8071 New Orleans Form 2016

What is the 8071 New Orleans Form

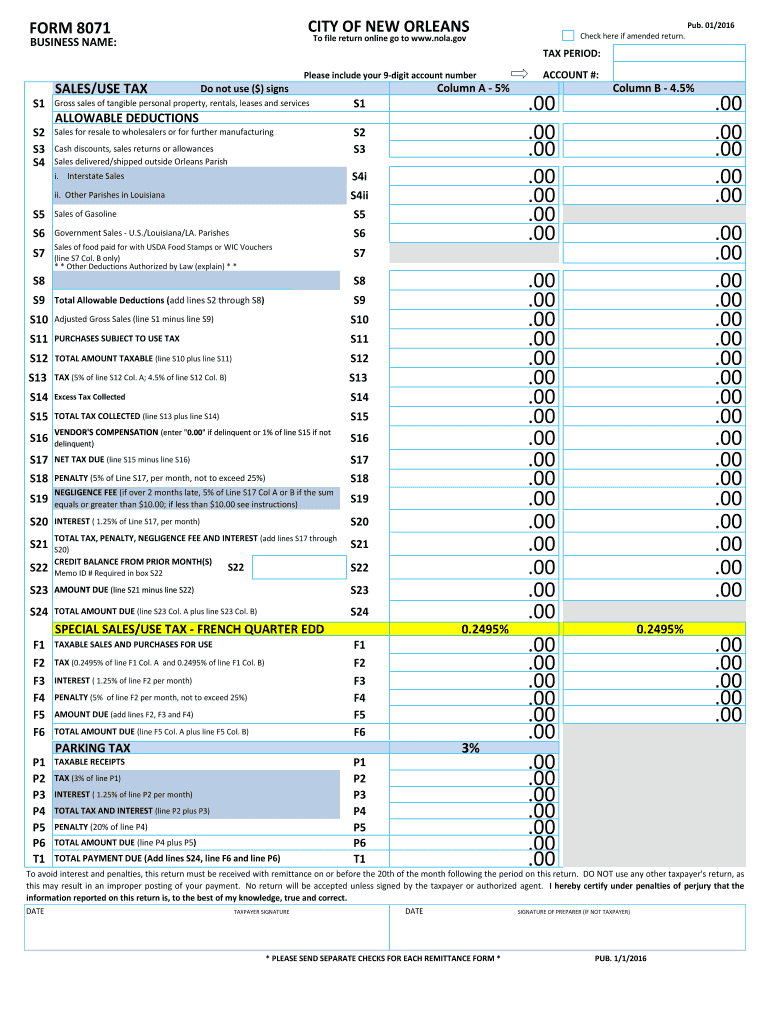

The 8071 New Orleans Form is a crucial document used for reporting sales tax in the city of New Orleans. This form is specifically designed for businesses and individuals who need to comply with local tax regulations. It captures essential information regarding sales transactions and helps ensure that the appropriate sales tax is collected and remitted to the city. The form is part of the city of New Orleans' efforts to streamline tax collection and maintain accurate records for revenue purposes.

How to use the 8071 New Orleans Form

Using the 8071 New Orleans Form involves several straightforward steps. First, gather all necessary information related to your sales transactions, such as total sales, taxable sales, and applicable exemptions. Next, accurately fill out the form, ensuring that all fields are completed as required. Once the form is filled, review it for any errors or omissions. After verification, you can submit the form either online or through traditional mail, depending on your preference and the submission guidelines provided by the city.

Steps to complete the 8071 New Orleans Form

Completing the 8071 New Orleans Form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant sales data for the reporting period.

- Access the form, which can be found on the official city website.

- Fill in your business information, including name, address, and tax identification number.

- Enter sales figures, including total sales and taxable sales.

- Calculate the total sales tax owed based on the applicable rate.

- Review the form for accuracy.

- Submit the completed form as per the submission guidelines.

Key elements of the 8071 New Orleans Form

The 8071 New Orleans Form includes several key elements that are essential for accurate reporting. These elements typically consist of:

- Business Information: Name, address, and tax ID of the business.

- Sales Data: Total sales, taxable sales, and any exemptions claimed.

- Tax Calculation: A section for calculating the total sales tax owed.

- Signature Line: A space for the authorized person to sign and date the form.

Legal use of the 8071 New Orleans Form

The legal use of the 8071 New Orleans Form is governed by local tax laws and regulations. It is essential for businesses to use this form to report sales tax accurately to avoid penalties. Filing the form correctly ensures compliance with the city’s tax code, thereby protecting the business from potential audits and fines. Additionally, the form must be submitted by the designated deadlines to maintain good standing with the New Orleans Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

The 8071 New Orleans Form can be submitted through various methods to accommodate different preferences. These methods include:

- Online Submission: Fill out and submit the form electronically via the city’s official tax portal.

- Mail Submission: Print the completed form and send it to the designated mailing address provided by the city.

- In-Person Submission: Deliver the form directly to the local tax office during business hours.

Quick guide on how to complete revenue sales tax sales tax city of new orleans nola

Your assistance manual on how to prepare your 8071 New Orleans Form

If you’re curious about how to generate and submit your 8071 New Orleans Form, here are some concise guidelines on making tax declaration easier.

To begin, you merely need to set up your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an intuitive and powerful document tool that enables you to modify, generate, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures, and revisit to update information as needed. Optimize your tax handling with advanced PDF editing, eSigning, and convenient sharing.

Complete the following steps to finish your 8071 New Orleans Form in no time:

- Create your account and start editing PDFs in moments.

- Utilize our library to find any IRS tax form; browse through different versions and schedules.

- Hit Get form to access your 8071 New Orleans Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-valid eSignature (if required).

- Examine your document and rectify any errors.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Refer to this guide to file your taxes digitally with airSlate SignNow. Be aware that filing in paper format can lead to mistakes in returns and delays in refunds. Before e-filing your taxes, make sure to consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct revenue sales tax sales tax city of new orleans nola

FAQs

-

Is the new online sales tax law designed to put smaller e-sellers out of business?

In my opinion one of the reasons so many larger retailers were in favour of Quill being overturned was to increase the costs of smaller sellers. This reduces competition by creating a barrier to entry for smaller sellers who do not have the ability to manage filing returns in 45 states plus DC.Of course they did not say this, instead they said it was all about fairness.

-

How high would a sales tax in place of an income tax have to to be to keep the same level of tax revenue in the United States?

Here is a calculation that you might consider. This is off-the-cuff and not checked for accuracy.Last year's total tax receipts for the United States were:$3,643,000,000,000 that's about $11,209 per person.Last year Americans bought $4,401,000,000,000 worth of "goods". This averages out to about $13,500 per person.If we were to tax all of these "goods" at a rate that would equal total taxes that would give us a sales tax rate of something like 82%.It is well to remember however that sales taxes are extremely regressive, that is, take more of a poor person's income than they do it all, rich person's income.

-

Has anyone estimated how much revenue and profit each new android phone brings to Google (in app sales, ad sales, and any other form of revenue)?

It depends because there is no stats about how much android cells are sold but an estimate numbers are about 200k to 1000k cells are sold every day so it increase as mimimum as 8% percent of downloads every day. It increase the income of google in billions.

-

If you move out of your first house to a new home, then list the first house for sale, do you need to pay capital gains tax on the sale?

The sequence of events as you describe them suggest that you most certainly will need to pay capital gains once you sell you first home. if you learn the tax policies and you wish not to pay capital gains and also move to a new home you would then want to qualify to do what is called a 1031 exchange.Someone has made a comment that to do a 1031 exchange one must have the property in a business or rather owned by a business because 1031 is only allowed for a business asset . I suppose that is one reason why real estate investors recommend that when you purchase a property you should put the property in the name of the business not your personal self.My point was not necessarily to be right but to point the fact that there is a way to not have to pay capital gains tax and that is far more beneficial than to be right or wrong. I have been a real estate investor for over 30 years and to this date I have never done a 1031 exchange.It’s never too late to learn something new to you.

-

If the US replaced all Federal income AND payroll tax revenue paid by the bottom half of earners with a national sales tax, how high would it need to be? What if it was only the bottom 30%?

If the US replaced all Federal income AND payroll tax revenue paid by the bottom half of earners with a national sales tax, how high would it need to be? What if it was only the bottom 30%?EDIT: revised after comments made me realize that I had only looked at income tax, and not payroll taxLet’s look first at the income tax side of this.Looking at 2016 (using this: SOI Tax Stats Individual Statistical Tables by Size of Adjusted Gross Income )the bottom 50% of filers would mean people with incomes just under $40,000 per year (getting to that number gets to 53% of filers). The total income tax paid (after credits) by those people is about 46 billion dollars.Texas, with 6.25% sales tax (localities get more but the state itself only gets 6.25%) managed to raise a little over 28 billion in 2016. If we estimate Texas as being something like 1/12 of the U.S. economy, then it seems clear that a 1% sales tax rate would replace that revenue.If we move to the bottom 30%, you’re talking people that made $20,000 or less. Their tax revenue total was around 5 billion dollars. To make that up, you’re talking about maybe 0.1% sales tax. It would hardly be worth implementing, because at that level people would begin structuring small purchases to avoid any tax.So — the income tax side of the thing is pretty small potatoes.Now, let’s look at the payroll tax side of the equation.Pretty clearly, we’re looking at them paying 7.65% of their income (maybe a little less as they may have some income that isn’t subject to that, but it won’t be much) in payroll taxes — 6.2% for Old Age, Survivors, and Disability Insurance (commonly called Social Security) and 1.45% for Medicare. If we assume that the top half of earners will manage to spend as much on sales taxable items as the bottom half, then it seems that a sales tax rate of half that — 3.825% — should be more than adequate to cover them. If we move down to the bottom 30%, now we’re talking about maybe 2.55%.

-

How does New Hampshire's lack of a sales or income tax affect its government's ability to provide for its residents?

We just have high property taxes to make up for it. That, and a really meager set of social services compared to say, Massachusetts. We have libraries, they just are smaller than MA libs. We have police, fire, street sweepers, snow crews in winter, just like anywhere else. The "No income and sales tax" meme doesn't mean no taxes. We just pay a different kind of tax. In fiscal 2015, NH budgeted $5.4 billion in revenue (Where The Money Comes From) including about 25% from federal funds. There are other states with similar revenues. According to the Census Bureau (State Tax Revenues: Charts and Data), there were 5 states with revenues under $3 billion in 2012. Small government has an appeal in some places, but it's comparatively small. New Hampshire's economy is similar to that of Belarus (This brilliant map renames each US state with a country generating the same GDP). Don't be distracted by the labels. States run on money. NH residents are really happy that we aren't trying to fund a big state like New York, where the $3600 taxes / person are more than double NH's $1700. Florida, South Carolina, and Georgia all spend about $1700 2012 tax dollars per person. Governments live on cash. How they claim to come by it is as much a matter of spin as of fiscal sense. Even small states spend big bucks.

-

A Startup CEO take a sales prospect out to a New York Knicks game and spends $500 on the tickets. How much of the $500 spent is Tax Deductible for the business?

Beginning in 2018, after the TCJA reforms, none of it.Only 50% of business meals are deductible.

Create this form in 5 minutes!

How to create an eSignature for the revenue sales tax sales tax city of new orleans nola

How to create an electronic signature for your Revenue Sales Tax Sales Tax City Of New Orleans Nola online

How to create an electronic signature for your Revenue Sales Tax Sales Tax City Of New Orleans Nola in Chrome

How to make an electronic signature for putting it on the Revenue Sales Tax Sales Tax City Of New Orleans Nola in Gmail

How to make an eSignature for the Revenue Sales Tax Sales Tax City Of New Orleans Nola from your smartphone

How to generate an eSignature for the Revenue Sales Tax Sales Tax City Of New Orleans Nola on iOS

How to generate an eSignature for the Revenue Sales Tax Sales Tax City Of New Orleans Nola on Android devices

People also ask

-

What is the 8071 New Orleans form?

The 8071 New Orleans form is a specific document designed for various administrative purposes in New Orleans. It can be used for business transactions, and airSlate SignNow allows you to manage this form easily with our intuitive eSignature platform. Our solution ensures that your 8071 New Orleans form is securely sent and signed online.

-

How can I fill out the 8071 New Orleans form using airSlate SignNow?

Filling out the 8071 New Orleans form using airSlate SignNow is simple. You can upload the form directly to our platform, fill it out electronically, and then send it for signatures. This process saves time and reduces errors compared to handling paper forms.

-

Is there a cost associated with using airSlate SignNow for the 8071 New Orleans form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. We offer various pricing plans that cater to different needs, making it easy to sign documents like the 8071 New Orleans form without breaking the bank.

-

What features does airSlate SignNow offer for the 8071 New Orleans form?

airSlate SignNow provides a range of features for the 8071 New Orleans form, including easy document upload, customizable templates, and advanced eSignature options. Additionally, our platform offers secure storage and tracking, ensuring you always know the status of your documents.

-

Can I integrate airSlate SignNow with other tools to manage the 8071 New Orleans form?

Absolutely! airSlate SignNow integrates seamlessly with various business tools, allowing you to manage the 8071 New Orleans form within your existing workflows. Whether you're using CRM systems, project management tools, or email services, our integrations simplify the document signing process.

-

What are the benefits of using airSlate SignNow for the 8071 New Orleans form?

Using airSlate SignNow for the 8071 New Orleans form streamlines your document management process. You benefit from enhanced efficiency, improved accuracy, and reduced turnaround times. Plus, our signature verification ensures that your documents are legally binding.

-

Is the eSignature on the 8071 New Orleans form legally binding?

Yes, the eSignature made through airSlate SignNow on the 8071 New Orleans form is legally binding. Our platform adheres to stringent compliance regulations, ensuring that your signed documents hold up in court and meet all legal requirements.

Get more for 8071 New Orleans Form

Find out other 8071 New Orleans Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney