Fillable Ct Income Tax Forms 2018

What is the fillable CT income tax form?

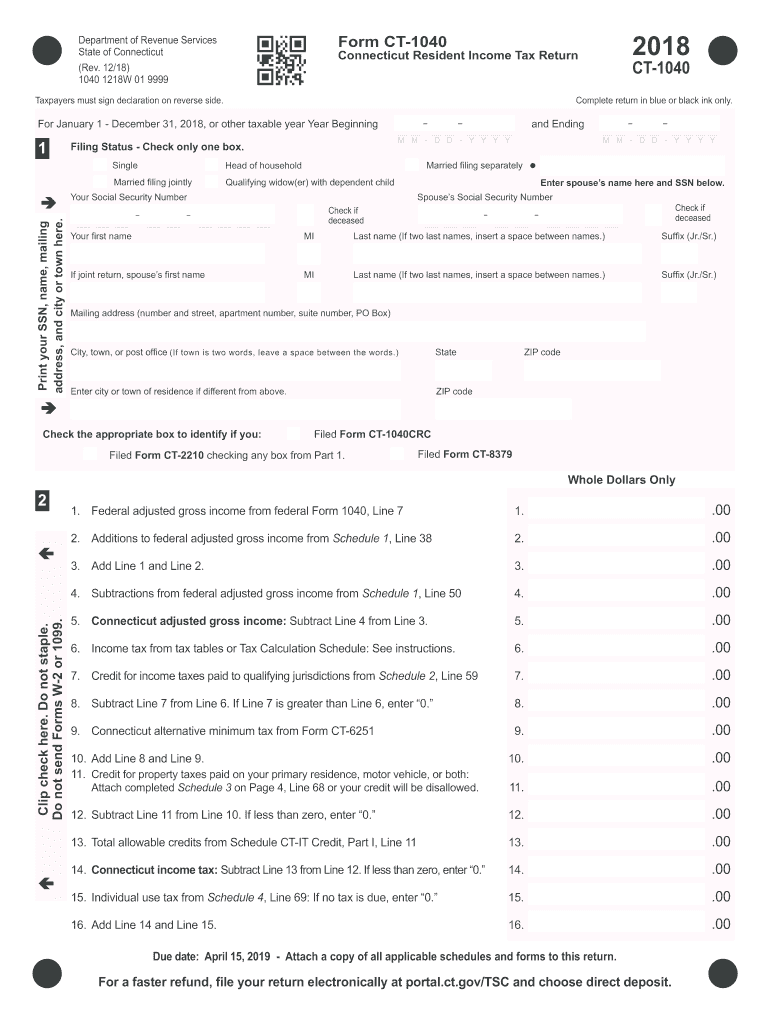

The 2016 CT 1040 is the official income tax form used by residents of Connecticut to report their personal income to the state. This form is essential for individuals to calculate their state tax liability based on their income, deductions, and credits. The fillable version of the CT 1040 allows taxpayers to complete the form online, ensuring ease of use and accuracy. By utilizing fillable fields, users can enter their information directly into the form, reducing the chances of errors that may occur with handwritten submissions.

Steps to complete the fillable CT income tax form

Completing the 2016 CT 1040 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Access the fillable CT 1040 form online through a secure platform.

- Enter your personal information, including your name, address, and Social Security number.

- Input your total income from all sources, ensuring to include all relevant income types.

- Claim any deductions and credits for which you qualify, following the guidelines provided in the form.

- Review all entered information for accuracy before proceeding to sign the document.

- Submit the completed form electronically or print it for mailing, depending on your preference.

Legal use of the fillable CT income tax form

The 2016 CT 1040 form is legally recognized as a valid document for filing state income taxes. When completed correctly and submitted on time, it fulfills the taxpayer's obligations under Connecticut state law. The form must be signed, either electronically or physically, to ensure its validity. Connecticut adheres to the guidelines set by the IRS regarding electronic signatures, allowing for a streamlined filing process that aligns with federal standards.

Filing deadlines / important dates

For the 2016 tax year, the filing deadline for the CT 1040 is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, allowing for additional time to file. It is crucial to stay informed about these dates to avoid penalties for late submissions.

Form submission methods (online / mail / in-person)

The 2016 CT 1040 can be submitted through various methods, providing flexibility for taxpayers. The online submission is the most efficient option, allowing for immediate processing and confirmation of receipt. Alternatively, taxpayers may choose to print the completed form and mail it to the Connecticut Department of Revenue Services. In-person submissions are also accepted at designated locations, though this method may require prior appointment scheduling.

Required documents

When completing the 2016 CT 1040, taxpayers must have several documents on hand to ensure accurate reporting. Key documents include:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental or investment income.

- Documentation for deductions and credits, including receipts and statements.

Quick guide on how to complete ct 1040 2018 2019 form

Your assistance manual on preparing your Fillable Ct Income Tax Forms

If you're interested in learning how to finalize and submit your Fillable Ct Income Tax Forms, here are a few concise recommendations to make tax filing simpler.

To start, you just need to create your airSlate SignNow account to change the way you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, draft, and complete your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and revisit to modify information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps outlined below to accomplish your Fillable Ct Income Tax Forms in just a few minutes:

- Create your account and begin working on PDFs quickly.

- Utilize our catalog to find any IRS tax form; browse through the variants and schedules available.

- Click Get form to access your Fillable Ct Income Tax Forms in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if applicable).

- Examine your document and correct any errors.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper can lead to increased mistakes and delayed reimbursements. Moreover, before e-filing your taxes, verify the IRS website for declaration regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 1040 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

Create this form in 5 minutes!

How to create an eSignature for the ct 1040 2018 2019 form

How to create an electronic signature for the Ct 1040 2018 2019 Form in the online mode

How to generate an eSignature for your Ct 1040 2018 2019 Form in Chrome

How to generate an electronic signature for putting it on the Ct 1040 2018 2019 Form in Gmail

How to create an eSignature for the Ct 1040 2018 2019 Form straight from your smartphone

How to create an electronic signature for the Ct 1040 2018 2019 Form on iOS devices

How to generate an eSignature for the Ct 1040 2018 2019 Form on Android devices

People also ask

-

What are Fillable Ct Income Tax Forms?

Fillable Ct Income Tax Forms are digital forms provided by airSlate SignNow that allow residents of Connecticut to easily fill out and submit their state income tax returns online. These forms are designed to streamline the filing process, ensuring accuracy and compliance with state regulations.

-

How can I access Fillable Ct Income Tax Forms using airSlate SignNow?

To access Fillable Ct Income Tax Forms, simply visit the airSlate SignNow website and navigate to the tax forms section. You can create an account, where you’ll find a variety of fillable forms, including those specific to Connecticut income tax.

-

Are Fillable Ct Income Tax Forms secure to use?

Yes, Fillable Ct Income Tax Forms offered by airSlate SignNow utilize advanced encryption and security measures to protect your sensitive information. We prioritize user privacy and ensure that all submitted data is securely stored and transmitted.

-

Can I eSign Fillable Ct Income Tax Forms with airSlate SignNow?

Absolutely! airSlate SignNow allows you to electronically sign Fillable Ct Income Tax Forms seamlessly. This feature not only saves time but also ensures that your forms are legally binding and compliant with state requirements.

-

What are the benefits of using Fillable Ct Income Tax Forms?

Using airSlate SignNow's Fillable Ct Income Tax Forms simplifies the filing process by eliminating paper forms and reducing errors. Additionally, it enhances efficiency with features like auto-fill and eSigning, making it easier to meet tax deadlines.

-

Is there a cost associated with Fillable Ct Income Tax Forms?

airSlate SignNow offers competitive pricing for access to Fillable Ct Income Tax Forms. You can choose from various subscription plans based on your needs, with many features available at an affordable monthly rate.

-

Do Fillable Ct Income Tax Forms integrate with other software?

Yes, Fillable Ct Income Tax Forms from airSlate SignNow can easily integrate with popular accounting and tax preparation software. This integration streamlines your workflow and allows for a comprehensive approach to managing your tax filings.

Get more for Fillable Ct Income Tax Forms

- Rodan and fields sales support form

- Rodan and fields upgrade business kit phone number form

- Rodan fields termination notice form

- Warranty letter form 241722352

- Irs 12180 form

- Federal information worksheet

- Rv purchase option agreement rv inspection form

- Attending physician statement fmla certification form

Find out other Fillable Ct Income Tax Forms

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form