Deferred Annuity Withdrawal Form American General

What is the Deferred Annuity Withdrawal Form American General

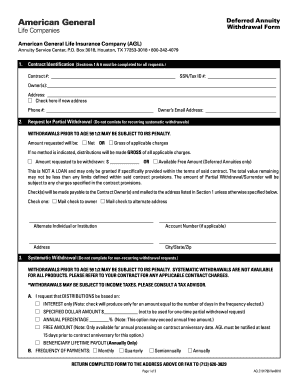

The Deferred Annuity Withdrawal Form American General is a specific document used by policyholders to request withdrawals from their deferred annuity accounts. This form is essential for individuals looking to access funds that have been accumulated in their annuity contracts. It includes details about the policyholder, the annuity contract, and the amount being withdrawn. Understanding this form is crucial for ensuring that the withdrawal process is completed accurately and in compliance with the terms of the annuity agreement.

Steps to Complete the Deferred Annuity Withdrawal Form American General

Completing the Deferred Annuity Withdrawal Form American General involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your annuity contract number and personal identification details. Next, accurately fill out the form, specifying the amount you wish to withdraw and the reason for the withdrawal. It is important to review the completed form for any errors before submission. Finally, submit the form through the designated method, whether online, by mail, or in person, ensuring you keep a copy for your records.

How to Obtain the Deferred Annuity Withdrawal Form American General

The Deferred Annuity Withdrawal Form American General can be obtained through multiple channels. Policyholders can visit the official American General website to download the form directly. Alternatively, contacting customer service can provide assistance in acquiring the form. Some financial advisors may also have access to the form and can assist in its completion. Ensuring you have the most current version of the form is vital for a smooth withdrawal process.

Key Elements of the Deferred Annuity Withdrawal Form American General

The key elements of the Deferred Annuity Withdrawal Form American General include several important sections that must be completed accurately. These sections typically encompass the policyholder's personal information, details about the annuity contract, the requested withdrawal amount, and the method of payment. Additionally, the form may require signatures and dates to validate the request. Understanding these elements helps ensure that all necessary information is provided, reducing the likelihood of processing delays.

Legal Use of the Deferred Annuity Withdrawal Form American General

The legal use of the Deferred Annuity Withdrawal Form American General is governed by specific regulations and guidelines. To be considered valid, the form must be completed in accordance with the terms outlined in the annuity contract. Additionally, compliance with relevant state and federal laws regarding annuity withdrawals is essential. Utilizing a reliable electronic signature solution can enhance the legal standing of the form, ensuring that it meets all necessary legal requirements for processing.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Deferred Annuity Withdrawal Form American General can be done through various methods, depending on the preferences of the policyholder. Online submission is often the fastest option, allowing for immediate processing. Alternatively, the form can be mailed to the designated address provided by American General, ensuring it is sent via a secure method. For those who prefer a personal touch, in-person submission at a local office can also be arranged. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete deferred annuity withdrawal form american general

Complete Deferred Annuity Withdrawal Form American General seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Handle Deferred Annuity Withdrawal Form American General on any device with the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Deferred Annuity Withdrawal Form American General effortlessly

- Obtain Deferred Annuity Withdrawal Form American General and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Deferred Annuity Withdrawal Form American General to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deferred annuity withdrawal form american general

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the American General annuity withdrawal form?

The American General annuity withdrawal form is a document required to request a withdrawal from your annuity account. It serves as a formal request that allows you to access your funds efficiently. Completing this form correctly ensures that your withdrawal is processed without delays.

-

How do I obtain the American General annuity withdrawal form?

You can obtain the American General annuity withdrawal form directly from the official American General website or by contacting their customer service. Alternatively, you can find the form on financial documents aggregator platforms. Having the correct form is essential for initiating your withdrawal process smoothly.

-

What information do I need to fill out the American General annuity withdrawal form?

To fill out the American General annuity withdrawal form, you'll need personal information such as your policy number, identification details, and the amount you wish to withdraw. Additionally, any beneficiary information may also be required. Ensuring all details are accurate will facilitate a quicker processing time for your withdrawal.

-

Are there any fees associated with the American General annuity withdrawal form?

Yes, there may be fees associated with withdrawing from your annuity, depending on the terms of your policy. It's important to review your policy documents or contact customer service to understand any potential charges related to your American General annuity withdrawal form. Understanding these fees can help you make informed financial decisions.

-

What are the benefits of using the American General annuity withdrawal form?

Using the American General annuity withdrawal form streamlines the withdrawal process by providing a clear and standard procedure for accessing your funds. This form helps ensure that all necessary information is provided upfront, reducing potential delays. Properly filling out the form also minimizes the chances of errors or complications during your withdrawal.

-

How long does it take to process the American General annuity withdrawal form?

The processing time for the American General annuity withdrawal form varies, typically ranging from a few days to a few weeks, depending on the completeness of your submission and the volume of requests. After submitting the form, you should receive a confirmation of receipt. For a specific timeframe, it is advisable to check with customer service directly.

-

Can I track the status of my withdrawal after submitting the American General annuity withdrawal form?

Yes, once you've submitted the American General annuity withdrawal form, you can generally track the status of your withdrawal. Most companies provide a way to monitor your account or contact customer support for updates. Keeping in touch ensures you are informed about the progress of your request.

Get more for Deferred Annuity Withdrawal Form American General

- Contractor certificate of compliance sfn 61040 north dakota dot nd form

- Dcf enrollment form

- Pc 8 2 adult adoption petition and change of name sos ri form

- 3q573 as form

- Parq questionnaire examples form

- Dear mr blueberry pdf form

- Manag director employment contract template form

- Management employment contract template form

Find out other Deferred Annuity Withdrawal Form American General

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe