LANSING INDIVIDUAL INCOME TAX FORMS and INSTR 2024-2026

What is the Lansing Individual Income Tax Forms and Instructions

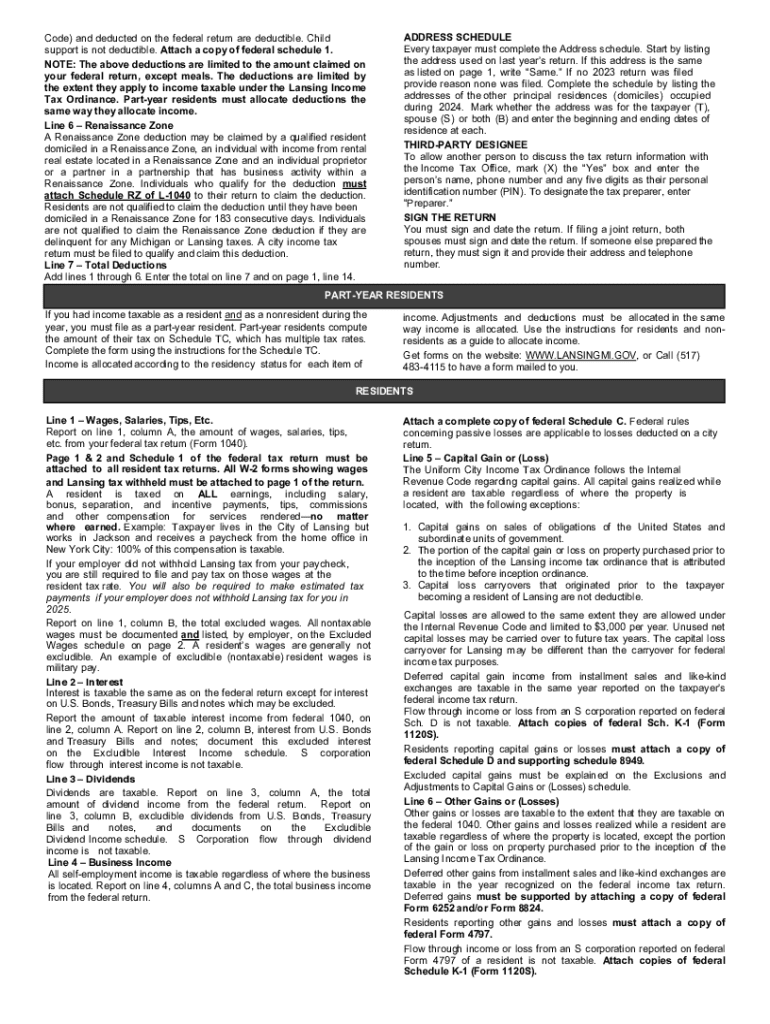

The Lansing Individual Income Tax Forms and Instructions are essential documents required for filing state income taxes in Lansing, Michigan. These forms are designed for individual taxpayers to report their income, claim deductions, and calculate their tax liability. The instructions provide detailed guidance on how to accurately complete the forms, ensuring compliance with state tax regulations. Understanding these forms is crucial for residents to fulfill their tax obligations and avoid potential penalties.

Steps to Complete the Lansing Individual Income Tax Forms and Instructions

Completing the Lansing Individual Income Tax Forms involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, download the appropriate forms from the Michigan Department of Treasury website or obtain them from local tax offices. Carefully follow the instructions provided with the forms, filling in personal information, income details, and applicable deductions. After completing the forms, review them for accuracy before submitting.

How to Obtain the Lansing Individual Income Tax Forms and Instructions

The Lansing Individual Income Tax Forms and Instructions can be obtained through various channels. Taxpayers can download the forms directly from the Michigan Department of Treasury's official website. Alternatively, physical copies may be available at local government offices, libraries, or community centers. It is advisable to ensure that you are using the most current version of the forms to avoid any issues during the filing process.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Lansing Individual Income Tax Forms is crucial to avoid late penalties. Typically, individual income tax returns are due on April fifteenth each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as deadlines for estimated tax payments, to ensure timely compliance with state tax laws.

Required Documents

To complete the Lansing Individual Income Tax Forms accurately, several documents are necessary. Taxpayers should gather their W-2 forms from employers, 1099 forms for additional income, and any documentation related to deductions or credits, such as mortgage interest statements or medical expenses. Additionally, having prior year tax returns can be helpful for reference when completing the current year's forms.

Digital vs. Paper Version

Taxpayers have the option to file their Lansing Individual Income Tax Forms either digitally or via paper submission. The digital version allows for quicker processing and may reduce the chances of errors, as many tax software programs provide built-in checks. Conversely, some individuals may prefer the paper version for its tangible nature. Regardless of the method chosen, it is essential to ensure that all forms are completed accurately and submitted on time.

Penalties for Non-Compliance

Failing to file the Lansing Individual Income Tax Forms on time or inaccurately can result in significant penalties. Common consequences include late fees, interest on unpaid taxes, and potential legal action from the state. Taxpayers are encouraged to understand their responsibilities and seek assistance if needed to avoid these penalties. Compliance with tax regulations not only prevents financial repercussions but also contributes to the overall functioning of state services.

Create this form in 5 minutes or less

Find and fill out the correct lansing individual income tax forms and instr

Create this form in 5 minutes!

How to create an eSignature for the lansing individual income tax forms and instr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR.?

LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR. are the official documents required for filing individual income taxes in Lansing. These forms provide the necessary information for taxpayers to report their income, deductions, and credits accurately. Understanding these forms is crucial for ensuring compliance with state tax laws.

-

How can airSlate SignNow help with LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR.?

airSlate SignNow simplifies the process of completing and submitting LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR. by allowing users to eSign documents securely. Our platform streamlines the workflow, making it easy to gather signatures and manage documents efficiently. This ensures that your tax forms are submitted on time and without hassle.

-

What features does airSlate SignNow offer for managing LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR.?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR. These tools enhance productivity and ensure that all necessary steps are completed for tax filing. Additionally, our platform provides reminders and notifications to keep you on track.

-

Is there a cost associated with using airSlate SignNow for LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR.?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when handling LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR.?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR. You can connect with popular platforms to streamline your workflow and enhance productivity. This integration allows for a more cohesive approach to tax preparation.

-

What are the benefits of using airSlate SignNow for LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR.?

Using airSlate SignNow for LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR. offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and are easily accessible. Additionally, the eSigning feature speeds up the process, allowing you to focus on other important tasks.

-

How secure is airSlate SignNow when handling LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR.?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR. from unauthorized access. Our platform complies with industry standards, ensuring that your sensitive information remains confidential and secure.

Get more for LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR

Find out other LANSING INDIVIDUAL INCOME TAX FORMS AND INSTR

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement