4892, Corporate Income Tax Amended Return 2024-2026

What is the 4892, Corporate Income Tax Amended Return

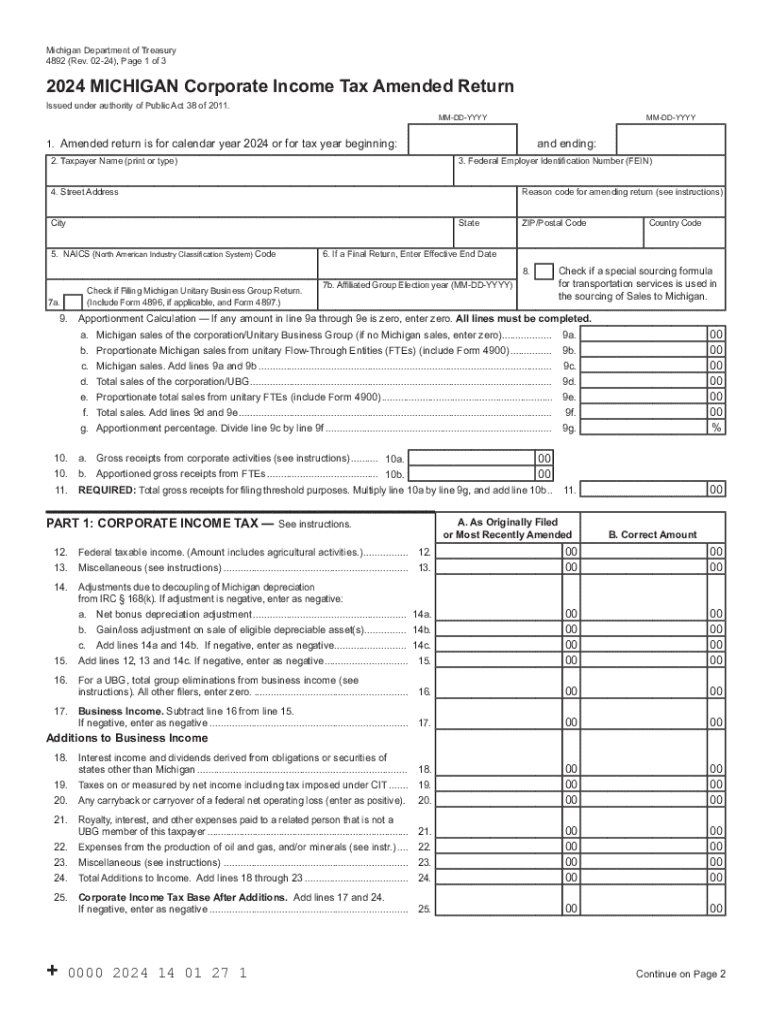

The 4892 form, known as the Corporate Income Tax Amended Return, is utilized by corporations in Michigan to amend previously filed corporate income tax returns. This form allows businesses to correct errors or make adjustments to their reported income, deductions, or credits. Filing this form ensures that the tax liability is accurately reflected and complies with Michigan tax laws.

How to use the 4892, Corporate Income Tax Amended Return

To use the 4892 form effectively, corporations must first gather all necessary financial documents related to the original return. This includes income statements, expense reports, and any relevant tax credits. After completing the form, businesses should review it carefully to ensure all information is accurate and complete. The amended return can then be submitted either online or via mail, depending on the corporation's preference and filing requirements.

Steps to complete the 4892, Corporate Income Tax Amended Return

Completing the 4892 form involves several key steps:

- Obtain the latest version of the 4892 form from the Michigan Department of Treasury website.

- Fill out the form with accurate information, including the original amounts reported and the corrected figures.

- Provide a detailed explanation for the amendments made, ensuring clarity for tax authorities.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate channels, either electronically or by mailing it to the designated address.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines when filing the 4892 form. Generally, the amended return should be filed within three years of the original due date of the return being amended. Important dates to keep in mind include the original filing deadline and any extensions that may apply. Staying informed about these deadlines helps avoid penalties and ensures compliance with state tax regulations.

Required Documents

When filing the 4892 form, corporations need to prepare various documents to support their amendments. Required documents typically include:

- Original corporate income tax return.

- Financial statements and supporting schedules.

- Documentation for any new deductions or credits claimed.

- Any correspondence with the Michigan Department of Treasury regarding the original return.

Penalties for Non-Compliance

Failing to file the 4892 form or submitting it inaccurately can lead to significant penalties for corporations. These may include fines, interest on unpaid taxes, and potential audits. It is crucial for businesses to ensure compliance with all filing requirements to avoid these consequences. Understanding the implications of non-compliance can help corporations maintain good standing with tax authorities.

Create this form in 5 minutes or less

Find and fill out the correct 4892 corporate income tax amended return

Create this form in 5 minutes!

How to create an eSignature for the 4892 corporate income tax amended return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Michigan form and why is it important?

The 2024 Michigan form is a crucial document required for various legal and financial transactions in Michigan. It ensures compliance with state regulations and helps streamline processes for businesses and individuals. Understanding its requirements can save time and prevent potential legal issues.

-

How can airSlate SignNow help with the 2024 Michigan form?

airSlate SignNow simplifies the process of completing and signing the 2024 Michigan form by providing an intuitive platform for electronic signatures. Users can easily upload, edit, and send the form for eSignature, ensuring a quick turnaround. This efficiency is particularly beneficial for businesses that need to manage multiple documents.

-

What are the pricing options for using airSlate SignNow for the 2024 Michigan form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting with a free trial. For those specifically handling the 2024 Michigan form, the plans include features that enhance document management and eSigning capabilities. This cost-effective solution ensures you only pay for what you need.

-

Are there any integrations available for the 2024 Michigan form with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, making it easy to manage the 2024 Michigan form alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, these integrations enhance workflow efficiency. This connectivity allows for a more streamlined document handling process.

-

What features does airSlate SignNow offer for managing the 2024 Michigan form?

airSlate SignNow provides a range of features for managing the 2024 Michigan form, including customizable templates, automated workflows, and secure storage. These tools help ensure that your documents are not only compliant but also easily accessible. The platform's user-friendly interface makes it simple to navigate through the signing process.

-

Can I track the status of my 2024 Michigan form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your 2024 Michigan form in real-time. You will receive notifications when the document is viewed, signed, or completed, giving you peace of mind and keeping you informed throughout the process. This feature is essential for maintaining transparency and accountability.

-

Is airSlate SignNow secure for handling the 2024 Michigan form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the 2024 Michigan form. The platform employs advanced encryption and authentication measures to protect your sensitive information. You can confidently manage your documents knowing they are secure from unauthorized access.

Get more for 4892, Corporate Income Tax Amended Return

Find out other 4892, Corporate Income Tax Amended Return

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement