Federal Information Worksheet 2012-2026

What is the Federal Information Worksheet

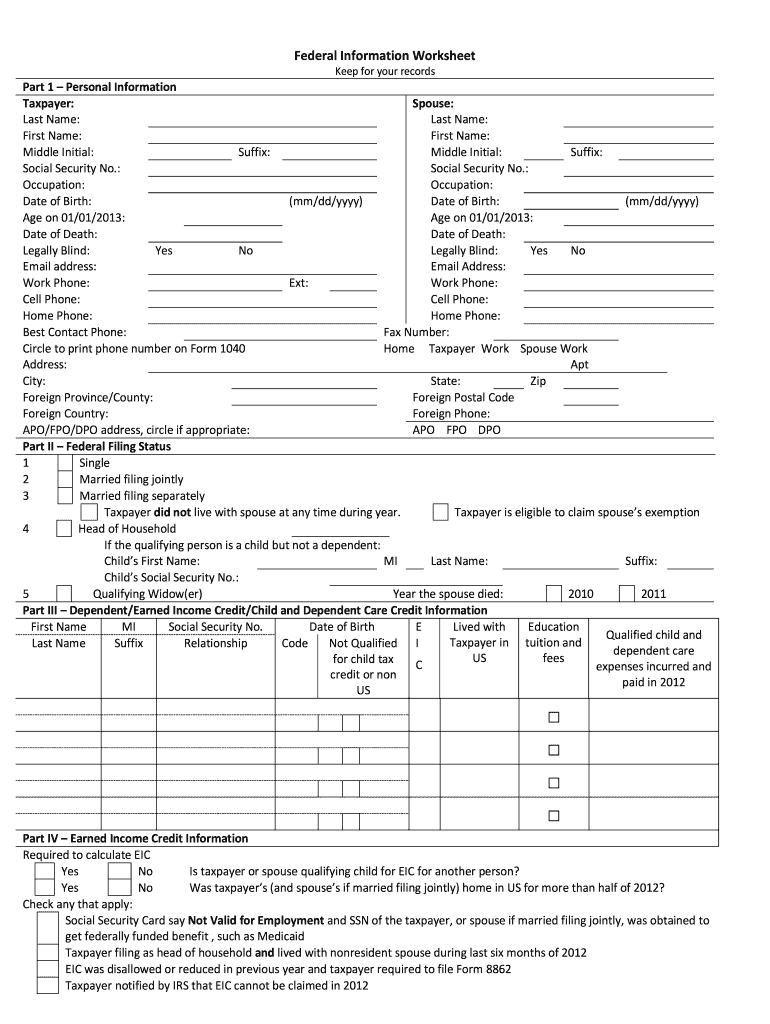

The Federal Information Worksheet is a crucial document used primarily for tax purposes in the United States. It serves as a means for individuals and businesses to provide necessary information to the Internal Revenue Service (IRS). This worksheet collects essential details such as personal identification, income, and deductions, which are vital for accurate tax filing. Understanding the purpose and structure of this form is essential for compliance and ensuring that all relevant information is submitted correctly.

How to use the Federal Information Worksheet

Using the Federal Information Worksheet involves several straightforward steps. First, gather all necessary documents, including income statements, previous tax returns, and any supporting documentation for deductions. Next, carefully fill out the worksheet, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the IRS. Utilizing digital tools can streamline this process, allowing for easy editing and secure submission.

Steps to complete the Federal Information Worksheet

Completing the Federal Information Worksheet requires a systematic approach. Follow these steps:

- Collect all relevant financial documents, including W-2s, 1099s, and receipts for deductible expenses.

- Fill in personal information, such as your name, address, and Social Security number.

- Document your income sources and amounts accurately.

- List any deductions you plan to claim, ensuring you have supporting documentation.

- Review the worksheet for accuracy and completeness.

- Submit the completed worksheet to the IRS, either electronically or by mail.

Legal use of the Federal Information Worksheet

The Federal Information Worksheet must be used in accordance with IRS guidelines to ensure its legal validity. This means adhering to specific regulations regarding the information provided and the manner of submission. For electronic submissions, compliance with eSignature laws, such as the ESIGN Act and UETA, is essential to ensure that your electronically signed documents are legally binding. Understanding these legal requirements helps protect against potential disputes and ensures that your tax filings are accepted without issue.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Federal Information Worksheet. These guidelines outline acceptable practices for filling out the form, including the necessity of accurate reporting and timely submission. Familiarizing yourself with these guidelines can help avoid common pitfalls and ensure compliance with federal tax laws. It is advisable to consult the IRS website or a tax professional for the most current information and updates regarding the worksheet.

Required Documents

To successfully complete the Federal Information Worksheet, certain documents are required. These typically include:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical bills or charitable contributions.

- Previous tax returns for reference and consistency.

Having these documents ready will facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Quick guide on how to complete federal information worksheet

Explore how to effortlessly navigate the Federal Information Worksheet process with this simple guide

Online eFiling and document completion are becoming more widespread and are the preferred option for many users. It offers numerous advantages over outdated hard copies, including convenience, time savings, enhanced accuracy, and security.

With services like airSlate SignNow, you can locate, modify, validate, enhance, and share your Federal Information Worksheet without getting bogged down by endless printing and scanning. Refer to this concise guide to begin and complete your form.

Follow these steps to obtain and complete Federal Information Worksheet

- Begin by clicking the Get Form button to open your document in our editor.

- Pay attention to the green tag on the left that indicates required fields to ensure you don't miss them.

- Utilize our premium features to annotate, modify, sign, protect, and enhance your document.

- Secure your file or convert it into a fillable form using the options available in the right panel.

- Review the document for any mistakes or inconsistencies.

- Select DONE to complete your edits.

- Either rename your document or keep the original name.

- Choose the storage option where you wish to save your document, send it via USPS, or click the Download Now button to download your file.

If Federal Information Worksheet doesn’t meet your needs, you can explore our extensive selection of pre-uploaded templates that require minimal input to fill out. Discover our solution today!

Create this form in 5 minutes or less

FAQs

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

Would it make sense to fill out CBT/DBT worksheets at home instead of going to therapy yourself?

This is certainly something you could do, but it would not have quite the same “punch” as filling the sheets out along with attending regular therapy sessions.In regards to DBT in particular, I believe that it depends largely on your level of self-awareness and how severe your BPD symptoms are. Sometimes it is incredibly difficult to get to see someone who specializes or is experienced with DBT, so I can see attempting the exercises on your own in tandem with CBT as being helpful, at least until you can get in DBT sessions.In my case, since my BPD is more “mild” and I had been in therapy for a long time prior to my BPD diagnosis for my depression and anxiety, my therapist and I found that I had already been implementing a lot of DBT techniques already on my own, which made the process a bit easier for me. I didn't have to teach myself an entirely new way of thinking, but rather just enforce and build upon much of what was already there to better manage my emotional deregulation in times of extreme stress.That being said, going through DBT with my therapist was still much more helpful than anything I could have done on my own. It helped me realize that I wasn’t far from the right path, and it really helped me improve my coping skills and mindfulness. It took me from a novice, to an intermediate, and will continue until I am an expert.I absolutely reccommend that you explore DBT and CBT on your own and learn all you can because it is extremely helpful. However, it’s not a substitute for a therapist. Ideally you want both.

-

How do I fill out money for a federal inmate?

One way is by Momey Gram this site tells you how you can do it on line.Commissary Deposit | Send Money to an Inmate | MoneyGram

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

-

For the new 2018 W-4 form, do I also print out the separate A-H worksheet and fill that out for my employer?

No, an employee is not required to give the separate worksheet to the employer. Keep it for your own records.

Create this form in 5 minutes!

How to create an eSignature for the federal information worksheet

How to generate an eSignature for your Federal Information Worksheet in the online mode

How to make an electronic signature for your Federal Information Worksheet in Chrome

How to generate an electronic signature for putting it on the Federal Information Worksheet in Gmail

How to generate an eSignature for the Federal Information Worksheet right from your mobile device

How to create an eSignature for the Federal Information Worksheet on iOS devices

How to create an eSignature for the Federal Information Worksheet on Android devices

People also ask

-

What is the federal information worksheet for TurboTax?

The federal information worksheet for TurboTax is a form that helps you organize your tax information before filing. It collects essential data regarding income, deductions, and credits to simplify the TurboTax filing process. Utilizing the federal information worksheet TurboTax can help ensure you don’t miss any important details.

-

How can I access the federal information worksheet for TurboTax?

You can access the federal information worksheet for TurboTax directly through the TurboTax software or its website. It is typically provided as part of the TurboTax preparation process. If you're using other tax preparation tools, check their resources for a similar worksheet.

-

Is there a cost associated with using the federal information worksheet TurboTax?

Using the federal information worksheet for TurboTax is generally included in your purchase or subscription of the TurboTax software. There are various pricing tiers depending on the complexity of your tax situation. Be sure to check the TurboTax pricing page for specific details regarding any additional costs.

-

What are the benefits of using the federal information worksheet when filing with TurboTax?

The federal information worksheet for TurboTax streamlines the tax filing process by ensuring all relevant information is organized and ready. This can help minimize errors and improve the accuracy of your tax return. By using the worksheet, you can save time and potentially increase your tax refund.

-

Can I integrate my federal information worksheet TurboTax with other tools?

TurboTax allows to import some financial documents directly, which can enhance your experience. However, it may not have full integration with all document management tools. To utilize the federal information worksheet effectively, consider using it alongside airSlate SignNow for secure document signing and management.

-

What types of information are typically found on the federal information worksheet TurboTax?

The federal information worksheet for TurboTax typically includes sections for your income, filing status, dependents, and potential deductions. Gathering this information in advance can make your tax filing process smoother. Accurate completion of this worksheet will prepare you for the main TurboTax forms.

-

How does airSlate SignNow assist with tax preparation and the federal information worksheet TurboTax?

airSlate SignNow provides an easy-to-use platform to securely send and eSign documents associated with your tax preparation. Using airSlate SignNow in combination with your federal information worksheet TurboTax ensures that all needed documents are signed and stored safely. This can help enhance your overall tax filing efficiency.

Get more for Federal Information Worksheet

Find out other Federal Information Worksheet

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast