Hmda Form

What is the HMDA Form

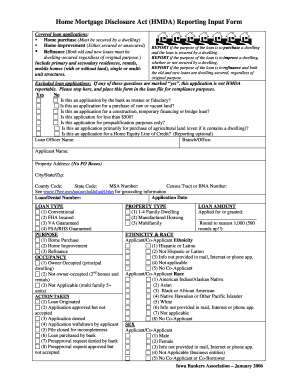

The HMDA form, also known as the Home Mortgage Disclosure Act form, is a critical document used by financial institutions to collect and report data about mortgage lending. This form is designed to ensure transparency in lending practices and to help identify discriminatory lending patterns. The data collected includes information about loan applicants, the type of loans, and the outcomes of those applications. By requiring lenders to disclose this information, the HMDA aims to promote fair lending and to protect consumers from discrimination.

Steps to Complete the HMDA Form

Completing the HMDA form involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including borrower details, loan terms, and property information. Next, fill out each section of the form carefully, ensuring that all data is accurate and complete. Pay special attention to the demographic information required, as this is crucial for compliance with fair lending laws. Once the form is completed, review it thoroughly for any errors before submission.

Legal Use of the HMDA Form

The legal use of the HMDA form is governed by federal regulations that mandate how and when the data must be collected and reported. Financial institutions must adhere to the guidelines set forth by the Consumer Financial Protection Bureau (CFPB) to ensure compliance. This includes maintaining the confidentiality of borrower information and using the collected data solely for the purposes outlined in the HMDA. Failure to comply with these regulations can result in significant penalties and legal repercussions.

Key Elements of the HMDA Form

The HMDA form consists of several key elements that must be accurately reported. These include:

- Loan Information: Details about the type of loan, amount, and terms.

- Borrower Demographics: Information about the race, ethnicity, and gender of the applicant.

- Property Details: Address and type of property being financed.

- Action Taken: The outcome of the loan application, such as approval or denial.

Each of these elements plays a vital role in the overall purpose of the HMDA, which is to promote fair lending practices across the United States.

Form Submission Methods

The HMDA form can be submitted through various methods, depending on the institution's preference and regulatory requirements. Common submission methods include:

- Online Submission: Many institutions utilize secure online platforms to submit HMDA data electronically.

- Mail Submission: Institutions may also choose to send physical copies of the HMDA form to the appropriate regulatory agency.

- In-Person Submission: Some institutions may opt to deliver the form directly to regulatory offices during designated filing periods.

Each submission method must comply with the guidelines established by the CFPB to ensure proper processing and record-keeping.

Examples of Using the HMDA Form

Examples of using the HMDA form include various scenarios in which lenders must collect and report data. For instance, a bank processing mortgage applications must complete the HMDA form for each application it receives. This includes documenting the race and ethnicity of the applicants to ensure compliance with fair lending laws. Additionally, lenders may use the data collected to analyze their lending patterns and identify any potential disparities in loan approvals among different demographic groups.

Quick guide on how to complete hmda form 34788916

Complete Hmda Form seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without interruptions. Manage Hmda Form on any platform with airSlate SignNow Android or iOS apps and enhance any document-centric operation today.

How to alter and eSign Hmda Form effortlessly

- Find Hmda Form and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to retain your changes.

- Select your preferred method of sharing your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Hmda Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hmda form 34788916

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HMDA form and why is it important?

The HMDA form, or Home Mortgage Disclosure Act form, is a document that financial institutions must complete to disclose mortgage data. This form is essential for ensuring transparency in the lending process and helps regulators monitor compliance with fair lending laws.

-

How does airSlate SignNow help with HMDA form submissions?

airSlate SignNow provides an efficient platform for preparing, signing, and submitting HMDA forms electronically. With our user-friendly interface, you can streamline the submission process and ensure that all necessary data is accurately captured.

-

Is airSlate SignNow cost-effective for small businesses requiring HMDA forms?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Small businesses can take advantage of our cost-effective solutions to manage their HMDA forms without breaking the bank.

-

What features does airSlate SignNow offer for managing HMDA forms?

Our platform offers a variety of features to manage HMDA forms, including customizable templates, secure e-signature options, and real-time tracking of document status. These features simplify the process and enhance efficiency for users.

-

Can airSlate SignNow integrate with other software for HMDA form processing?

Yes, airSlate SignNow seamlessly integrates with various CRM and accounting software, enhancing your overall workflow for HMDA form processing. This allows for easier data management and ensures that your records are always up-to-date.

-

What are the benefits of using airSlate SignNow for HMDA form completion?

Using airSlate SignNow for HMDA form completion offers numerous benefits such as faster processing times, improved accuracy, and reduced paperwork. By digitizing the process, you save time and ensure compliance with regulatory requirements.

-

How secure is airSlate SignNow when handling HMDA forms?

airSlate SignNow prioritizes the security of your documents, including HMDA forms, by utilizing advanced encryption and secure storage solutions. This ensures that sensitive information remains protected throughout the signing and submission process.

Get more for Hmda Form

Find out other Hmda Form

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking