Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit 2022

Understanding the Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit

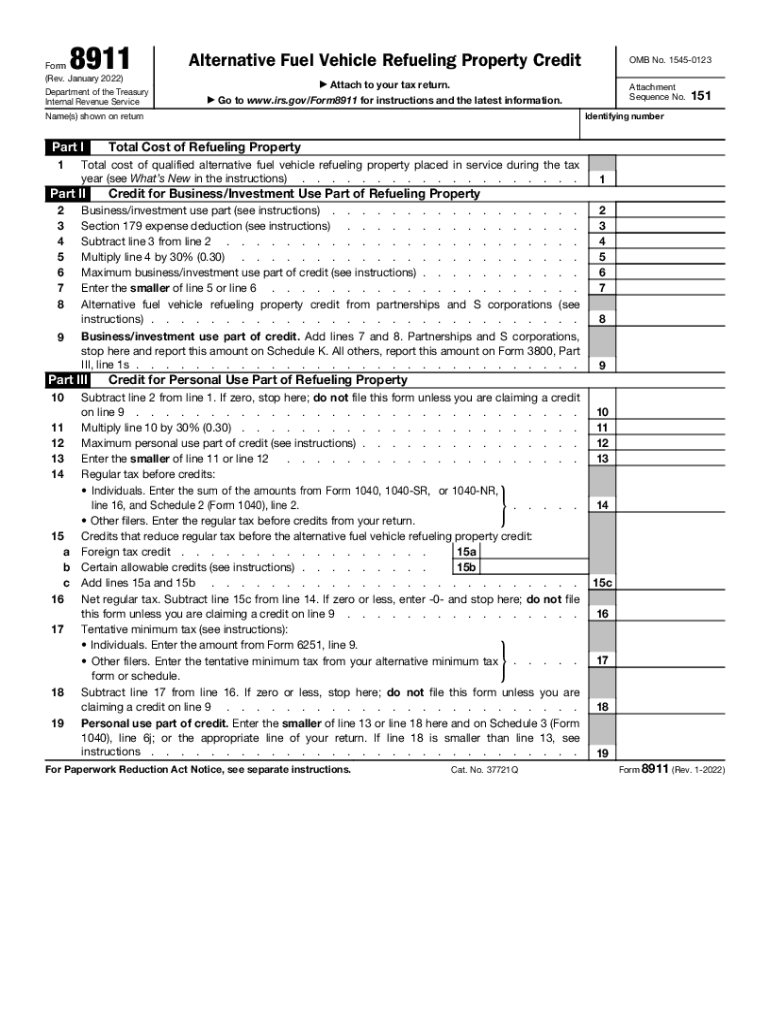

The Form 8911 is used to claim the Alternative Fuel Vehicle Refueling Property Credit, which incentivizes the installation of refueling property for alternative fuel vehicles. This credit aims to encourage the use of alternative fuels, contributing to energy independence and environmental sustainability. Eligible taxpayers can receive a credit for a percentage of the costs associated with installing qualified refueling property, which includes equipment for electric vehicle charging, hydrogen refueling, and other alternative fuel sources.

Steps to Complete the Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit

Completing Form 8911 involves several key steps:

- Gather necessary documentation, including receipts for installation costs and details about the property.

- Fill out the form by providing information about the property, including its location and the type of alternative fuel it supports.

- Calculate the credit amount based on eligible expenses, ensuring to adhere to IRS guidelines for allowable costs.

- Review the form for accuracy before submission to avoid delays or rejections.

Eligibility Criteria for the Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit

To qualify for the Alternative Fuel Vehicle Refueling Property Credit, taxpayers must meet specific eligibility criteria. The property must be used primarily for refueling alternative fuel vehicles and must be installed after a certain date specified by the IRS. Additionally, the taxpayer must be the owner of the property and must not have claimed a similar credit for the same property in prior years. Understanding these criteria is essential to ensure compliance and maximize potential tax benefits.

IRS Guidelines for Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit

The IRS provides detailed guidelines for the completion and submission of Form 8911. These guidelines outline eligible costs, the calculation of the credit, and the documentation required for substantiation. Taxpayers should familiarize themselves with these guidelines to ensure they are claiming the credit correctly. The IRS also specifies the record-keeping requirements to support the credit claim, which includes maintaining receipts and documentation for all expenses related to the installation of the refueling property.

Filing Deadlines for the Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit

Filing deadlines for Form 8911 align with the general tax filing deadlines for individual and business taxpayers. Typically, the form must be submitted along with the taxpayer's annual income tax return. It is crucial to be aware of these deadlines to avoid penalties or interest on unpaid taxes. Taxpayers should also consider filing for an extension if they are unable to meet the deadline, ensuring that they still submit Form 8911 within the extended timeframe.

Required Documents for the Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit

When completing Form 8911, taxpayers must provide various documents to support their claim. Required documents typically include:

- Receipts for the purchase and installation of the refueling property.

- Documentation proving the property is used for alternative fuel vehicles.

- Any additional records that demonstrate compliance with IRS requirements.

Having these documents organized and readily available can streamline the filing process and help ensure a successful credit claim.

Quick guide on how to complete form 8911 rev january alternative fuel vehicle refueling property credit

Complete Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without interruptions. Handle Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The simplest method to modify and electronically sign Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit with ease

- Find Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of the documents or conceal sensitive details using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8911 rev january alternative fuel vehicle refueling property credit

Create this form in 5 minutes!

How to create an eSignature for the form 8911 rev january alternative fuel vehicle refueling property credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit?

Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit is a tax form used to claim a credit for the installation of refueling property for alternative fuel vehicles. This credit can help businesses offset the costs associated with setting up infrastructure for electric or alternative fuel vehicles, promoting a greener environment.

-

How can airSlate SignNow assist with Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit?

airSlate SignNow provides an efficient platform for businesses to manage and eSign documents related to Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit. Our solution streamlines the documentation process, ensuring that all necessary forms are completed accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow for Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures that you can manage your Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit documentation without breaking the bank, with options for monthly or annual subscriptions.

-

What features does airSlate SignNow offer for managing Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to simplify the process of handling Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit. These tools enhance efficiency and ensure compliance with tax regulations.

-

What are the benefits of using airSlate SignNow for Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit?

Using airSlate SignNow for Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit allows businesses to save time and reduce errors in their documentation process. Our user-friendly interface and robust features help ensure that you can focus on your core business activities while we handle the paperwork.

-

Can airSlate SignNow integrate with other software for Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for managing Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit. This integration allows for easy data transfer and improved collaboration across your business tools.

-

Is airSlate SignNow secure for handling Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit documents. You can trust that your sensitive information is safe with us.

Get more for Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit

- Cdr 4905 hamilton co form

- Prime hardhat application aviva ensurco insurance group inc form

- Application for a replacement biometric residence permit form

- Mrcm status certificate form

- Missionary member request for reimbursement christian care form

- Csbilling capecoral com form

- Personal financial statement southstar bank ssb form

- Llc tax return in the state of ky turbotax support intuit form

Find out other Form 8911 Rev January Alternative Fuel Vehicle Refueling Property Credit

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe