Quiktrip Insurance Form

What is the Quiktrip Insurance

The Quiktrip insurance refers to a specific type of coverage offered by QuikTrip, a well-known convenience store chain in the United States. This insurance typically encompasses health benefits, providing employees with access to medical services. Quiktrip health insurance is designed to support the well-being of employees and their families, ensuring that they have financial protection against medical expenses. Understanding the details of this insurance is crucial for employees to maximize their benefits and make informed decisions regarding their healthcare needs.

How to Obtain the Quiktrip Insurance

To obtain Quiktrip insurance, employees must follow a structured process. Initially, they should review the benefits package provided by QuikTrip during the onboarding process. This package includes essential information about the available health insurance options. Employees can typically enroll in the insurance during open enrollment periods or after qualifying life events, such as marriage or the birth of a child. It is advisable to consult with the HR department for specific enrollment instructions and deadlines to ensure timely coverage.

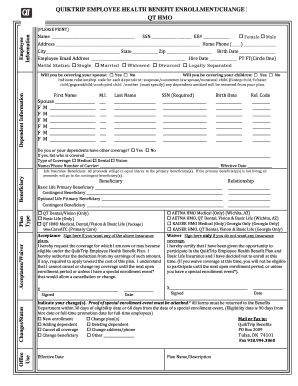

Steps to Complete the Quiktrip Insurance Form

Completing the Quiktrip insurance form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including Social Security numbers, contact details, and dependent information. Next, carefully fill out the form, ensuring that all sections are complete and accurate. Review the form for any errors before submission. Once finalized, submit the form electronically through the designated platform, such as airSlate SignNow, or follow the specified submission methods outlined by QuikTrip. Maintaining a copy of the submitted form is advisable for personal records.

Legal Use of the Quiktrip Insurance

The legal use of Quiktrip insurance is governed by various regulations that ensure compliance with federal and state laws. The insurance must adhere to the Affordable Care Act (ACA) guidelines, which outline the minimum essential coverage requirements. Additionally, Quiktrip insurance must comply with the Employee Retirement Income Security Act (ERISA), providing transparency and protection for employees. Understanding these legal frameworks is essential for employees to ensure that their insurance coverage meets all necessary legal standards.

Key Elements of the Quiktrip Insurance

Key elements of Quiktrip insurance include coverage details, premium costs, deductibles, and co-pays. Employees should be aware of the specific benefits included in their plan, such as preventive care, hospitalization, and prescription drug coverage. Additionally, understanding the premium costs and how they are deducted from paychecks is important for budgeting. Familiarity with deductibles and co-pays will help employees anticipate out-of-pocket expenses when accessing healthcare services.

Examples of Using the Quiktrip Insurance

Examples of using Quiktrip insurance can help employees understand how to navigate their coverage effectively. For instance, if an employee requires a routine check-up, they can schedule an appointment with an in-network provider to minimize costs. In the case of an unexpected medical emergency, employees should know how to access urgent care services and the steps to take for reimbursement. Additionally, understanding how to file claims for prescription medications ensures that employees can take full advantage of their benefits.

Quick guide on how to complete quiktrip insurance

Complete Quiktrip Insurance effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your documents promptly without delays. Manage Quiktrip Insurance on any platform with airSlate SignNow apps for Android or iOS, and enhance any document-centric operation today.

The easiest method to modify and electronically sign Quiktrip Insurance without hassle

- Find Quiktrip Insurance and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Quiktrip Insurance and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quiktrip insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is QuikTrip insurance?

QuikTrip insurance is a specialized insurance product designed to cover the unique needs of the QuikTrip customer experience. It ensures that customers are protected while using services provided by QuikTrip, including fuel purchases and convenience store transactions. By providing tailored coverage, QuikTrip insurance aims to enhance customer satisfaction and peace of mind.

-

How much does QuikTrip insurance cost?

The cost of QuikTrip insurance varies depending on the coverage options selected and individual customer needs. Typically, premiums are competitive and designed to offer great value. It's important for customers to compare options to find the most cost-effective QuikTrip insurance plan suitable for their requirements.

-

What features are included in QuikTrip insurance?

QuikTrip insurance typically includes features such as liability coverage, protection against theft, and damage coverage for purchased goods. Additional benefits may include roadside assistance and coverage for accidental injuries while on the premises. These features ensure that customers receive comprehensive support while using QuikTrip services.

-

What are the benefits of having QuikTrip insurance?

The primary benefits of having QuikTrip insurance include increased safety and financial protection during your QuikTrip visits. Customers can enjoy peace of mind knowing that they are covered against various risks. Furthermore, having QuikTrip insurance can streamline claim processes and enhance customer service experiences.

-

Can I purchase QuikTrip insurance online?

Yes, QuikTrip insurance can be purchased online through the official QuikTrip website or associated platforms. The online process is typically straightforward, allowing for easy comparisons and selections of various coverage options. This convenience makes it accessible for customers to acquire QuikTrip insurance without hassle.

-

Is QuikTrip insurance customizable?

Yes, QuikTrip insurance is customizable to fit individual customer preferences and needs. Customers can choose from different coverage tiers and add-ons to enhance their protection. This flexibility helps ensure that each policyholder gets the most out of their QuikTrip insurance experience.

-

Does QuikTrip insurance integrate with other services?

QuikTrip insurance is designed to integrate seamlessly with other products and services offered by QuikTrip. This may include rewards programs or payment options available at their convenience stores. The integration makes managing your QuikTrip insurance easier while benefiting from other QuikTrip services.

Get more for Quiktrip Insurance

- Bank transfer authorization form 483056173

- Ucd extension form

- Q i dont think my court appointed attorney is defending me as form

- App 110 respondents notice designating record on appeallimited civil case judicial council forms

- Delivery driver employment contract template form

- Dental employment contract template form

- Director employment contract template form

- Exhibit 5 dekalb county fire department field incident report form

Find out other Quiktrip Insurance

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey