Ct Fuel Tax Sticker 2000

What is the Ct Fuel Tax Sticker

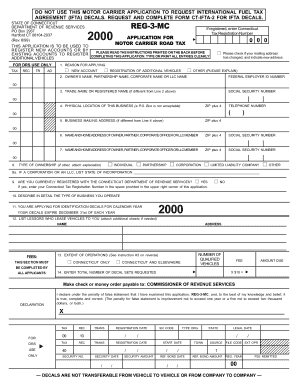

The Connecticut Fuel Tax Sticker is a crucial document for businesses operating commercial vehicles that travel through Connecticut. This sticker serves as proof of compliance with the International Fuel Tax Agreement (IFTA), which simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. The sticker must be displayed on the vehicle, allowing enforcement agencies to verify that the vehicle is compliant with state fuel tax regulations.

How to obtain the Ct Fuel Tax Sticker

To obtain the Connecticut fuel tax sticker, businesses must first register with the Connecticut Department of Revenue Services (DRS) as an IFTA carrier. This involves completing an application form, which can typically be submitted online or via mail. Once registered, carriers will receive their IFTA decals, which are valid for the calendar year. It is important to ensure that all fees are paid and that the application is filled out accurately to avoid delays in processing.

Steps to complete the Ct Fuel Tax Sticker

Completing the process for the Connecticut fuel tax sticker involves several key steps:

- Register with the Connecticut DRS as an IFTA carrier.

- Complete the IFTA application form with accurate information about your business and vehicles.

- Submit the application along with any required fees to the DRS.

- Receive your IFTA decals, which must be affixed to your vehicles as specified.

- Maintain accurate records of fuel purchases and mileage to ensure compliance with IFTA reporting requirements.

Legal use of the Ct Fuel Tax Sticker

The legal use of the Connecticut fuel tax sticker is governed by the regulations set forth by the IFTA. Carriers must ensure that the sticker is displayed on their vehicles at all times while operating in jurisdictions that require it. Failure to properly display the sticker can result in penalties and fines. Additionally, carriers must keep detailed records of fuel purchases and miles traveled to substantiate their fuel tax reports.

State-specific rules for the Ct Fuel Tax Sticker

Connecticut has specific rules regarding the use of the fuel tax sticker, including the requirement for all commercial vehicles operating over a certain weight to display the sticker. The state mandates that carriers file quarterly fuel tax reports, detailing fuel consumption and mileage in each jurisdiction. Non-compliance with these rules can lead to audits, penalties, and potential revocation of the IFTA registration.

Key elements of the Ct Fuel Tax Sticker

The Connecticut fuel tax sticker contains several key elements that are essential for identification and verification purposes. These include:

- The IFTA logo, indicating compliance with the agreement.

- The year of validity, which is typically displayed prominently.

- A unique identification number assigned to the carrier.

- Information about the issuing state, in this case, Connecticut.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the Connecticut fuel tax sticker can result in significant penalties. These may include fines for not displaying the sticker, late fees for delayed reporting, and potential audits by the state. In severe cases, non-compliance can lead to the suspension of the IFTA registration, which would prevent the carrier from legally operating in multiple jurisdictions.

Quick guide on how to complete ct fuel tax sticker

Complete Ct Fuel Tax Sticker effortlessly on any device

Digital document management has gained increased popularity among businesses and individuals. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Ct Fuel Tax Sticker on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign Ct Fuel Tax Sticker without hassle

- Obtain Ct Fuel Tax Sticker and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Ct Fuel Tax Sticker and ensure excellent communication at every stage of the document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct fuel tax sticker

Create this form in 5 minutes!

How to create an eSignature for the ct fuel tax sticker

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are ct ifta stickers and why do I need them?

CT IFTA stickers are essential for vehicles operating across state lines, indicating that the vehicle is registered under the International Fuel Tax Agreement. These stickers simplify the reporting process for fuel taxes, making compliance easier for trucking companies. Without these stickers, your vehicle may face penalties during inspections.

-

How much do ct ifta stickers cost?

The cost of CT IFTA stickers can vary depending on your state regulations and the number of vehicles you need stickers for. Typically, there is a nominal fee associated with each sticker application. It's important to budget for these costs as part of your vehicle registration expenditures.

-

How can I apply for ct ifta stickers through airSlate SignNow?

Applying for CT IFTA stickers via airSlate SignNow is convenient and straightforward. Simply complete the necessary forms electronically, sign them using our eSignature features, and submit them as directed. This process speeds up your application and ensures you remain compliant with state regulations.

-

What are the benefits of using airSlate SignNow for ct ifta stickers?

Using airSlate SignNow offers a streamlined process for obtaining your CT IFTA stickers, allowing you to submit documents quickly and securely. The platform is user-friendly and eliminates the need for paper forms, making it more environmentally friendly. Additionally, with eSigning, you’ll save time and reduce delays.

-

Can I track my application for ct ifta stickers?

Yes, with airSlate SignNow, you can track your application for CT IFTA stickers easily. The platform provides real-time updates on your document status, ensuring you are always informed about any approvals or needed actions. This transparency helps you manage your compliance efficiently.

-

Are ct ifta stickers refundable if I no longer need them?

Typically, CT IFTA stickers are not refundable once issued, as they are tied to the vehicle's registration status. Make sure your application is accurate and reflects your current needs before applying. If circumstances change, it's best to check with your local DMV for specific guidelines.

-

Do I need to renew my ct ifta stickers annually?

Yes, CT IFTA stickers must be renewed annually to ensure compliance with state regulations. It is essential to keep track of renewal dates to avoid fines or penalties. By using airSlate SignNow, you can set reminders and manage your renewals conveniently.

Get more for Ct Fuel Tax Sticker

Find out other Ct Fuel Tax Sticker

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy