Cpa Letter for Mortgage Form

What is the CPA Letter for Mortgage

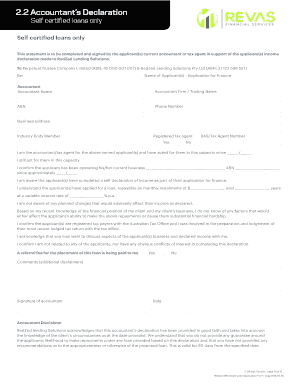

The CPA letter for mortgage, often referred to as a CPA comfort letter, is a document prepared by a certified public accountant (CPA) that verifies an individual's income and financial status. This letter is typically required by lenders during the mortgage application process to assess the borrower's ability to repay the loan. The CPA letter provides assurance to the lender that the financial information presented by the borrower is accurate and reliable. It may include details such as the borrower's income, employment status, and any other relevant financial information that supports the mortgage application.

Key Elements of the CPA Letter for Mortgage

A well-structured CPA letter for mortgage should include several critical components to ensure its validity and usefulness. These elements typically consist of:

- CPA's Contact Information: The letter should include the CPA's name, firm name, address, phone number, and email.

- Borrower's Information: It should clearly state the borrower's name, address, and relevant identification details.

- Income Verification: The letter must detail the borrower's income sources, amounts, and any additional financial information that supports the loan application.

- Statement of Accuracy: A declaration that the information provided is accurate and based on the CPA's professional judgment.

- Date and Signature: The letter must be dated and signed by the CPA to validate its authenticity.

How to Obtain the CPA Letter for Mortgage

To obtain a CPA letter for mortgage, follow these steps:

- Select a CPA: Choose a certified public accountant who has experience in preparing letters for mortgage applications.

- Prepare Documentation: Gather necessary financial documents, such as tax returns, pay stubs, and bank statements, to provide to the CPA.

- Request the Letter: Schedule a meeting with the CPA to discuss your financial situation and request the letter.

- Review and Finalize: Once the CPA drafts the letter, review it for accuracy before it is finalized and signed.

Legal Use of the CPA Letter for Mortgage

The CPA letter for mortgage serves as a legally recognized document when submitted to lenders. To ensure its legal standing, the letter must comply with relevant regulations and standards. This includes adherence to the guidelines set forth by the American Institute of CPAs (AICPA) and any applicable state laws. Additionally, the letter should be prepared on the CPA's official letterhead and include their signature to enhance its legitimacy. Properly executed, the CPA letter can significantly strengthen a borrower’s mortgage application.

Steps to Complete the CPA Letter for Mortgage

Completing a CPA letter for mortgage involves several essential steps to ensure it meets the lender's requirements:

- Gather Financial Information: Collect all necessary financial documents that the CPA will need to verify your income.

- Consult with the CPA: Discuss your financial situation with the CPA to ensure they understand your income sources and any other relevant details.

- Draft the Letter: The CPA will draft the letter, including all key elements and ensuring accuracy.

- Review for Accuracy: Carefully review the letter for any errors or omissions before it is finalized.

- Obtain Signature: Ensure the CPA signs the letter to authenticate it.

Quick guide on how to complete cpa letter for mortgage 471561878

Complete Cpa Letter For Mortgage effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to craft, adjust, and eSign your documents promptly without any delays. Manage Cpa Letter For Mortgage on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Cpa Letter For Mortgage with ease

- Obtain Cpa Letter For Mortgage and click on Get Form to initiate the process.

- Make use of the tools we provide to complete your form.

- Highlight essential sections of the documents or obscure private information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Cpa Letter For Mortgage and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cpa letter for mortgage 471561878

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CPA letter for mortgage?

A CPA letter for mortgage is a document prepared by a Certified Public Accountant that verifies your income and financial status for lenders. This letter serves as a crucial part of your mortgage application, providing evidence of your financial stability, which can enhance your chances of approval.

-

How can airSlate SignNow help with obtaining a CPA letter for mortgage?

airSlate SignNow streamlines the process of requesting and signing your CPA letter for mortgage. With our easy-to-use platform, you can securely send documents to your accountant for signature, ensuring a quick turnaround and reducing delays in your mortgage approval process.

-

What are the benefits of using airSlate SignNow for a CPA letter for mortgage?

Using airSlate SignNow for your CPA letter for mortgage provides you with a fast, efficient, and cost-effective solution. You can easily manage your document workflow, sign securely online, and track the status of your requests, making the entire process seamless.

-

Is there a cost associated with using airSlate SignNow for documents like CPA letters for mortgage?

Yes, airSlate SignNow offers various pricing plans suited to different business needs. Our plans are designed to provide excellent value for features related to document management, including those needed for CPA letters for mortgage, allowing you to choose the best option for your budget.

-

Can I integrate airSlate SignNow with other applications for my CPA letter for mortgage?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications including CRM, cloud storage, and accounting tools. This makes it easy to manage your CPA letter for mortgage alongside your other business processes, improving efficiency and organization.

-

How secure is airSlate SignNow when handling sensitive documents like a CPA letter for mortgage?

Security is a top priority at airSlate SignNow. We use industry-standard encryption and secure authentication methods to ensure that your CPA letter for mortgage and other documents are kept confidential and protected from unauthorized access.

-

Can I track the progress of my CPA letter for mortgage if I use airSlate SignNow?

Yes, airSlate SignNow allows you to effortlessly track the status of your CPA letter for mortgage directly within the platform. You'll receive real-time notifications and updates, so you always know when your document has been viewed, signed, or completed.

Get more for Cpa Letter For Mortgage

Find out other Cpa Letter For Mortgage

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy