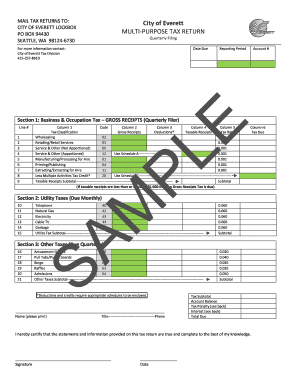

City of Everett Multi Purpose Tax Return Form

What is the City of Everett Multi Purpose Tax Return

The City of Everett Multi Purpose Tax Return is a comprehensive form designed for residents and businesses in Everett, Washington, to report various types of income and expenses for tax purposes. This form allows taxpayers to consolidate their tax reporting into a single document, simplifying the process of filing and ensuring compliance with local tax regulations. It encompasses multiple tax categories, making it a versatile tool for both individual and business taxpayers.

How to use the City of Everett Multi Purpose Tax Return

Using the City of Everett Multi Purpose Tax Return involves several key steps. First, gather all necessary financial documents, including income statements, expense receipts, and any relevant tax forms. Next, accurately fill out the form, ensuring that all information is complete and correct. It is crucial to follow the specific guidelines provided by the City of Everett to avoid errors that could lead to delays or penalties. Finally, submit the completed form through the appropriate channels, whether online, by mail, or in person.

Steps to complete the City of Everett Multi Purpose Tax Return

Completing the City of Everett Multi Purpose Tax Return can be straightforward if you follow these steps:

- Collect all necessary documents, including W-2s, 1099s, and any other income-related paperwork.

- Review the instructions provided with the form to understand the requirements and sections.

- Fill out the form accurately, ensuring that all income and deductions are reported.

- Double-check your entries for accuracy, especially numerical values and personal information.

- Sign and date the form, which is essential for its validity.

- Submit the form according to the preferred method: online, by mail, or in person.

Legal use of the City of Everett Multi Purpose Tax Return

The legal use of the City of Everett Multi Purpose Tax Return is governed by local tax laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted in compliance with the deadlines set by the city. An electronic submission is considered valid if it meets the requirements established under the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronic signatures hold the same legal weight as handwritten ones.

Required Documents

To successfully complete the City of Everett Multi Purpose Tax Return, several documents are typically required:

- Income statements, such as W-2s and 1099s.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any additional documentation that supports claims made on the return.

Filing Deadlines / Important Dates

Filing deadlines for the City of Everett Multi Purpose Tax Return are crucial to avoid penalties. Typically, the deadline aligns with the federal tax filing date, which is April 15 each year. However, taxpayers should verify any specific local deadlines or extensions that may apply. It is advisable to keep track of these dates to ensure timely submission and compliance with local tax laws.

Quick guide on how to complete city of everett multi purpose tax return

Effortlessly Prepare City Of Everett Multi Purpose Tax Return on Any Device

The management of online documents has gained signNow traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage City Of Everett Multi Purpose Tax Return on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign City Of Everett Multi Purpose Tax Return with Ease

- Locate City Of Everett Multi Purpose Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with the tools offered by airSlate SignNow specifically for that function.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details, then click on the Done button to save your modifications.

- Choose how you wish to share your form, either by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign City Of Everett Multi Purpose Tax Return to ensure smooth communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of everett multi purpose tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Everett multi purpose tax return?

The city of Everett multi purpose tax return is a comprehensive tax form designed for local residents and businesses to streamline their tax filing process. It consolidates various tax requirements into one document, making it easier to submit necessary information efficiently. This tax return form helps ensure compliance with local tax regulations while maximizing deductions.

-

How does airSlate SignNow facilitate the city of Everett multi purpose tax return process?

airSlate SignNow simplifies the city of Everett multi purpose tax return process by allowing users to easily create, send, and eSign their tax documents. With its user-friendly interface and efficient eSignature capabilities, businesses can ensure that their tax returns are submitted timely and securely. This eliminates the hassle of physical paperwork and enhances productivity.

-

What are the pricing options for using airSlate SignNow for my city of Everett multi purpose tax return?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses handling their city of Everett multi purpose tax return. The plans vary based on features, such as the number of documents and users, ensuring that you only pay for what you need. Additionally, a free trial is available to help you assess the platform before committing.

-

Are there any features specifically for the city of Everett multi purpose tax return in airSlate SignNow?

Yes, airSlate SignNow includes several features tailored for the city of Everett multi purpose tax return, including customizable templates and automated reminders. These features ensure that users complete their returns on time and with all necessary information. Furthermore, eSigning helps to expedite the filing process by allowing immediate online document approval.

-

What are the benefits of using airSlate SignNow for the city of Everett multi purpose tax return?

Using airSlate SignNow for your city of Everett multi purpose tax return simplifies the entire filing process, saving you time and reducing errors. The platform’s automation tools and eSigning capabilities streamline documentation, allowing you to focus on your business rather than paperwork. Additionally, it enhances document security and compliance with local regulations.

-

Can I integrate airSlate SignNow with my accounting software for the city of Everett multi purpose tax return?

Absolutely! airSlate SignNow easily integrates with various accounting software to facilitate the city of Everett multi purpose tax return process. This integration allows for seamless data transfer, reducing manual entry and ensuring accuracy in your tax filings. You can maintain all your financial information in one place for better management.

-

How secure is my information when using airSlate SignNow for the city of Everett multi purpose tax return?

Security is a top priority at airSlate SignNow, particularly when handling sensitive documents like the city of Everett multi purpose tax return. The platform employs advanced encryption protocols and adheres to industry standards to protect your data. Additionally, you can manage user permissions to ensure that only authorized personnel have access to critical information.

Get more for City Of Everett Multi Purpose Tax Return

Find out other City Of Everett Multi Purpose Tax Return

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement