AMERICAN AMICABLE LIFE INSURANCE COMPANY of TEXAS 2025-2026

What is the American Amicable Life Insurance Company of Texas

The American Amicable Life Insurance Company of Texas is a life insurance provider based in Texas, offering a range of insurance products designed to meet various financial needs. Established to provide security and peace of mind, the company specializes in life insurance policies, including term life, whole life, and universal life insurance. These products are tailored to help individuals and families secure their financial future, providing benefits that can assist with expenses such as mortgage payments, education costs, and other financial obligations in the event of an untimely death.

How to obtain the American Amicable Life Insurance Company of Texas

Obtaining a policy from the American Amicable Life Insurance Company of Texas involves several straightforward steps. First, individuals should assess their insurance needs and determine the type of coverage that best suits their situation. Next, they can contact the company directly or visit their website to gather information on available policies and premium rates. After selecting a policy, applicants will need to complete an application form, providing necessary personal and financial information. This may include health history, lifestyle choices, and beneficiary details. Once the application is submitted, the company will review it and may request additional information or schedule a medical exam before finalizing the policy.

Steps to complete the American Amicable Life Insurance Company of Texas application

Completing the application for a policy with the American Amicable Life Insurance Company of Texas involves a series of organized steps:

- Step One: Gather necessary documents, including identification, financial statements, and health records.

- Step Two: Choose the appropriate type of life insurance policy based on personal needs.

- Step Three: Fill out the application form accurately, ensuring all information is complete.

- Step Four: Submit the application along with any required documents.

- Step Five: Await the underwriting process, during which the company evaluates the application.

- Step Six: Review and accept the final policy offer, making any necessary premium payments.

Key elements of the American Amicable Life Insurance Company of Texas policies

The policies offered by the American Amicable Life Insurance Company of Texas include several key elements that are important for policyholders to understand:

- Coverage Amount: The total sum that beneficiaries will receive upon the policyholder's death.

- Premiums: The regular payments required to maintain the policy, which can vary based on the type of coverage and the insured's risk profile.

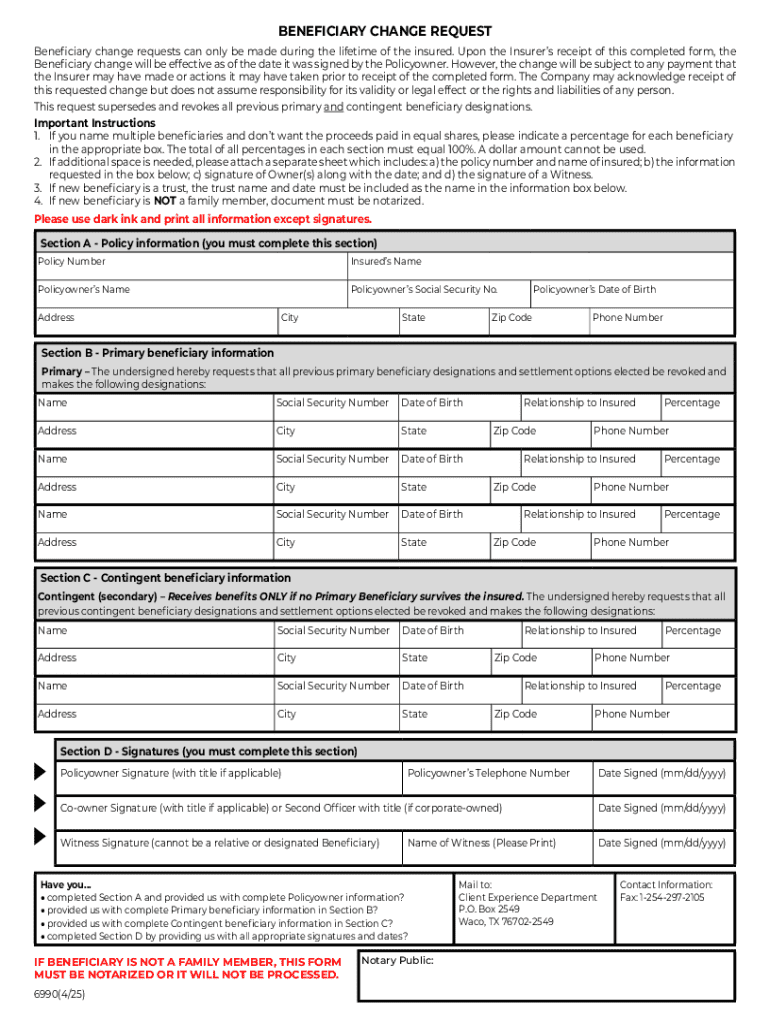

- Beneficiary Designation: The individual(s) or entity designated to receive the death benefit.

- Policy Term: The duration for which the coverage is active, particularly relevant for term life insurance.

- Riders: Optional add-ons that can enhance coverage, such as accidental death benefits or waiver of premium provisions.

Legal use of the American Amicable Life Insurance Company of Texas policies

The legal use of policies from the American Amicable Life Insurance Company of Texas involves understanding the rights and responsibilities of both the insurer and the policyholder. Policies are legally binding contracts that stipulate the terms of coverage, premium obligations, and conditions under which benefits are paid. It is essential for policyholders to read and comprehend these terms to ensure compliance and to understand their rights, such as the right to contest a claim or to make changes to the policy, including beneficiary updates. Additionally, policyholders should be aware of state regulations that may affect their policies.

Eligibility Criteria for American Amicable Life Insurance Company of Texas policies

Eligibility for life insurance policies from the American Amicable Life Insurance Company of Texas typically depends on several factors:

- Age: Applicants must fall within the age limits set by the company, which can vary by policy type.

- Health Status: A medical examination may be required, and pre-existing conditions can affect eligibility and premiums.

- Lifestyle Choices: Factors such as smoking or high-risk activities may influence eligibility and coverage options.

- Financial Stability: Applicants may need to demonstrate financial responsibility to ensure they can maintain premium payments.

Create this form in 5 minutes or less

Find and fill out the correct american amicable life insurance company of texas

Create this form in 5 minutes!

How to create an eSignature for the american amicable life insurance company of texas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What types of life insurance products does the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS offer?

The AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS provides a variety of life insurance products, including term life, whole life, and universal life insurance. Each product is designed to meet different financial needs and goals, ensuring that customers can find the right coverage for their situation.

-

How can I get a quote from the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS?

To obtain a quote from the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS, you can visit their website or contact an authorized agent. The process is straightforward and typically requires basic information about your health and lifestyle to provide an accurate estimate.

-

What are the benefits of choosing the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS?

Choosing the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS offers several benefits, including competitive pricing, a range of customizable policies, and reliable customer service. Their commitment to customer satisfaction ensures that you receive the support you need throughout your insurance journey.

-

Are there any discounts available with the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS?

Yes, the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS offers various discounts that may apply based on your health, lifestyle, and the type of policy you choose. It's advisable to inquire about potential discounts when obtaining your quote to maximize your savings.

-

How does the claims process work with the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS?

The claims process with the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS is designed to be simple and efficient. Policyholders or beneficiaries can submit a claim online or via phone, and the company aims to process claims promptly to provide financial support when it is needed most.

-

Can I manage my policy online with the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS?

Yes, the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS offers an online portal where policyholders can manage their accounts. This includes viewing policy details, making payments, and updating personal information, making it convenient to stay on top of your insurance needs.

-

What is the age limit for applying for life insurance with the AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS?

The AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS has specific age limits for different types of life insurance policies. Generally, applicants can apply for coverage from a young age up to their late 70s, but it's best to check the specific policy details for exact age requirements.

Get more for AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS

- Agreement paperwork in a pending divorce case no children form

- Note this form is to be used with sale contracts for the

- When parties create a contract it should be presumed that form

- Agreement paperwork in a pending divorce case children after form

- Please see the attached set of instructions for your form

- 633a sections 633a form

- State of iowa hereinafter referred to as the trustor and the trustee designated form

- Grevocable living trust agreement form

Find out other AMERICAN AMICABLE LIFE INSURANCE COMPANY OF TEXAS

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online