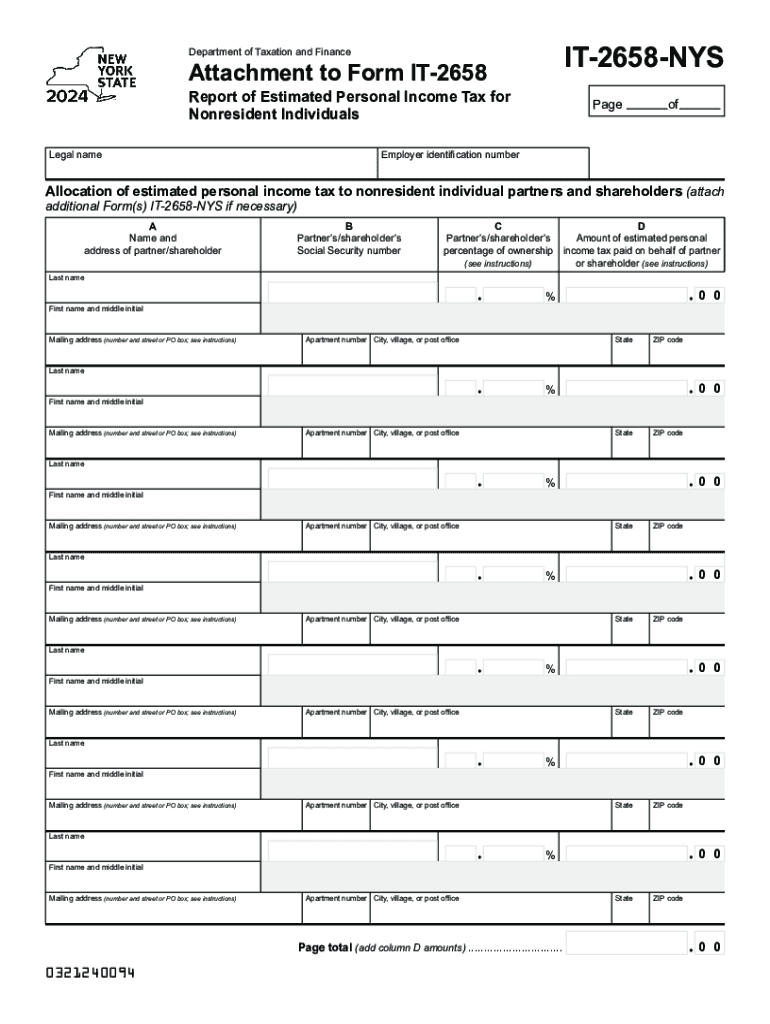

The Form IT 2658 NYS, officially known as the Attachment to Form IT 2658 Report of Estimated Personal Income Tax for Nonresident Individuals, is specifically designed for nonresidents who need to report their estimated personal income tax obligations to the state of New York. This form is essential for individuals who earn income in New York but do not reside there. It helps ensure compliance with state tax laws and provides a clear framework for reporting income accurately.

Steps to Complete the Form IT 2658 NYS

Completing the Form IT 2658 NYS involves several key steps:

- Gather necessary documentation, including income statements and any relevant tax information.

- Fill out personal identification details, ensuring accuracy in your name, address, and Social Security number.

- Report your estimated income for the year, breaking it down by source if necessary.

- Calculate your estimated tax liability based on New York’s nonresident tax rates.

- Review your entries for accuracy before submission.

How to Obtain the Form IT 2658 NYS

The Form IT 2658 NYS can be acquired through various means. It is available for download on the New York State Department of Taxation and Finance website. Additionally, individuals can request a physical copy by contacting the department directly. Ensure you have the most current version to avoid any compliance issues.

Filing Deadlines for Form IT 2658 NYS

It is crucial to adhere to the filing deadlines associated with Form IT 2658 NYS. Typically, the estimated tax payments are due quarterly, with specific dates set by the New York State Department of Taxation and Finance. Failing to meet these deadlines may result in penalties or interest charges, so keeping track of these dates is essential for compliance.

Key Elements of the Form IT 2658 NYS

The Form IT 2658 NYS includes several key elements that must be completed accurately:

- Personal identification information, including your name and address.

- Details regarding your income sources and estimated amounts.

- Calculation of your estimated tax liability based on applicable rates.

- Signature to certify the information provided is accurate and complete.

Legal Use of the Form IT 2658 NYS

The legal use of Form IT 2658 NYS is essential for nonresident individuals to fulfill their tax obligations in New York. This form serves as an official declaration of estimated income and tax liability, which is necessary for compliance with state tax laws. Proper use of this form helps prevent legal repercussions and ensures that individuals meet their tax responsibilities.

Create this form in 5 minutes or less

Find and fill out the correct form it 2658 nys attachment to form it 2658 report of estimated personal income tax for nonresident individuals year

Create this form in 5 minutes!

How to create an eSignature for the form it 2658 nys attachment to form it 2658 report of estimated personal income tax for nonresident individuals year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2658nys individuals form?

The 2658nys individuals form is a specific document designed for individuals in New York State to facilitate various administrative processes. It is essential for ensuring compliance with state regulations and can be easily completed and submitted using airSlate SignNow.

-

How can I fill out the 2658nys individuals form using airSlate SignNow?

Filling out the 2658nys individuals form with airSlate SignNow is straightforward. Simply upload the form to our platform, fill in the required fields, and use our eSignature feature to sign it electronically, making the process quick and efficient.

-

Is there a cost associated with using airSlate SignNow for the 2658nys individuals form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. You can choose a plan that suits your requirements for managing the 2658nys individuals form and other documents, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the 2658nys individuals form?

airSlate SignNow provides a range of features for the 2658nys individuals form, including customizable templates, secure eSigning, and document tracking. These features streamline the process, making it easier for users to manage their forms efficiently.

-

Can I integrate airSlate SignNow with other applications for the 2658nys individuals form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow seamlessly. This means you can easily manage the 2658nys individuals form alongside other tools you use in your business.

-

What are the benefits of using airSlate SignNow for the 2658nys individuals form?

Using airSlate SignNow for the 2658nys individuals form provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the signing process, ensuring that you can focus on what matters most.

-

Is airSlate SignNow secure for handling the 2658nys individuals form?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption and security protocols to protect your data, ensuring that your 2658nys individuals form and other documents are safe and secure.

Get more for Form IT 2658 NYS Attachment To Form IT 2658 Report Of Estimated Personal Income Tax For Nonresident Individuals Year

- Ju 050650 notice of hearing on at risk youth petition washington form

- Risk youth petition form

- Ju 050710 order of disposition at risk youth washington form

- Ju 050800 order on review hearing at risk youth washington form

- Motion show cause form

- Hearing contempt 497430092 form

- Ju 050920 order on hearing regarding contempt washington form

- Ju 060100 advice about diversion when confinement is possible washington form

Find out other Form IT 2658 NYS Attachment To Form IT 2658 Report Of Estimated Personal Income Tax For Nonresident Individuals Year

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed