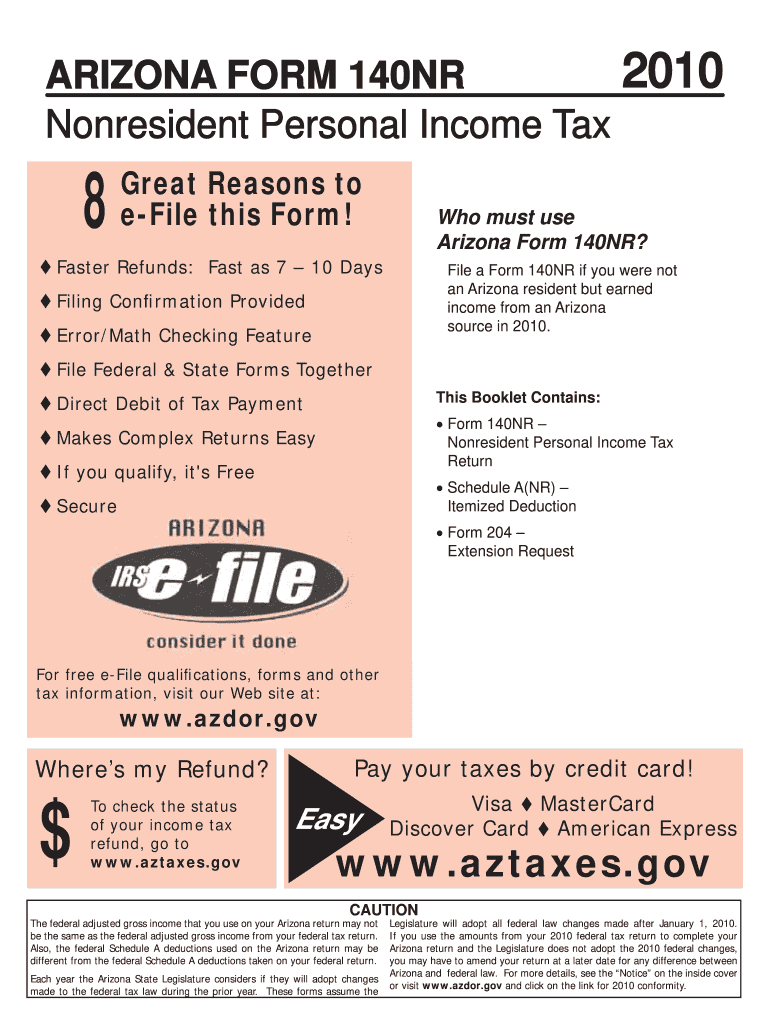

Az 140nr Form

What is the AZ 140NR?

The AZ 140NR is a specific tax form used by individuals in Arizona who are filing their state income tax returns. This form is particularly relevant for those who are non-residents or part-year residents of Arizona. It allows taxpayers to report their income earned within the state while ensuring compliance with state tax regulations. Understanding the AZ 140NR is essential for accurate tax reporting and to avoid potential penalties.

How to Use the AZ 140NR

Using the AZ 140NR involves several key steps to ensure that all required information is accurately reported. First, gather all necessary documentation, such as W-2 forms and other income statements. Next, complete the form by entering your personal information, including your name, address, and Social Security number. It is important to accurately report your Arizona-source income and any deductions or credits you may qualify for. Finally, review the completed form for accuracy before submission.

Steps to Complete the AZ 140NR

Completing the AZ 140NR requires careful attention to detail. Follow these steps:

- Gather all relevant income documents, including W-2s and 1099s.

- Fill out your personal information at the top of the form.

- Report your Arizona-source income in the designated section.

- Include any applicable deductions or credits.

- Review the form for completeness and accuracy.

- Sign and date the form before submission.

Legal Use of the AZ 140NR

The AZ 140NR is legally recognized as a valid document for reporting state income tax. It is essential to comply with Arizona tax laws when using this form. Electronic signatures are accepted, provided they meet the legal requirements outlined by state regulations. Utilizing a reliable electronic signature solution can enhance the security and validity of your submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the AZ 140NR to avoid penalties. Typically, the deadline for filing state income tax returns in Arizona is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Always check for any updates or changes to ensure timely filing.

Required Documents

When preparing to complete the AZ 140NR, several documents are necessary to ensure accurate reporting. These include:

- W-2 forms from employers.

- 1099 forms for any additional income.

- Receipts or documentation for deductions.

- Any prior year tax returns, if applicable.

Form Submission Methods

The AZ 140NR can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Arizona Department of Revenue's website.

- Mailing a printed copy of the form to the appropriate tax office.

- In-person submission at designated tax offices.

Quick guide on how to complete az 140nr

Easily Prepare Az 140nr on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents swiftly without delays. Manage Az 140nr on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Edit and Electronically Sign Az 140nr

- Find Az 140nr and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, and mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from your preferred device. Edit and electronically sign Az 140nr and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the az 140nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 140nr, and how does it relate to airSlate SignNow?

The term 140nr refers to a code used by airSlate SignNow to facilitate various services relating to document management and electronic signatures. This code is part of the platform's streamlined system aimed at enhancing user experience and ensuring secure document transactions.

-

What features does airSlate SignNow offer with the 140nr plan?

The 140nr plan includes essential features such as unlimited eSigning, customizable templates, document tracking, and advanced security options. These tools are designed to enhance your workflow and streamline the signing process, making it highly efficient for businesses of all sizes.

-

How much does the 140nr plan cost?

The pricing for the 140nr plan is competitive, tailored to meet the needs of small to large businesses. Users can choose from various subscription options, ensuring you only pay for what you need while enjoying all the powerful features airSlate SignNow has to offer.

-

What are the benefits of using airSlate SignNow's 140nr plan?

Using the 140nr plan ensures that your business benefits from a user-friendly interface, reliable customer support, and robust security measures. This plan allows you to efficiently manage document workflows, reducing turnaround time and enhancing collaboration among team members.

-

Can I integrate airSlate SignNow with other applications while using the 140nr plan?

Yes, the 140nr plan supports numerous integrations with applications such as Google Drive, Salesforce, and Dropbox. These integrations ensure that your document workflows remain seamless, allowing you to connect with the tools you already use and enhance overall productivity.

-

Is it easy to get started with airSlate SignNow's 140nr plan?

Absolutely! Getting started with the 140nr plan is simple and quick. Users can sign up online, set up their account, and begin sending documents for eSignature in just a few minutes, making it an ideal choice for businesses looking to streamline operations without a steep learning curve.

-

What types of businesses can benefit from the 140nr plan?

The 140nr plan is versatile and suited for a wide range of businesses, from startups to established enterprises. Any organization that needs efficient document signing and automation capabilities will find value in what airSlate SignNow offers under this plan.

Get more for Az 140nr

- D1328 form

- Brick township opra request form

- Travel agency transfer form royal caribbean

- Foster care applicationquestionnaire form

- Peter fewing soccer campswestern washingtonnorthwestpeter fewing soccer campswestern washingtonnorthwestpeter fewing soccer form

- Peter fewing soccer campswestern washington form

- Peterfewingsoccercamp com images1 pf registration2021 peter fewing soccer camp mail in camp registration form

- American amicable life insurance company of texas form

Find out other Az 140nr

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed