It201x Form

What is the It201x

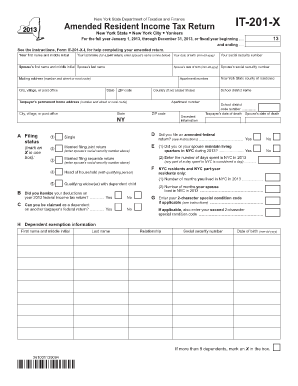

The It201x form is a state tax form used in the United States, specifically for individual income tax filings. It is designed to help taxpayers report their income, claim deductions, and calculate their tax liability. The It201x is essential for ensuring compliance with state tax regulations and is typically required for residents who earn income within the state. Understanding its purpose and requirements is crucial for accurate tax reporting.

How to use the It201x

Using the It201x form involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any receipts for deductible expenses. Next, individuals should carefully read the instructions provided with the form to understand the specific requirements for their filing situation. After filling out the form, it is important to review all entries for accuracy before submission to avoid potential delays or penalties.

Steps to complete the It201x

Completing the It201x form requires a systematic approach. Begin by entering personal information, such as your name, address, and Social Security number. Next, report all sources of income, including wages, dividends, and other earnings. After documenting income, move on to claim any applicable deductions and credits. Finally, calculate the total tax owed or refund due, and ensure that all calculations are double-checked for accuracy.

Legal use of the It201x

The It201x form must be used in accordance with state tax laws to ensure its legal validity. This includes adhering to deadlines for submission and maintaining accurate records of all reported income and deductions. The form is recognized as a legal document, and any discrepancies or false information can lead to penalties or legal consequences. Therefore, it is essential to complete the form truthfully and in compliance with all relevant regulations.

Filing Deadlines / Important Dates

Filing deadlines for the It201x form are critical to avoid late fees and penalties. Typically, the deadline for submitting the form is April 15th of each year, coinciding with federal tax deadlines. However, taxpayers should check for any state-specific extensions or changes to this date, especially in light of unique circumstances that may arise. Marking these important dates on a calendar can help ensure timely submissions.

Required Documents

To complete the It201x form accurately, certain documents are required. Taxpayers should gather their W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation for any other income sources. Additionally, receipts for deductible expenses, such as medical costs or educational expenses, should be collected. Having these documents ready will facilitate a smoother filing process.

Examples of using the It201x

There are various scenarios in which the It201x form may be utilized. For instance, a full-time employee would use the form to report their annual salary and any additional income earned throughout the year. A self-employed individual would also use the It201x to report income from their business activities, along with any applicable deductions for business expenses. Understanding these examples can help taxpayers recognize their specific filing needs.

Quick guide on how to complete it201x

Complete It201x effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage It201x on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and eSign It201x with ease

- Locate It201x and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign It201x and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it201x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it201x and how does airSlate SignNow utilize it?

The term 'it201x' refers to innovative technology solutions that facilitate digital document management. airSlate SignNow implements it201x tools to provide a seamless eSigning experience, allowing businesses to send, sign, and manage documents efficiently while ensuring security and compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs and sizes. Whether you're a small business or a large enterprise, you can choose a plan that best fits your requirements while leveraging the capabilities of it201x for effective document management.

-

What features does airSlate SignNow offer?

airSlate SignNow provides a range of features including customizable templates, mobile access, and real-time tracking of document status. With it201x advancements, these features enhance productivity and ensure that all your document signing needs are met efficiently.

-

How does airSlate SignNow ensure document security?

Document security is a priority for airSlate SignNow, utilizing it201x technologies to maintain high-level encryption and compliance with industry regulations. Your documents are protected throughout the signing process, ensuring that sensitive information remains confidential.

-

Can airSlate SignNow integrate with other business tools?

Yes, airSlate SignNow seamlessly integrates with other popular business tools and software, enhancing overall workflow efficiency. Through it201x integrations, users can connect to software such as CRM systems, email providers, and project management tools.

-

What benefits does airSlate SignNow provide for my team?

By using airSlate SignNow, your team can benefit from improved collaboration and faster turnaround times for document approvals. Leveraging it201x technologies, your team will find the eSigning process simpler and more effective, leading to increased productivity.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to manage document signing on-the-go. With it201x enhancements, the mobile app ensures that you can access important documents and eSign them anytime, anywhere.

Get more for It201x

Find out other It201x

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word