Uob Credit Card Increase Limit Form

Understanding the UOB Credit Card Increase Limit

The UOB credit card increase limit refers to the maximum amount of credit that a cardholder can access on their UOB credit card. This limit is determined based on various factors, including the cardholder's creditworthiness, income, and spending habits. Increasing this limit can provide financial flexibility, allowing cardholders to make larger purchases or manage unexpected expenses more effectively. It is essential to understand how this limit works and the implications of requesting an increase.

Steps to Complete the UOB Credit Card Increase Limit Form

Completing the UOB credit card increase limit form involves several straightforward steps. First, gather necessary financial information, such as your income, monthly expenses, and existing debts. Next, access the form through the UOB online banking portal or mobile application. Fill in the required fields accurately, ensuring that all information is current and truthful. Review your application for any errors before submission. Once completed, submit the form electronically for processing.

Eligibility Criteria for Increasing Your UOB Credit Card Limit

To qualify for a UOB credit card limit increase, applicants typically need to meet specific eligibility criteria. These may include having an existing UOB credit card in good standing, a consistent payment history, and a stable income. Additionally, UOB may consider the cardholder's overall credit score and financial behavior. Meeting these criteria improves the chances of a successful application for an increased credit limit.

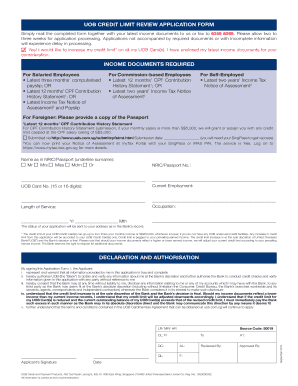

Required Documents for the UOB Credit Card Increase Limit

When applying for a UOB credit card limit increase, certain documents may be required to support your application. Commonly requested documents include proof of income, such as recent pay stubs or tax returns, and identification verification, like a government-issued ID. Providing accurate and complete documentation can expedite the review process and enhance the likelihood of approval.

Legal Use of the UOB Credit Card Increase Limit

The legal use of the UOB credit card increase limit is governed by the terms and conditions set forth by UOB. Cardholders must adhere to responsible borrowing practices and ensure that they do not exceed their credit limit. Misuse of credit, such as failing to make timely payments or accumulating excessive debt, can lead to penalties and negatively impact credit scores. Understanding these legal obligations is crucial for maintaining a healthy financial profile.

How to Obtain the UOB Credit Card Increase Limit

Obtaining an increase in your UOB credit card limit involves a formal request through the designated channels provided by UOB. Cardholders can initiate this process via online banking, mobile apps, or by contacting customer service directly. It is advisable to prepare a strong case for the increase by demonstrating financial stability and responsible credit usage. Once the request is submitted, UOB will review the application and notify the cardholder of the decision.

Examples of Using the UOB Credit Card Increase Limit

Utilizing the UOB credit card increase limit can enhance financial flexibility in various scenarios. For instance, a cardholder may want to make a significant purchase, such as home appliances or travel expenses, without the need for immediate cash. Additionally, having a higher credit limit can be beneficial in emergencies, allowing for necessary expenditures without incurring high-interest debt. Understanding these practical applications can help cardholders make informed decisions regarding their credit usage.

Quick guide on how to complete uob credit card increase limit

Prepare Uob Credit Card Increase Limit seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any delays. Manage Uob Credit Card Increase Limit on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign Uob Credit Card Increase Limit effortlessly

- Obtain Uob Credit Card Increase Limit and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, dragging form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and eSign Uob Credit Card Increase Limit and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uob credit card increase limit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the UOB credit limit review form?

The UOB credit limit review form is a document used by customers of UOB to request a review of their current credit limit. This form allows customers to update their financial information and potentially increase their available credit, enhancing their purchasing power.

-

How do I access the UOB credit limit review form?

You can access the UOB credit limit review form through the UOB website or by logging into your online banking account. It is important to have your account details handy to fill out the form accurately and efficiently.

-

What information do I need to provide in the UOB credit limit review form?

When filling out the UOB credit limit review form, you will need to provide personal identification details, income information, and any other relevant financial data. This information helps UOB evaluate your request and determine if an increase in your credit limit is warranted.

-

How long does it take to process the UOB credit limit review form?

The processing time for the UOB credit limit review form can vary, but you can typically expect a response within a few business days. UOB strives to review requests promptly to ensure their customers have quick access to updates on their credit limits.

-

Are there any fees associated with submitting the UOB credit limit review form?

There are generally no fees for submitting the UOB credit limit review form. However, it’s essential to check specific terms and conditions, as fees may apply based on your account type or if you exceed your credit limit.

-

What are the benefits of reviewing my UOB credit limit?

Reviewing your UOB credit limit can provide various benefits, including improved financial flexibility and increased purchasing power for larger purchases. A higher credit limit can also positively impact your credit score by reducing your credit utilization ratio.

-

Can I submit the UOB credit limit review form online?

Yes, you can submit the UOB credit limit review form online through the UOB website. Online submission is convenient and allows for quicker processing, making it easier for you to request a credit limit review from the comfort of your home.

Get more for Uob Credit Card Increase Limit

- Class reunion registration form template word

- Philam life enrollment form

- Adding a iframe in maximo applications form

- Certificate of organization pa form

- Nutrisearch pdf download form

- Starfish animal rescue form

- Demande de divorce formulaire a imprimer fill online

- B2b service agreement template form

Find out other Uob Credit Card Increase Limit

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure