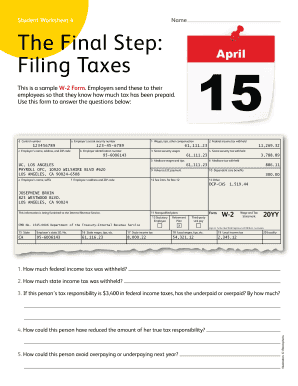

Worksheet #4 the Final Step Filing Taxes Form

What is the Worksheet #4 The Final Step Filing Taxes Form

The Worksheet #4 The Final Step Filing Taxes Form is a critical document used by taxpayers in the United States to finalize their tax returns. This form assists individuals in calculating their final tax obligations or refunds based on their income, deductions, and credits. It serves as a summary of all relevant financial information, ensuring that taxpayers accurately report their earnings and comply with federal tax regulations.

How to use the Worksheet #4 The Final Step Filing Taxes Form

Using the Worksheet #4 The Final Step Filing Taxes Form involves several straightforward steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, follow the instructions on the form to input your income, deductions, and credits. After completing the worksheet, review the calculations to ensure accuracy. Finally, use the information gathered to complete your tax return, either electronically or on paper.

Steps to complete the Worksheet #4 The Final Step Filing Taxes Form

Completing the Worksheet #4 The Final Step Filing Taxes Form requires attention to detail. Begin by entering your total income at the top of the form. Next, list any deductions you qualify for, such as student loan interest or mortgage interest. After calculating your taxable income, apply any credits you may be eligible for. Finally, determine your total tax liability or refund amount and ensure all figures are accurate before submission.

Legal use of the Worksheet #4 The Final Step Filing Taxes Form

The Worksheet #4 The Final Step Filing Taxes Form is legally binding when completed correctly and submitted to the appropriate tax authorities. To ensure its validity, the form must be filled out accurately, reflecting true financial information. Additionally, using a reliable electronic signature tool can enhance the legal standing of the document, as it complies with federal eSignature laws, ensuring that the form is recognized as legitimate by the IRS.

Key elements of the Worksheet #4 The Final Step Filing Taxes Form

Key elements of the Worksheet #4 The Final Step Filing Taxes Form include sections for personal information, income details, deductions, and tax credits. Each section is designed to capture specific financial data, allowing for a comprehensive overview of the taxpayer's financial situation. Understanding these elements is crucial for accurately completing the form and ensuring compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Worksheet #4 The Final Step Filing Taxes Form typically align with the annual tax filing season. Generally, individual taxpayers must submit their forms by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to filing deadlines to avoid penalties or interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Worksheet #4 The Final Step Filing Taxes Form can be submitted through various methods. Taxpayers have the option to file electronically using approved tax software, which allows for quicker processing and confirmation of receipt. Alternatively, the form can be mailed to the appropriate IRS address or submitted in person at designated IRS offices. Each submission method has its own advantages, such as speed or direct interaction with IRS representatives.

Quick guide on how to complete worksheet 4 the final step filing taxes form

Complete Worksheet #4 The Final Step Filing Taxes Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly without interruptions. Manage Worksheet #4 The Final Step Filing Taxes Form on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to edit and eSign Worksheet #4 The Final Step Filing Taxes Form with ease

- Locate Worksheet #4 The Final Step Filing Taxes Form and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Worksheet #4 The Final Step Filing Taxes Form and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the worksheet 4 the final step filing taxes form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Worksheet #4 The Final Step Filing Taxes Form?

Worksheet #4 The Final Step Filing Taxes Form is a crucial document for accurately completing your tax return process. It helps taxpayers organize essential information needed for filing taxes, ensuring compliance with regulations and minimizing errors.

-

How does airSlate SignNow assist with the Worksheet #4 The Final Step Filing Taxes Form?

airSlate SignNow streamlines the process of completing the Worksheet #4 The Final Step Filing Taxes Form by allowing users to fill out, sign, and send documents electronically. This enhances efficiency and ensures that your tax forms are securely managed and easily accessible.

-

What are the pricing options for using airSlate SignNow with the Worksheet #4 The Final Step Filing Taxes Form?

airSlate SignNow offers flexible pricing plans tailored to different business needs, from individual users to large teams. Check the website for detailed information on subscription levels and what features are included, particularly for managing the Worksheet #4 The Final Step Filing Taxes Form.

-

Can I integrate airSlate SignNow with other tools for managing my taxes?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms that assist in tax management and filing processes. This includes accounting software, helping users efficiently handle their Worksheet #4 The Final Step Filing Taxes Form alongside their accounting needs.

-

What are the benefits of using airSlate SignNow for my Worksheet #4 The Final Step Filing Taxes Form?

Using airSlate SignNow for your Worksheet #4 The Final Step Filing Taxes Form provides numerous benefits, including time-saving automation, secure storage of documents, and simplified e-signature processes. This results in a smoother tax filing experience overall.

-

Is airSlate SignNow suitable for individuals filing the Worksheet #4 The Final Step Filing Taxes Form?

Absolutely! airSlate SignNow is user-friendly and designed to cater to both individuals and businesses. Whether you’re filing the Worksheet #4 The Final Step Filing Taxes Form for personal use or within a corporate framework, the platform meets varying needs.

-

What features does airSlate SignNow offer that are useful for the Worksheet #4 The Final Step Filing Taxes Form?

Key features of airSlate SignNow include document templates, e-signatures, secure cloud storage, and collaboration tools. These features are particularly beneficial when working with the Worksheet #4 The Final Step Filing Taxes Form, allowing for streamlined processes.

Get more for Worksheet #4 The Final Step Filing Taxes Form

Find out other Worksheet #4 The Final Step Filing Taxes Form

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now