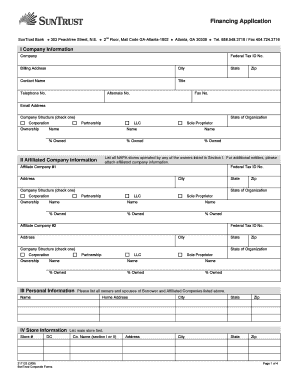

SunTrust NAPA Loan Program Financing Application Form

What is the SunTrust NAPA Loan Program Financing Application

The SunTrust NAPA Loan Program Financing Application is a specific form designed for individuals seeking financial assistance through the SunTrust NAPA Loan Program. This program typically caters to borrowers looking for funding options to support various needs, such as home renovations, debt consolidation, or other significant expenses. The application collects essential information about the applicant's financial status, loan purpose, and personal details to facilitate the loan approval process.

Steps to complete the SunTrust NAPA Loan Program Financing Application

Completing the SunTrust NAPA Loan Program Financing Application involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documentation, including proof of income, employment history, and any other financial information required. Next, fill out the application form with your personal details, financial information, and the purpose of the loan. It is crucial to review the application for any errors or omissions before submission. Finally, submit the completed application electronically or via the preferred method outlined by SunTrust.

Eligibility Criteria

To qualify for the SunTrust NAPA Loan Program Financing Application, applicants must meet specific eligibility criteria. Generally, these criteria include being a legal resident of the United States, having a stable income source, and maintaining a satisfactory credit score. Additionally, the loan purpose may influence eligibility, as certain types of loans may have more stringent requirements. It is advisable to check with SunTrust for detailed eligibility guidelines tailored to the NAPA Loan Program.

Required Documents

When applying for the SunTrust NAPA Loan Program, certain documents are necessary to support your application. Commonly required documents include:

- Proof of income, such as pay stubs or tax returns

- Employment verification

- Identification documents, like a driver's license or passport

- Financial statements, including bank statements and existing loan details

Having these documents ready can streamline the application process and enhance the likelihood of approval.

Legal use of the SunTrust NAPA Loan Program Financing Application

The legal use of the SunTrust NAPA Loan Program Financing Application is governed by various regulations that ensure the protection of both the lender and the borrower. Electronic signatures, when used, must comply with the ESIGN Act and UETA, which establish the validity of eSignatures in legal transactions. Additionally, the application must be completed truthfully, as providing false information can lead to legal repercussions and loan denial.

Form Submission Methods

Applicants can submit the SunTrust NAPA Loan Program Financing Application through various methods. The primary method is online submission, which allows for a quick and efficient application process. Alternatively, applicants may choose to print the form and submit it via mail or deliver it in person to a designated SunTrust location. Each submission method has its advantages, and applicants should select the one that best suits their needs and preferences.

Quick guide on how to complete suntrust napa loan program financing application

Prepare SunTrust NAPA Loan Program Financing Application effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage SunTrust NAPA Loan Program Financing Application on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to update and electronically sign SunTrust NAPA Loan Program Financing Application with ease

- Find SunTrust NAPA Loan Program Financing Application and then click Get Form to begin.

- Make use of the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your desired method to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow efficiently caters to your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign SunTrust NAPA Loan Program Financing Application and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the suntrust napa loan program financing application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SunTrust NAPA Loan Program Financing Application?

The SunTrust NAPA Loan Program Financing Application is a streamlined process designed for borrowers to apply for financing through SunTrust’s NAPA program. This application simplifies the loan process, making it easier to secure the funding needed for vehicle purchases. By utilizing airSlate SignNow, you can complete and eSign the application quickly and securely.

-

How does the SunTrust NAPA Loan Program Financing Application benefit borrowers?

Borrowers benefit from the SunTrust NAPA Loan Program Financing Application by gaining access to competitive financing options tailored for vehicle purchases. The application process is efficient and user-friendly, allowing you to submit your request without unnecessary delays. Additionally, the use of airSlate SignNow ensures that your documents are handled securely.

-

What features are included in the SunTrust NAPA Loan Program Financing Application?

The SunTrust NAPA Loan Program Financing Application includes features such as easy eSigning, document tracking, and secure data encryption. These features enhance the application experience by simplifying document management and ensuring your information remains confidential. With airSlate SignNow, you can efficiently navigate the entire process.

-

Are there any fees associated with the SunTrust NAPA Loan Program Financing Application?

While there may be certain fees associated with processing the SunTrust NAPA Loan Program Financing Application, these can vary depending on the specific loan terms and conditions. It is advisable to review the details provided during the application process to understand any applicable costs. airSlate SignNow helps ensure transparency by allowing you to view all necessary information.

-

How long does it take to process the SunTrust NAPA Loan Program Financing Application?

The processing time for the SunTrust NAPA Loan Program Financing Application can vary; however, the goal is to provide a timely response. Using airSlate SignNow can expedite the process as all documents can be submitted and signed electronically. Typically, you can expect feedback within a few business days.

-

What documents are required for the SunTrust NAPA Loan Program Financing Application?

To complete the SunTrust NAPA Loan Program Financing Application, you will need to provide basic personal and financial information, proof of income, and details regarding the vehicle you intend to purchase. By preparing these documents in advance and using airSlate SignNow, you can streamline the submission process. Ensuring you have everything ready can signNowly speed up your application.

-

Can I use the SunTrust NAPA Loan Program Financing Application on my mobile device?

Yes, the SunTrust NAPA Loan Program Financing Application is designed to be mobile-friendly, allowing users to apply for financing conveniently from their smartphones or tablets. With airSlate SignNow, eSigning and document submission can be done on-the-go, making the process even more accessible for borrowers. This flexibility offers signNow advantages for busy individuals.

Get more for SunTrust NAPA Loan Program Financing Application

Find out other SunTrust NAPA Loan Program Financing Application

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors