Vat Return Form

What is the VAT Return Form?

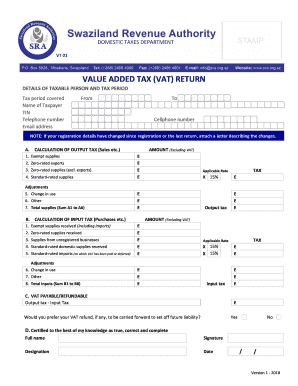

The VAT return form is a document used by businesses to report their Value Added Tax (VAT) obligations to the Internal Revenue Service (IRS). This form details the amount of VAT collected on sales and the VAT paid on purchases. The information provided helps determine whether a business owes VAT or is eligible for a refund. Understanding the VAT return form is essential for compliance with tax regulations and for maintaining accurate financial records.

Steps to Complete the VAT Return Form

Completing the VAT return form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial records, including sales invoices and purchase receipts. Next, calculate the total VAT collected from sales and the total VAT paid on purchases. Fill in the form with these figures, ensuring that all calculations are correct. Finally, review the completed form for any errors before submission. It is advisable to keep a copy for your records.

How to Obtain the VAT Return Form

The VAT return form can be obtained through the IRS website or from authorized tax professionals. Many businesses also utilize accounting software that provides a digital version of the VAT return form, streamlining the process of completion and submission. Ensure that you are using the most current version of the form to avoid any compliance issues.

Legal Use of the VAT Return Form

For the VAT return form to be legally valid, it must be completed accurately and submitted within the specified deadlines. The form must also comply with federal regulations regarding eSignature and electronic submissions. Utilizing a reliable eSignature platform can enhance the legal standing of your completed form by providing necessary authentication and compliance with laws such as ESIGN and UETA.

Key Elements of the VAT Return Form

Key elements of the VAT return form include sections for reporting total sales, total purchases, VAT collected, and VAT paid. Additionally, there may be areas for adjustments, exemptions, and credits. Each section must be filled out accurately to ensure that the form reflects the true financial position of the business regarding VAT obligations.

Filing Deadlines / Important Dates

Filing deadlines for the VAT return form are crucial for compliance. Typically, businesses must submit their VAT returns quarterly or annually, depending on their revenue and tax structure. It is important to check the IRS guidelines for specific deadlines to avoid penalties and interest charges for late submissions.

Penalties for Non-Compliance

Failure to submit the VAT return form on time or inaccuracies in reporting can result in penalties from the IRS. These penalties may include fines, interest on unpaid taxes, and potential audits. Understanding the importance of timely and accurate submissions can help businesses avoid these consequences and maintain good standing with tax authorities.

Quick guide on how to complete vat return form 447138514

Prepare Vat Return Form effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any hitches. Manage Vat Return Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to alter and eSign Vat Return Form effortlessly

- Obtain Vat Return Form and click Get Form to begin.

- Utilize the available tools to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about misplaced or lost documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Vat Return Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat return form 447138514

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT return example PDF?

A VAT return example PDF is a sample document that illustrates how to complete a VAT return for your business. This type of PDF helps businesses understand the format and necessary information for filing their VAT returns accurately. By using a VAT return example PDF, you can streamline your tax reporting process.

-

How can airSlate SignNow help with VAT returns?

AirSlate SignNow provides a seamless way to eSign your VAT return forms quickly and securely. With our platform, you can upload your VAT return example PDF and get signatures from necessary parties without the hassle of printing or scanning. This makes the VAT filing process more efficient and ensures compliance.

-

Is there a cost associated with using airSlate SignNow for VAT return processes?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan includes features to help manage your document workflows, including eSigning VAT return example PDFs. You can choose a plan that fits your budget while benefiting from our easy-to-use solutions.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! AirSlate SignNow integrates seamlessly with many accounting platforms, simplifying the process of sending and eSigning VAT return example PDFs. This integration allows for smoother data transfer and management of your financial documents, enhancing productivity.

-

What are the key features of airSlate SignNow for handling VAT returns?

Key features include secure eSigning, document tracking, customizable templates, and user-friendly dashboards. With these tools, managing VAT return example PDFs becomes straightforward, ensuring that all your documents are completed and signed promptly. Efficient organization simplifies compliance with tax regulations.

-

How secure is my information when using airSlate SignNow for VAT returns?

AirSlate SignNow prioritizes your security with industry-standard encryption and compliance with data protection regulations. When using our platform to handle VAT return example PDFs, your sensitive information is protected throughout the signing process. Trust our solution for secure document management.

-

Are there any benefits to using airSlate SignNow over traditional signing methods for VAT returns?

Yes, using airSlate SignNow for VAT returns saves time and reduces paperwork compared to traditional methods. You can easily send, sign, and store VAT return example PDFs digitally, which streamlines your filing process. This also minimizes the chance of errors and ensures timely submissions.

Get more for Vat Return Form

- Medical release for by stysa form

- Illinois department of revenue fiduciary income and replacement tax return form il 1041 363601110 due on or before the 15th day

- Sma service rebate form

- Bloodborne pathogens quiz answers 263315799 form

- Medicare savings program application dphhsmtgov form

- Dbpr cilb 8 application for financially responsible form

- Certificate of use purpose and processwest park form

- Noc hillsborough county form

Find out other Vat Return Form

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document