W4p Form

What is the W-4P?

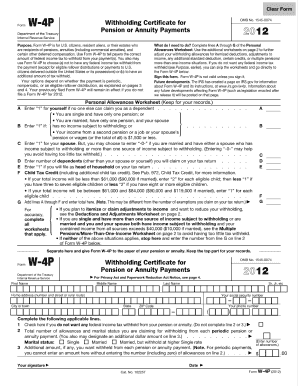

The W-4P form, also known as the Withholding Certificate for Pension or Annuity Payments, is a tax form used by individuals to instruct payers of pensions and annuities on how much federal income tax to withhold from their payments. This form is particularly relevant for retirees or individuals receiving retirement benefits, as it helps ensure that the correct amount of tax is withheld to avoid underpayment or overpayment during tax filing. Completing the W-4P accurately is essential for managing tax liabilities effectively.

How to Use the W-4P

Using the W-4P involves several straightforward steps. First, you need to obtain the form, which can typically be found on the IRS website or through your pension or annuity provider. Next, fill out the required sections, including your personal information and the amount of withholding you desire. You may choose to have no withholding, a specific dollar amount, or a percentage withheld. Once completed, submit the form to the payer of your pension or annuity payments. It is advisable to review your withholding periodically, especially if your financial situation changes.

Steps to Complete the W-4P

Completing the W-4P requires careful attention to detail. Here are the key steps:

- Download the W-4P form from the IRS website or request it from your pension provider.

- Fill in your name, address, and Social Security number at the top of the form.

- Indicate your marital status and the amount you wish to withhold.

- If applicable, specify any additional withholding amounts in the designated section.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your pension or annuity payer.

Legal Use of the W-4P

The W-4P is legally recognized as a valid document for determining federal income tax withholding on pension and annuity payments. It is essential that the form is filled out accurately to comply with IRS regulations. Failure to submit a W-4P can result in automatic withholding at the highest tax rate, which may not reflect your actual tax liability. Ensuring that the form is completed and submitted correctly helps maintain compliance with tax laws and avoids potential penalties.

IRS Guidelines for the W-4P

The IRS provides specific guidelines for completing the W-4P. It is important to refer to these guidelines to ensure compliance. The IRS recommends that individuals review their withholding at the beginning of each year or whenever there is a significant change in income or personal circumstances. Additionally, the IRS offers a withholding calculator on their website to help individuals determine the appropriate amount to withhold based on their tax situation.

Filing Deadlines / Important Dates

While the W-4P does not have a specific filing deadline, it is crucial to submit the form before you receive your first pension or annuity payment to ensure the correct amount is withheld. If you make changes to your withholding preferences, submit a new W-4P as soon as possible to avoid any discrepancies in tax withholding. Keeping track of tax deadlines is essential for effective tax planning and compliance.

Quick guide on how to complete w4p

Complete W4p effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle W4p on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to adjust and electronically sign W4p without hassle

- Obtain W4p and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Adjust and electronically sign W4p and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w4p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is w4p?

The term 'w4p' refers to a specific feature within airSlate SignNow that simplifies the process of completing and signing W-4 forms electronically. With w4p, users can easily manage tax forms for employees, ensuring compliance and accuracy while saving time and resources.

-

How does w4p improve document management?

W4p within airSlate SignNow enhances document management by allowing users to create, send, and sign W-4 forms quickly and securely. This results in streamlined workflows, reducing the chances of errors and speeding up the entire process, which is particularly beneficial for HR departments.

-

Is there a cost associated with using w4p?

While airSlate SignNow offers competitive pricing for its plans, the specific features associated with w4p are included in various subscription tiers. It's best to review the pricing page on our website to find the plan that best suits your needs and budget.

-

What features are included with w4p on airSlate SignNow?

W4p provides features such as customizable templates, real-time tracking, and multi-signature options specifically designed for W-4 forms. These features help streamline the signing process, making it efficient and user-friendly.

-

Can w4p integrate with other software solutions?

Yes, airSlate SignNow with w4p is designed to integrate seamlessly with various business applications, including CRMs and HR systems. This interoperability helps businesses maintain consistent workflows and utilize their existing software investments effectively.

-

What benefits does using w4p offer to businesses?

Utilizing w4p can signNowly reduce the time spent on paperwork and administrative tasks, allowing businesses to focus more on core operations. Additionally, the ability to track document status reduces the likelihood of errors and omissions, enhancing overall compliance.

-

How secure is the data when using w4p?

AirSlate SignNow employs robust security measures to protect data during the use of w4p. These include encryption, secure data storage, and compliance with industry standards, ensuring that your sensitive information remains confidential and secure.

Get more for W4p

Find out other W4p

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe