Tax Brief Form 990, Schedule M Noncash Contributions 2024

Understanding the IRS Form 990, Schedule M for Noncash Contributions

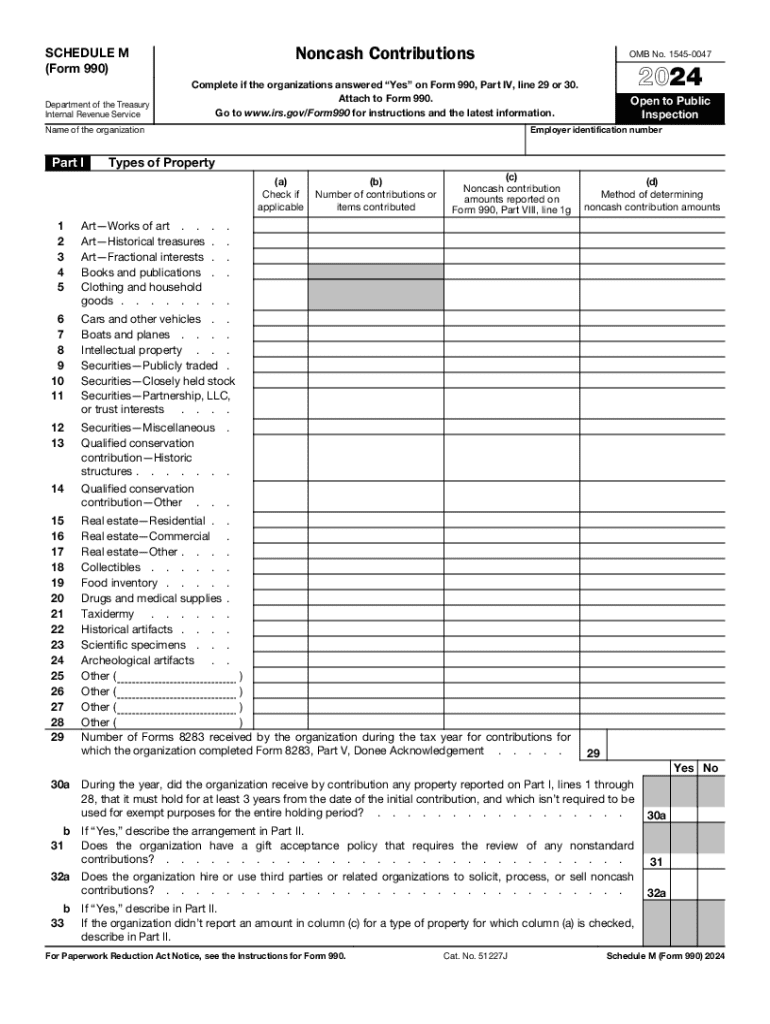

The IRS Form 990, Schedule M is designed for organizations to report noncash contributions. This form is essential for nonprofits as it provides transparency regarding the value and type of noncash donations received. Noncash contributions can include items like clothing, vehicles, or real estate. Accurate reporting of these contributions helps maintain compliance with IRS regulations and ensures that the organization is properly recognized for its charitable efforts.

Steps to Complete the IRS Form 990, Schedule M

Completing the IRS Form 990, Schedule M involves several key steps:

- Gather Documentation: Collect all necessary records of noncash contributions, including appraisals and receipts.

- Determine Fair Market Value: Assess the fair market value of each noncash item donated, as this will be required for accurate reporting.

- Fill Out the Form: Enter the details of each contribution in the appropriate sections of Schedule M, ensuring all values are accurate.

- Review for Accuracy: Double-check all entries for completeness and correctness before submission.

Legal Use of the IRS Form 990, Schedule M

The IRS Form 990, Schedule M is legally required for tax-exempt organizations that receive noncash contributions. This form serves to document the organization's compliance with IRS guidelines and helps to validate the tax-exempt status of the organization. Failure to accurately complete and submit this form can result in penalties and potential loss of tax-exempt status.

Filing Deadlines for the IRS Form 990, Schedule M

Organizations must file the IRS Form 990, including Schedule M, by the 15th day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this typically means a May 15 deadline. It is crucial to adhere to these deadlines to avoid late fees and maintain good standing with the IRS.

Examples of Noncash Contributions Reported on Schedule M

Common examples of noncash contributions that should be reported on Schedule M include:

- Clothing and Household Items: Donations of gently used clothing, furniture, and appliances.

- Vehicles: Cars, boats, or other vehicles donated to the organization.

- Real Estate: Property donations, which may require professional appraisals to determine value.

- Stocks and Bonds: Noncash financial contributions that can be assessed for their market value at the time of donation.

Required Documents for Filing Schedule M

To successfully complete the IRS Form 990, Schedule M, organizations should prepare the following documents:

- Appraisals: Professional appraisals for noncash items valued over a certain threshold.

- Receipts: Documentation from donors confirming the contribution of noncash items.

- Record of Contributions: Detailed records of all noncash donations received throughout the year.

Create this form in 5 minutes or less

Find and fill out the correct tax brief form 990 schedule m noncash contributions

Create this form in 5 minutes!

How to create an eSignature for the tax brief form 990 schedule m noncash contributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2021 schedule m and how does it work?

The 2021 schedule m is a specific form used for reporting certain tax information. It allows businesses to accurately report their income and deductions, ensuring compliance with tax regulations. By utilizing airSlate SignNow, you can easily eSign and send your 2021 schedule m documents securely.

-

How can airSlate SignNow help with the 2021 schedule m?

airSlate SignNow streamlines the process of preparing and submitting your 2021 schedule m. With our user-friendly platform, you can quickly fill out, eSign, and send your documents without the hassle of printing or mailing. This saves time and ensures your submissions are handled efficiently.

-

What are the pricing options for using airSlate SignNow for the 2021 schedule m?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have access to all the necessary features for managing your 2021 schedule m. Visit our pricing page for detailed information.

-

Are there any integrations available for managing the 2021 schedule m?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow for the 2021 schedule m. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to easily access and manage your documents. This integration simplifies the process of preparing your tax forms.

-

What features does airSlate SignNow offer for the 2021 schedule m?

airSlate SignNow provides a range of features designed to simplify the management of your 2021 schedule m. Key features include customizable templates, secure eSigning, and document tracking. These tools ensure that your documents are completed accurately and efficiently.

-

Can I use airSlate SignNow on mobile devices for the 2021 schedule m?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage your 2021 schedule m on the go. Whether you're using a smartphone or tablet, you can easily fill out, eSign, and send your documents from anywhere, ensuring you never miss a deadline.

-

What are the benefits of using airSlate SignNow for the 2021 schedule m?

Using airSlate SignNow for your 2021 schedule m offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and sent quickly, helping you stay organized and compliant with tax regulations.

Get more for Tax Brief Form 990, Schedule M Noncash Contributions

Find out other Tax Brief Form 990, Schedule M Noncash Contributions

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now