Sc Isp 3520 Form

What is the Sc Isp 3520

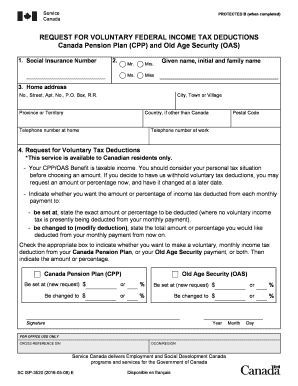

The Sc Isp 3520 is a form used in the United States for requesting voluntary federal income tax deductions. This form is particularly relevant for individuals looking to manage their tax obligations related to the Canada Pension Plan (CPP). By submitting the Sc Isp 3520, taxpayers can ensure that their deductions are processed correctly, aligning with federal tax regulations. Understanding the purpose and function of this form is crucial for anyone seeking to optimize their tax situation.

How to Use the Sc Isp 3520

Using the Sc Isp 3520 involves several straightforward steps. First, gather the necessary personal and financial information, including your Social Security number and details about your income. Next, download the form from a reliable source or obtain a hard copy. Fill out the form accurately, ensuring that all sections are completed. Finally, submit the form according to the specified submission methods, which may include online, mail, or in-person options. Proper usage of the form is essential to avoid delays or issues with your tax deductions.

Steps to Complete the Sc Isp 3520

Completing the Sc Isp 3520 requires careful attention to detail. Follow these steps for successful completion:

- Begin by entering your personal information, including your name and address.

- Provide your Social Security number to ensure proper identification.

- Detail your income sources and any applicable deductions.

- Review the form for accuracy, making sure all required fields are filled.

- Sign and date the form to validate your submission.

Ensuring that each step is followed correctly will help facilitate a smooth processing of your request.

Legal Use of the Sc Isp 3520

The Sc Isp 3520 must be used in compliance with federal tax laws to be considered legally valid. This includes adhering to the guidelines set forth by the Internal Revenue Service (IRS) regarding voluntary deductions. When properly filled out and submitted, the form serves as a legal document that supports your request for deductions. It is important to maintain records of your submission and any correspondence related to the form for future reference.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial when submitting the Sc Isp 3520. Generally, forms must be submitted by specific dates to ensure that your deductions are processed for the correct tax year. It is advisable to check the IRS website or consult a tax professional for the most current deadlines. Missing these deadlines can result in delays or denial of your deduction requests, impacting your overall tax situation.

Required Documents

To successfully complete the Sc Isp 3520, certain documents are required. These typically include:

- Your Social Security number for identification purposes.

- Proof of income, such as pay stubs or tax returns.

- Any additional documentation that supports your claim for deductions.

Having these documents ready will streamline the process and help ensure the accuracy of your submission.

Quick guide on how to complete sc isp 3520

Effortlessly Prepare Sc Isp 3520 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents since you can easily locate the right form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Handle Sc Isp 3520 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Sc Isp 3520 with Ease

- Obtain Sc Isp 3520 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Sc Isp 3520 while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc isp 3520

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the isp 3520cpp and how does it benefit my business?

The isp 3520cpp is a cutting-edge electronic signature tool offered by airSlate SignNow that streamlines the document signing process. By utilizing this innovative solution, businesses can signNowly reduce turnaround times and improve workflow efficiency. It also enhances compliance and security, ensuring that your documents are handled with utmost care.

-

How much does the isp 3520cpp cost?

Pricing for the isp 3520cpp varies based on your business needs and the scale of use. airSlate SignNow offers flexible subscription plans that cater to different requirements, ensuring that you can find a cost-effective solution. For detailed pricing information, it's best to visit our pricing page or contact our sales team.

-

What features does the isp 3520cpp provide?

The isp 3520cpp comes equipped with a variety of features designed to enhance document management. Key functionalities include customizable templates, real-time tracking, and comprehensive audit trails. These tools help businesses maintain organization and transparency in their document handling processes.

-

Can the isp 3520cpp integrate with my existing software?

Yes, the isp 3520cpp is designed with integration in mind. It seamlessly connects with a range of popular business applications, allowing for an enhanced workflow. By integrating with tools you already use, you can maximize efficiency and minimize disruption during implementation.

-

Is the isp 3520cpp secure for sensitive information?

Absolutely! The isp 3520cpp prioritizes security, using advanced encryption methods to protect your sensitive data. It also complies with various industry standards and regulations, ensuring that your documents remain confidential and secure throughout the signing process.

-

How easy is it to set up the isp 3520cpp for my team?

Setting up the isp 3520cpp is a simple and straightforward process. With user-friendly design and helpful guides, your team can quickly acclimate to the tool. Typically, users report being able to generate and send documents for eSignature within minutes of initial setup.

-

What are the benefits of using the isp 3520cpp over traditional methods?

Using the isp 3520cpp offers numerous advantages, including faster turnaround times, reduced paperwork, and lower operational costs. Traditional methods can be time-consuming and cumbersome, while the isp 3520cpp streamlines the signing process, enabling quicker decision-making and enhancing overall productivity.

Get more for Sc Isp 3520

- Potvrda o zaposlenju word form

- Clg 006 answers form

- Usmc meritorious mast template form

- Upshur cad form

- Request for replacement certification card california department of form

- Uspto petition to make special form

- Accounts receivable purchase agreement template form

- Acknowledgement of debt agreement template form

Find out other Sc Isp 3520

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure