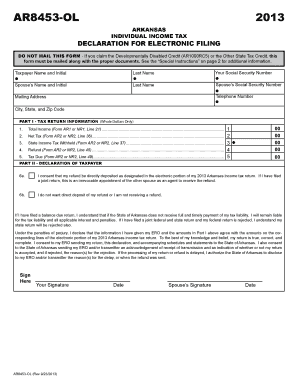

Ar8453ol Form

What is the 2018 AR8453OL?

The 2018 AR8453OL is a specific tax form used primarily for electronic filing of tax returns in the United States. This form serves as a declaration of the taxpayer's intent to file electronically, ensuring compliance with IRS regulations. It is crucial for individuals and businesses that choose to submit their tax documents digitally, as it provides necessary verification and authentication of the taxpayer's identity.

How to Use the 2018 AR8453OL

Using the 2018 AR8453OL involves several key steps. First, ensure that you have all required documentation and information at hand. This includes your Social Security number, income statements, and any relevant deductions. Next, you will need to complete the form accurately, providing your signature electronically. Once completed, the form can be submitted alongside your electronic tax return through a compatible e-filing software.

Steps to Complete the 2018 AR8453OL

Completing the 2018 AR8453OL requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including your W-2s, 1099s, and any other income statements.

- Access the form through your e-filing software.

- Fill in your personal information, ensuring accuracy in your name and Social Security number.

- Review your entries for any errors or omissions.

- Sign the form electronically, which may involve entering a PIN or using a digital signature feature.

- Submit the form along with your electronic tax return.

Legal Use of the 2018 AR8453OL

The legal use of the 2018 AR8453OL is governed by IRS regulations, which stipulate that electronic signatures must meet specific criteria to be considered valid. This includes compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Utilizing a reliable e-signature solution ensures that your submission is legally binding and protects your rights as a taxpayer.

Filing Deadlines / Important Dates

Filing deadlines for the 2018 AR8453OL align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due by April 15 of the following year. However, if you file for an extension, you may have until October 15 to submit your forms, including the AR8453OL. It is essential to stay informed about these dates to avoid penalties and ensure timely processing of your tax return.

Required Documents

To complete the 2018 AR8453OL successfully, you will need several documents, including:

- Your Social Security number or Employer Identification Number (EIN)

- Income statements such as W-2s and 1099s

- Records of deductions and credits

- Any prior year tax returns, if applicable

Who Issues the Form

The 2018 AR8453OL is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement of tax laws in the United States. This form is part of the IRS's efforts to facilitate electronic filing and improve the efficiency of tax submissions.

Quick guide on how to complete ar8453ol

Complete Ar8453ol effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed papers, as you can easily access the required form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Ar8453ol across any platform using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The simplest method to alter and eSign Ar8453ol with ease

- Locate Ar8453ol and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device you prefer. Modify and eSign Ar8453ol and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar8453ol

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 ar8453ol and how does it relate to airSlate SignNow?

The 2018 ar8453ol is a crucial document for tax submissions, and airSlate SignNow offers a seamless solution for eSigning this form. With our platform, users can securely sign, send, and manage their 2018 ar8453ol, ensuring compliance and accuracy.

-

How does airSlate SignNow enhance the signing experience for the 2018 ar8453ol?

AirSlate SignNow elevates the signing experience for the 2018 ar8453ol by providing a user-friendly interface and mobile access. Users can quickly sign the document from any device, ensuring that they meet filing deadlines.

-

What are the pricing options available for using airSlate SignNow for the 2018 ar8453ol?

AirSlate SignNow offers affordable pricing plans suitable for various business sizes. Our plans provide full features for handling the 2018 ar8453ol and other documents, making it a cost-effective choice for eSigning.

-

Are there any special features for the 2018 ar8453ol when using airSlate SignNow?

Yes, airSlate SignNow offers features like templates and automated reminders specifically beneficial for the 2018 ar8453ol. These tools help streamline the signing process and ensure timely submission.

-

Can I integrate airSlate SignNow with other tools for managing the 2018 ar8453ol?

Absolutely, airSlate SignNow supports integration with various applications such as Google Drive and Dropbox. This ensures that your 2018 ar8453ol can be easily accessed and organized alongside your other documents.

-

Is airSlate SignNow compliant with electronic signature laws for the 2018 ar8453ol?

Yes, airSlate SignNow is compliant with electronic signature laws, such as the ESIGN Act and UETA. This compliance ensures that your signed 2018 ar8453ol is legally binding and recognized across all jurisdictions.

-

How does airSlate SignNow ensure the security of the 2018 ar8453ol?

AirSlate SignNow prioritizes security with features like AES 256-bit encryption and two-factor authentication. This signNowly protects your 2018 ar8453ol and other sensitive documents from unauthorized access.

Get more for Ar8453ol

Find out other Ar8453ol

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast