VAT431NB Form and Notes VAT Refund for DIY Housebuildings Claim Form and Notes for New Houses 2019

What is the VAT431NB form?

The VAT431NB form is a specific document used in the United States for claiming VAT refunds related to DIY housebuilding projects. This form is particularly relevant for individuals who are constructing new homes and wish to recover VAT incurred on eligible materials and services. By utilizing this form, DIY housebuilders can ensure they are compliant with tax regulations while effectively managing their finances during construction.

How to use the VAT431NB form

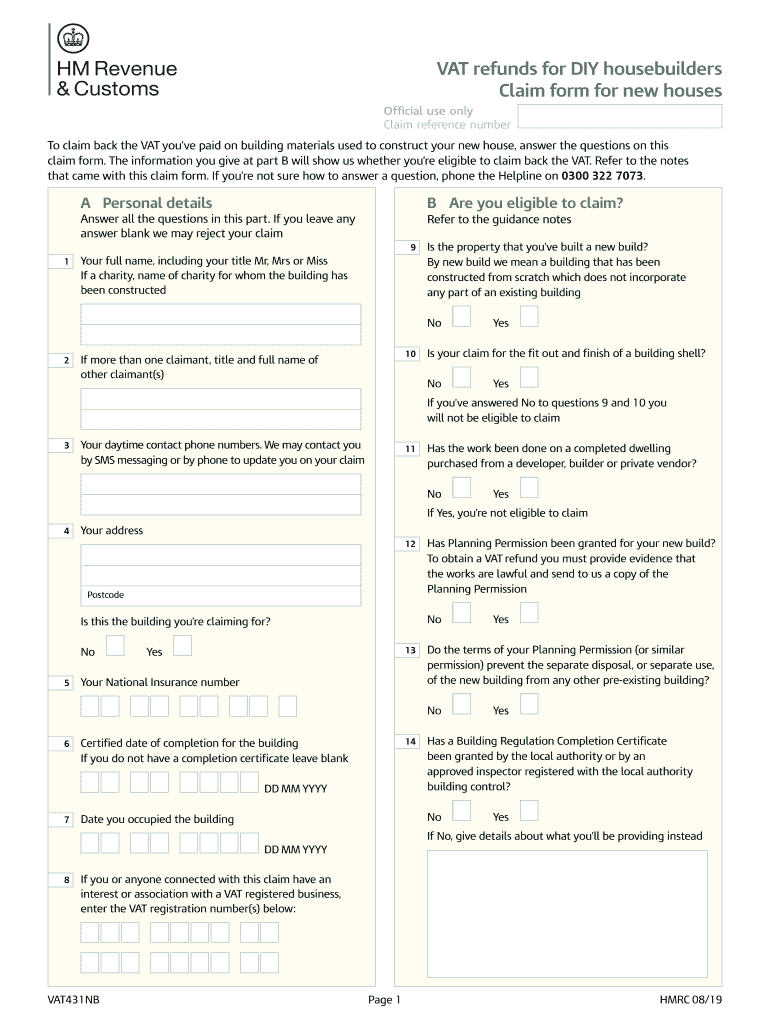

Using the VAT431NB form involves several straightforward steps. First, gather all relevant invoices and receipts that detail the VAT paid on materials and services used in your DIY housebuilding project. Next, accurately fill out the form with your personal details, project information, and the total VAT amount you are claiming. It is essential to ensure that all information is correct and complete to avoid delays in processing your claim.

Steps to complete the VAT431NB form

Completing the VAT431NB form requires attention to detail. Begin by entering your name and contact information at the top of the form. Then, provide specific details about your housebuilding project, including the address and start date. Next, list all items for which you are claiming VAT refunds, ensuring to include the respective VAT amounts. Finally, review the form for accuracy, sign it, and submit it as instructed.

Key elements of the VAT431NB form

The key elements of the VAT431NB form include the applicant's personal information, project details, and a detailed breakdown of VAT claims. It is crucial to include accurate data for each section, as this will facilitate a smoother review process. Additionally, ensuring compliance with all required documentation, such as receipts and invoices, is vital for the legitimacy of the claim.

Eligibility criteria for the VAT431NB form

To be eligible to use the VAT431NB form, applicants must be individuals undertaking a DIY housebuilding project for a new home. The project must meet specific criteria set by tax authorities, including the type of materials purchased and the nature of the construction work. Understanding these eligibility requirements is essential for a successful claim.

Form submission methods

The VAT431NB form can be submitted through various methods, including online submission, mail, or in-person delivery to the appropriate tax authority. Each submission method has its guidelines and requirements, so it is important to choose the one that best suits your needs and ensures timely processing of your claim.

Required documents for the VAT431NB form

When submitting the VAT431NB form, several documents are required to support your claim. These typically include invoices and receipts that detail the VAT paid on eligible purchases, proof of identity, and any additional documentation that may be requested by the tax authority. Having these documents organized and ready will help streamline the submission process.

Quick guide on how to complete vat431nb form and notes vat refund for diy housebuildings claim form and notes for new houses

Easily Prepare VAT431NB Form And Notes VAT Refund For DIY Housebuildings Claim Form And Notes For New Houses on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your paperwork quickly without delays. Manage VAT431NB Form And Notes VAT Refund For DIY Housebuildings Claim Form And Notes For New Houses on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Simplest Way to Edit and eSign VAT431NB Form And Notes VAT Refund For DIY Housebuildings Claim Form And Notes For New Houses with Ease

- Locate VAT431NB Form And Notes VAT Refund For DIY Housebuildings Claim Form And Notes For New Houses and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Modify and eSign VAT431NB Form And Notes VAT Refund For DIY Housebuildings Claim Form And Notes For New Houses to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat431nb form and notes vat refund for diy housebuildings claim form and notes for new houses

Create this form in 5 minutes!

How to create an eSignature for the vat431nb form and notes vat refund for diy housebuildings claim form and notes for new houses

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is vat431nb and how does it benefit businesses?

Vat431nb is a powerful feature within airSlate SignNow that streamlines document signing and management. It allows businesses to send and eSign documents quickly, reducing the time spent on paperwork. By integrating vat431nb, companies can enhance their efficiency and focus on core activities.

-

How much does it cost to use vat431nb with airSlate SignNow?

The pricing for using vat431nb with airSlate SignNow is competitive and designed to accommodate businesses of all sizes. There are various subscription plans available, allowing you to choose one that best fits your budget. Each plan provides access to features including enhanced document signing through vat431nb.

-

What features does vat431nb offer?

Vat431nb includes features such as custom templates, automated workflows, and secure cloud storage. These tools enhance the document signing process and improve overall productivity. Additionally, vat431nb supports multi-party signing to accommodate complex business needs.

-

Can vat431nb integrate with other software applications?

Yes, vat431nb seamlessly integrates with various software applications, including CRM and project management tools. This integration allows for a cohesive workflow and better management of documents throughout your business processes. By leveraging vat431nb, teams can work more efficiently.

-

Is vat431nb secure for sensitive documents?

Absolutely! Vat431nb adheres to strict security protocols to protect sensitive documents. Features like encryption and secure access controls ensure that your data remains safe during the signing process. Using vat431nb provides peace of mind for businesses handling confidential information.

-

How does vat431nb improve the document signing experience?

Vat431nb simplifies the document signing experience through its user-friendly interface. It enables quick sending and signing of documents from any device, enhancing accessibility and convenience. This improvement leads to faster agreement closures for businesses leveraging vat431nb.

-

What types of documents can be signed using vat431nb?

Vat431nb supports a wide range of document types, including contracts, agreements, and forms. This versatility makes it suitable for various industries, from real estate to legal services. By using vat431nb, businesses can easily handle diverse document signing needs.

Get more for VAT431NB Form And Notes VAT Refund For DIY Housebuildings Claim Form And Notes For New Houses

- Claim against estate 497431332 form

- Wisconsin guardian litem 497431333 form

- Wisconsin guardian ad form

- Notice for resident form

- Approval of distribution to ward for wisconsin resident informal and formal administration wisconsin

- Overdue inventory form

- Wisconsin notice form

- Transfer affidavit form 497431339

Find out other VAT431NB Form And Notes VAT Refund For DIY Housebuildings Claim Form And Notes For New Houses

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template