Ugtma Form

What is the Ugtma

The Ugtma, or Uniform Gifts to Minors Act, is a legal framework that allows for the transfer of assets to minors without the need for a formal trust. This act facilitates the management and protection of assets until the minor reaches the age of majority, which is typically eighteen in most states. Under the Ugtma, custodians can manage gifts made to minors, ensuring that the assets are used for the benefit of the child. This can include cash, securities, and other types of property.

How to use the Ugtma

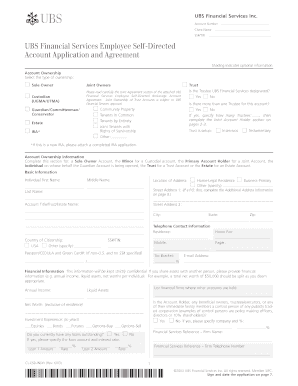

Using the Ugtma involves several steps to ensure compliance with legal requirements. First, a donor must decide on the assets they wish to transfer to a minor. Next, the donor must select a custodian who will manage the assets on behalf of the minor. After that, the donor completes the Ugtma form, which requires specific information about the donor, the minor, and the assets being transferred. Once the form is completed and signed, it should be submitted to the appropriate financial institution or agency to formalize the transfer.

Steps to complete the Ugtma

Completing the Ugtma form involves a straightforward process:

- Gather necessary information about the donor, minor, and assets.

- Select a custodian who will manage the assets until the minor reaches the age of majority.

- Fill out the Ugtma form, providing accurate details about the transfer.

- Sign the form to validate the transfer.

- Submit the completed form to the relevant financial institution or agency.

Legal use of the Ugtma

The Ugtma is legally binding when all requirements are met, including proper documentation and adherence to state-specific regulations. This act is recognized across the United States, providing a uniform approach to gifting assets to minors. To ensure that the transfer is legally valid, it is essential to comply with the specific laws of the state where the minor resides, as each state may have its own nuances regarding the Ugtma.

Key elements of the Ugtma

Several key elements define the Ugtma and its application:

- Custodianship: A designated adult must manage the assets until the minor reaches the age of majority.

- Asset Types: The Ugtma allows for various asset types, including cash, stocks, and real estate.

- Age of Majority: The minor typically gains control of the assets at age eighteen, though some states allow for a later age.

- Tax Implications: Gifts under the Ugtma may have tax benefits, including exclusions from gift taxes up to a certain limit.

State-specific rules for the Ugtma

While the Ugtma provides a uniform framework, each state may have specific rules that govern its application. These rules can include variations in the age of majority, permissible assets, and the responsibilities of custodians. It is crucial for donors and custodians to familiarize themselves with their state's regulations to ensure compliance and avoid potential legal issues.

Quick guide on how to complete ugtma

Finish Ugtma effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow provides all the necessary tools to create, alter, and electronically sign your documents swiftly without interruptions. Manage Ugtma on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

Ways to modify and electronically sign Ugtma with ease

- Locate Ugtma and then click Get Form to begin.

- Utilize the resources we offer to finalize your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to misplaced or lost documents, tedious form searches, or mistakes that necessitate creating new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device of your choice. Alter and electronically sign Ugtma while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ugtma

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ugtma in the context of airSlate SignNow?

Ugtma refers to a specialized feature within airSlate SignNow that simplifies the management of documents for users. By utilizing ugtma, businesses can streamline their electronic signature processes, making it easier to handle transactions efficiently. This ensures that all documents are securely signed and stored in one place.

-

How does airSlate SignNow's ugtma feature enhance document security?

The ugtma feature in airSlate SignNow incorporates advanced encryption methods to safeguard sensitive documents. This means that businesses can feel confident that their signed documents are protected against unauthorized access. By using ugtma, users can maintain compliance with industry regulations regarding document security.

-

What are the pricing options for airSlate SignNow, particularly related to ugtma?

AirSlate SignNow offers various pricing tiers that include the ugtma feature at each level. This allows businesses of all sizes to choose a plan that best fits their budget while still accessing essential functionalities like ugtma. Customers can find detailed pricing information directly on the airSlate SignNow website.

-

What benefits does ugtma provide for businesses using airSlate SignNow?

Ugtma provides several benefits, such as reducing transaction times and enhancing collaboration among team members. By implementing ugtma, businesses can efficiently manage their document workflows and ensure timely approvals. With these improvements, companies can focus on growth rather than administrative bottlenecks.

-

Can airSlate SignNow's ugtma feature be integrated with other software applications?

Yes, the ugtma feature in airSlate SignNow can be easily integrated with various third-party applications. This interoperability ensures that data flows seamlessly across platforms, optimizing workflow processes. Businesses can connect ugtma with CRM systems, project management tools, and more to enhance operational efficiency.

-

Is the ugtma functionality user-friendly for non-technical teams?

Absolutely! The ugtma functionality within airSlate SignNow is designed to be user-friendly, allowing even non-technical users to navigate the system effortlessly. The intuitive interface ensures that team members can easily access and use ugtma without extensive training. This facilitates smoother adoption across all business sectors.

-

How does airSlate SignNow ensure compliance with e-signature laws through ugtma?

AirSlate SignNow's ugtma feature is fully compliant with all major e-signature laws, including ESIGN and UETA. This compliance guarantees that documents signed using ugtma hold legal validity, providing peace of mind for businesses. By adhering to these regulations, airSlate SignNow empowers users to conduct transactions seamlessly and reliably.

Get more for Ugtma

- Universal direct deposit form

- Yazoo kees zkh61252 parts form

- Dl 410 fo renewal by mail eligibility form drivers licenses org

- Tamuc 1098 t form

- Past year papers form

- Hhs llc application for employment form

- Cr 126 application for extension of time to file briefcriminal case judicial council forms

- Cook employment contract template 787751089 form

Find out other Ugtma

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement