Rebasment Form

What is the Rebasment Form

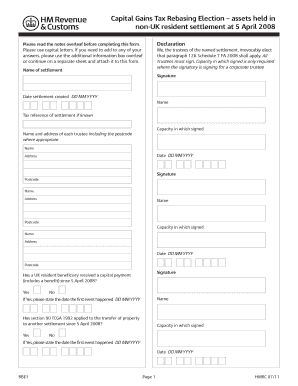

The Rebasment Form is a crucial document used in various financial and legal contexts, particularly in real estate and tax scenarios. It allows individuals or businesses to adjust the basis of an asset, which can impact depreciation and capital gains calculations. Understanding the purpose of this form is essential for accurate financial reporting and compliance with tax regulations.

How to use the Rebasment Form

Using the Rebasment Form involves several key steps to ensure that it is completed correctly. First, gather all necessary information related to the asset in question, including purchase price, improvements made, and any relevant depreciation taken. Next, fill out the form accurately, ensuring that all figures are correct and supported by documentation. Finally, submit the completed form to the appropriate authority, whether that be a tax agency or another regulatory body, to ensure compliance.

Steps to complete the Rebasment Form

Completing the Rebasment Form requires careful attention to detail. Follow these steps for accurate submission:

- Collect all relevant financial documents related to the asset.

- Fill in the required fields on the form, including asset description and basis adjustments.

- Review the form for accuracy, ensuring all calculations are correct.

- Sign and date the form as required.

- Submit the form to the designated agency by the specified deadline.

Legal use of the Rebasment Form

The legal validity of the Rebasment Form hinges on compliance with applicable laws and regulations. It is essential to ensure that the form is filled out in accordance with IRS guidelines and any state-specific requirements. Failure to comply can lead to penalties or issues with asset valuation. Therefore, understanding the legal implications is crucial for anyone using this form.

Key elements of the Rebasment Form

Several key elements must be included in the Rebasment Form to ensure its effectiveness. These include:

- Asset identification: Clearly describe the asset being rebasement.

- Adjustment details: Specify the adjustments being made to the asset's basis.

- Supporting documentation: Attach any necessary documents that validate the adjustments.

- Signature: Ensure that the form is signed by the appropriate parties.

Filing Deadlines / Important Dates

Filing deadlines for the Rebasment Form can vary based on the type of asset and the regulatory body involved. It is important to be aware of these deadlines to avoid penalties. Typically, forms should be submitted by the end of the tax year in which the adjustment is made. Keeping track of these dates ensures timely compliance and helps avoid complications with tax filings.

Quick guide on how to complete rebasment form

Manage Rebasment Form effortlessly on any device

Digital document handling has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your papers promptly without delays. Handle Rebasment Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-related workflows today.

How to alter and electronically sign Rebasment Form with ease

- Find Rebasment Form and select Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or mask sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Rebasment Form and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rebasment form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Rebasment Form in airSlate SignNow?

A Rebasment Form in airSlate SignNow is a customizable document that allows users to manage agreement changes effectively. This form is designed to streamline the process of modifying existing contracts, ensuring that all parties are on the same page and reducing confusion. Utilizing a Rebasment Form can signNowly enhance your document management efficiency.

-

How much does it cost to use the Rebasment Form feature?

The pricing for utilizing the Rebasment Form feature within airSlate SignNow varies based on the subscription plan you choose. Our plans are designed to fit different business needs, offering cost-effective solutions without compromising on efficiency. You can explore our pricing options on the airSlate SignNow website to find the best fit for your organization.

-

What are the key features of the Rebasment Form?

The Rebasment Form in airSlate SignNow offers several key features, including customizable templates, real-time collaboration, and electronic signature capabilities. Users can easily modify the form to suit their specific requirements, ensuring a tailored solution for every business scenario. Additionally, the form is designed to enhance workflow and improve overall document turnaround time.

-

How can a Rebasment Form benefit my business?

A Rebasment Form can signNowly benefit your business by streamlining contract modifications and reducing the time spent on administrative tasks. This helps improve compliance and minimizes errors during the document signing process. Ultimately, using a Rebasment Form leads to faster agreement executions and enhanced productivity across your team.

-

Does airSlate SignNow integrate with other software for using the Rebasment Form?

Yes, airSlate SignNow offers seamless integrations with various software platforms, allowing you to utilize the Rebasment Form effectively. You can connect to popular tools like CRM systems, project management applications, and cloud storage services, ensuring a cohesive workflow. These integrations enhance document management capabilities and improve productivity.

-

Is it easy to create a Rebasment Form in airSlate SignNow?

Creating a Rebasment Form in airSlate SignNow is user-friendly and straightforward. With our intuitive interface, you can customize form fields, add branding elements, and set up workflows with minimal effort. This simplicity ensures that users of all technical levels can quickly create and send forms without any hassle.

-

Can I track the status of my Rebasment Form?

Absolutely! airSlate SignNow provides robust tracking features for your Rebasment Form, allowing you to monitor progress in real time. You'll receive notifications when the form is viewed, signed, or completed, which helps you stay informed and manage deadlines effectively. This transparency ensures you can always maintain communication with involved parties.

Get more for Rebasment Form

- Texas scholars form ector county independent school district ectorcountyisd

- Pre calculus worksheets with answers pdf form

- Sba 10 tab checklist form

- Surgery scheduling request form wesley medical center

- Satisfaction of judgment georgia form

- Cancer family history questionnaire form

- Affidavit of waiver sample form

- Home care agreement template form

Find out other Rebasment Form

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself