Value Added Tax VAT Refunds for DIY Housebuilders Claim Form for New Houses 2022-2026

Understanding the VAT Refunds for DIY Housebuilders Claim Form

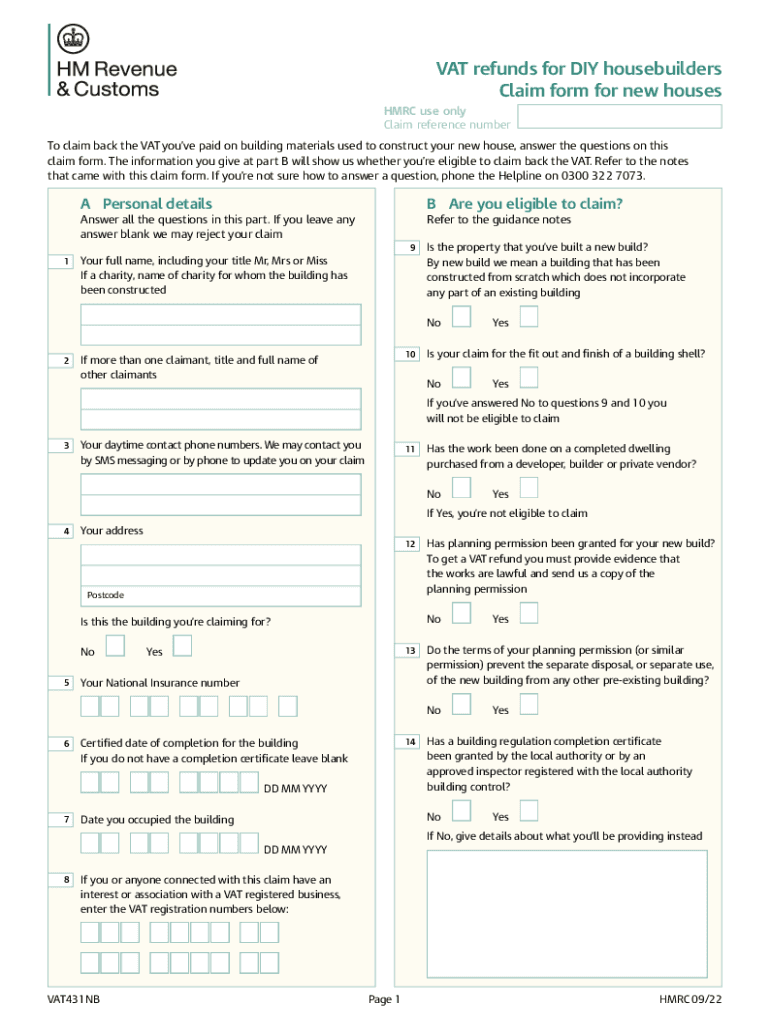

The VAT431NB form is designed for individuals who are constructing new homes and wish to claim back the Value Added Tax (VAT) incurred on their building materials and services. This form is particularly relevant for DIY housebuilders who are taking on the project themselves, allowing them to reclaim VAT that can significantly reduce the overall cost of construction. The form is essential for ensuring compliance with HMRC regulations and facilitates the reimbursement process.

Steps to Complete the VAT431NB Form

Filling out the VAT431NB form requires careful attention to detail to ensure accuracy and compliance. Here are the steps to follow:

- Gather necessary documents, including invoices and receipts for materials and services purchased.

- Fill in your personal details, including your name, address, and contact information.

- Provide details about the property being constructed, including the address and type of building.

- List all eligible expenses, ensuring that each entry includes the date, supplier, and amount paid.

- Sign and date the form to certify that the information provided is accurate and complete.

Eligibility Criteria for the VAT431NB Form

To successfully claim VAT refunds using the VAT431NB form, certain eligibility criteria must be met. These include:

- The property must be a new build, constructed for residential purposes.

- The claimant must be the individual who undertook the building work.

- All materials and services claimed must be directly related to the construction of the new home.

- The claim must be submitted within the time limits set by HMRC, typically within three months of the completion of the building work.

Required Documents for the VAT431NB Form

When submitting the VAT431NB form, it is crucial to include supporting documentation to substantiate your claim. Required documents typically include:

- Invoices from suppliers detailing the VAT paid on materials.

- Receipts for services rendered during the construction process.

- A declaration of the construction project, confirming it meets the criteria for VAT refunds.

Form Submission Methods for the VAT431NB

The VAT431NB form can be submitted through various methods to accommodate different preferences:

- Online submission through the HMRC website, which may expedite the processing time.

- Mailing a printed version of the form to the appropriate HMRC address.

- In-person submission at designated HMRC offices, if available in your area.

Legal Use of the VAT431NB Form

The VAT431NB form is legally recognized as a valid claim for VAT refunds under UK tax law. To ensure compliance, it is important to:

- Follow all guidelines set forth by HMRC regarding the completion and submission of the form.

- Maintain accurate records of all transactions related to the construction project.

- Be aware of any updates or changes to VAT regulations that may affect eligibility or submission processes.

Quick guide on how to complete value added tax vat refunds for diy housebuilders claim form for new houses

Complete Value Added Tax VAT Refunds For DIY Housebuilders Claim Form For New Houses effortlessly on any gadget

Digital document administration has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without holdups. Manage Value Added Tax VAT Refunds For DIY Housebuilders Claim Form For New Houses on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The most efficient method to modify and electronically sign Value Added Tax VAT Refunds For DIY Housebuilders Claim Form For New Houses seamlessly

- Locate Value Added Tax VAT Refunds For DIY Housebuilders Claim Form For New Houses and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive details using the tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal value as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced papers, tedious form searches, or errors that require reprinting documents. airSlate SignNow fulfills your document management needs in just a few clicks from any preferred device. Modify and electronically sign Value Added Tax VAT Refunds For DIY Housebuilders Claim Form For New Houses and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct value added tax vat refunds for diy housebuilders claim form for new houses

Create this form in 5 minutes!

How to create an eSignature for the value added tax vat refunds for diy housebuilders claim form for new houses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the vat431nb word line form?

The vat431nb word line form is a specific document format used for VAT reporting and can be easily managed with airSlate SignNow. This form allows businesses to maintain compliance while simplifying the process of electronic signatures for official documents.

-

How does airSlate SignNow simplify the vat431nb word line form process?

airSlate SignNow streamlines the completion of the vat431nb word line form by providing an intuitive interface that minimizes paperwork. With features like templates and reusable fields, users can efficiently fill out and eSign this form, saving valuable time and reducing errors.

-

Can I integrate the vat431nb word line form with other software?

Yes, airSlate SignNow offers integrations with various software platforms, enabling seamless access to the vat431nb word line form across your tools. This interconnected experience enhances productivity and ensures that all your documents are managed within one ecosystem.

-

Is there a cost associated with using the vat431nb word line form on airSlate SignNow?

airSlate SignNow provides a cost-effective solution for handling the vat431nb word line form, with flexible pricing plans to suit different business needs. You can choose from various subscription options to ensure you're only paying for the features you need to effectively manage your documentation.

-

What benefits does airSlate SignNow offer for the vat431nb word line form?

By using airSlate SignNow for the vat431nb word line form, businesses can enhance efficiency, eliminate paper waste, and ensure secure signing. The platform also provides tracking features that allow users to monitor the status of their forms in real-time.

-

Are there any mobile capabilities for the vat431nb word line form?

Absolutely! airSlate SignNow offers mobile functionality that enables users to complete and eSign the vat431nb word line form on the go. This feature ensures that business processes remain uninterrupted, whether in the office or out in the field.

-

How secure is the vat431nb word line form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your information, including the completed vat431nb word line form, is protected with advanced encryption methods and compliance certifications, ensuring that sensitive data remains confidential and secure.

Get more for Value Added Tax VAT Refunds For DIY Housebuilders Claim Form For New Houses

- Nsa health screening form

- Neutrasal prescription form 456764583

- W4 fillable form

- Construction site visitor waiver form

- Cuna mutual life insurance change beneficiary form

- 576 d los angeles county assessor assessor lacounty form

- Fillable online assessor lacounty vessel property statement form

- Employees withholding exemption certificaterevised form

Find out other Value Added Tax VAT Refunds For DIY Housebuilders Claim Form For New Houses

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later