Bauthorizationb to Release Confidential Business Btax Informationb Revenue Ky 2015

What is the Authorization to Release Confidential Business Tax Information Revenue KY

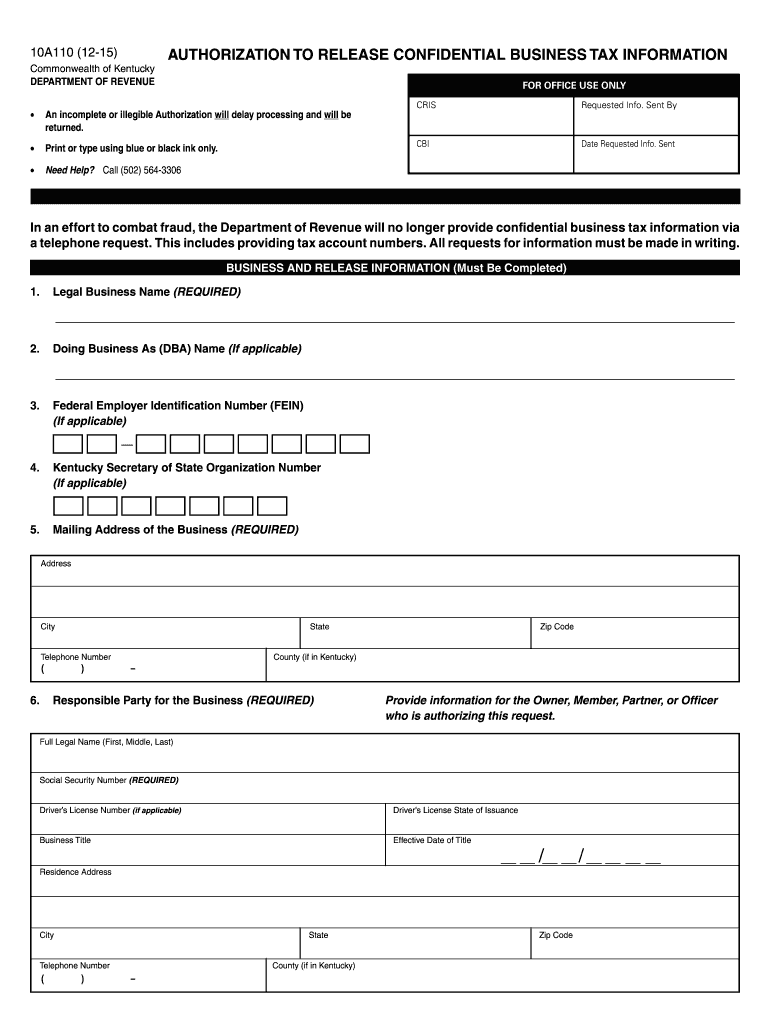

The Authorization to Release Confidential Business Tax Information Revenue KY is a formal document that allows individuals or entities to grant permission for the disclosure of sensitive tax information to designated parties. This form is essential for businesses that need to share their tax data with accountants, financial advisors, or other authorized representatives. The document ensures compliance with privacy regulations while facilitating necessary communication regarding tax matters.

Steps to Complete the Authorization to Release Confidential Business Tax Information Revenue KY

Completing the Authorization to Release Confidential Business Tax Information Revenue KY involves several key steps:

- Obtain the form: Access the latest version of the authorization form through official state resources or tax preparation services.

- Fill in required information: Provide accurate details, including the business name, tax identification number, and the names of individuals authorized to receive the information.

- Sign the document: Ensure that the form is signed by an authorized representative of the business, which may include an owner or designated officer.

- Submit the form: Send the completed form to the appropriate tax authority or designated recipient as specified in the instructions.

Legal Use of the Authorization to Release Confidential Business Tax Information Revenue KY

This authorization form is legally binding and must be used in accordance with state and federal regulations. It is crucial for businesses to understand the legal implications of sharing tax information, including potential liabilities. The form protects both the disclosing party and the recipient by establishing clear terms for the use of the shared information. Misuse or unauthorized disclosure can lead to penalties or legal consequences.

Key Elements of the Authorization to Release Confidential Business Tax Information Revenue KY

Several key elements must be included in the Authorization to Release Confidential Business Tax Information Revenue KY to ensure its validity:

- Identification of parties: Clearly identify the business granting the authorization and the individuals or entities receiving the information.

- Scope of authorization: Specify the types of tax information that can be disclosed, such as income tax returns or payroll records.

- Timeframe: Indicate the duration for which the authorization is valid, ensuring it aligns with the business's needs.

- Signatures: Require signatures from authorized representatives to validate the agreement.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the release of confidential tax information. These guidelines emphasize the importance of obtaining proper authorization before disclosing any tax-related data. Businesses must adhere to IRS regulations to avoid potential audits or penalties. It is advisable to consult the IRS website or a tax professional for the most current information regarding compliance and best practices.

Form Submission Methods

The Authorization to Release Confidential Business Tax Information Revenue KY can typically be submitted through various methods:

- Online: Many states offer electronic submission options through their tax portals.

- Mail: The completed form can be mailed to the appropriate tax authority.

- In-person: Businesses may also choose to deliver the form directly to their local tax office.

Quick guide on how to complete bauthorizationb to release confidential business btax informationb revenue ky

Your assistance manual on how to prepare your Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky

If you’re wondering how to create and submit your Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky, here are some concise instructions on how to simplify tax processing.

To begin, you simply need to set up your airSlate SignNow account to transform your approach to handling documents online. airSlate SignNow is a highly intuitive and powerful document solution that enables you to modify, draft, and finalize your income tax documents with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and return to amend information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky in a few minutes:

- Create your account and start editing PDFs in moments.

- Use our directory to locate any IRS tax form; navigate through versions and schedules.

- Click Obtain form to access your Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky in our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Signature Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to submit your taxes digitally with airSlate SignNow. Please keep in mind that filing on paper may increase the likelihood of return errors and delay reimbursements. Certainly, before e-filing your taxes, check the IRS website for compliance rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct bauthorizationb to release confidential business btax informationb revenue ky

Create this form in 5 minutes!

How to create an eSignature for the bauthorizationb to release confidential business btax informationb revenue ky

How to make an eSignature for your Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky in the online mode

How to make an eSignature for the Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky in Google Chrome

How to make an eSignature for signing the Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky in Gmail

How to generate an electronic signature for the Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky right from your smartphone

How to make an eSignature for the Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky on iOS

How to make an eSignature for the Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky on Android

People also ask

-

What is the 'Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky.' form?

The 'Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky.' form is a legal document that allows businesses to authorize the release of their tax information to specified parties. It ensures that confidential tax information is shared securely and complies with relevant state regulations.

-

How can airSlate SignNow assist with the 'Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky.'?

AirSlate SignNow provides an intuitive platform for businesses to prepare, send, and eSign the 'Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky.' form. Our easy-to-use features streamline the signing process, ensuring that your documents are handled safely and efficiently.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers several pricing packages to accommodate businesses of all sizes. You can choose between monthly or annual plans, with features and support tailored to meet your needs, including the management of 'Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky.' documents.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various business tools and applications, enhancing your workflow. You can easily connect with popular platforms for file storage, project management, and CRM systems, making it simpler to manage 'Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky.' forms along with other documents.

-

What security measures does airSlate SignNow implement?

AirSlate SignNow prioritizes the security of your documents, including the 'Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky.' form. Our platform uses industry-standard encryption, secure cloud storage, and compliance with data protection regulations to ensure your confidential information remains safe.

-

How user-friendly is the airSlate SignNow platform?

AirSlate SignNow is designed to be highly user-friendly, making it accessible for individuals and businesses alike. The intuitive interface allows users to easily navigate through the process of creating and signing documents, including the 'Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky.' form.

-

Can users track the status of their documents in airSlate SignNow?

Absolutely! AirSlate SignNow provides real-time tracking for all your documents, including the 'Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky.' form. You can easily see who has signed, who needs to sign, and when the document was completed, ensuring transparency throughout the process.

Get more for Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky

- Travel baseball parent contract form

- Motion to reopen bankruptcy form

- Refund form pub

- Research evaluation form

- Intra district transfer application east side union high school esuhsd form

- Fitness homework cardio graph worksheet the health form

- Sar 2 315 required form substitution permitted

- Melbourne pathology request form pdf

Find out other Bauthorizationb To Release Confidential Business Btax Informationb Revenue Ky

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document