VAT1614F Opting to Tax Land and Buildings New Buildings ? Exclusion from an Option to Tax Use This Form to Opt to Tax Land and B

Understanding the VAT1614F Form

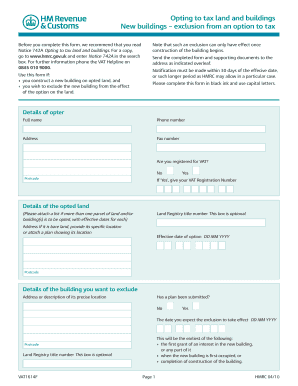

The VAT1614F form is a critical document for businesses opting to tax land and buildings, specifically for new buildings that are excluded from an option to tax. This form allows property owners to make a formal election regarding the VAT treatment of their properties. By completing this form, businesses can ensure they comply with tax regulations while maximizing their potential tax benefits. Understanding the implications of opting to tax is essential for effective financial planning and compliance.

How to Use the VAT1614F Form

Using the VAT1614F form involves several straightforward steps. First, ensure that you meet the eligibility criteria for opting to tax the specific land or building. Next, fill out the form accurately, providing all required information about the property and the reason for the election. Once completed, the form must be submitted to the relevant tax authority. It is advisable to keep a copy for your records and to consult a tax professional if you have any uncertainties regarding the process.

Steps to Complete the VAT1614F Form

Completing the VAT1614F form requires careful attention to detail. Follow these steps:

- Gather necessary documentation related to the property.

- Fill in the property details, including address and type of building.

- Indicate the reason for opting to tax, ensuring it aligns with the exclusions.

- Review the completed form for accuracy.

- Submit the form to the appropriate tax authority.

Each step is crucial to ensure compliance and avoid potential penalties.

Legal Use of the VAT1614F Form

The VAT1614F form is legally recognized as a binding document when completed and submitted correctly. It must adhere to specific regulations to ensure its validity. This includes providing accurate information and submitting the form within designated timelines. Understanding the legal implications of opting to tax is vital for businesses to avoid complications with tax authorities.

Required Documents for the VAT1614F Form

To successfully complete the VAT1614F form, several documents may be required. These typically include:

- Proof of ownership of the property.

- Documentation that supports the reason for opting to tax.

- Any previous correspondence with tax authorities regarding the property.

Having these documents ready can streamline the process and ensure all necessary information is provided.

IRS Guidelines Related to the VAT1614F Form

While the VAT1614F form is specific to VAT regulations, understanding IRS guidelines can provide additional context for U.S. businesses. The IRS outlines various tax obligations that may intersect with VAT considerations, particularly for businesses operating in multiple jurisdictions. Familiarity with these guidelines can aid in comprehensive tax planning and compliance.

Quick guide on how to complete vat1614f opting to tax land and buildings new buildings exclusion from an option to tax use this form to opt to tax land and

Effortlessly Prepare VAT1614F Opting To Tax Land And Buildings New Buildings ? Exclusion From An Option To Tax Use This Form To Opt To Tax Land And B on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as a perfect environmentally-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage VAT1614F Opting To Tax Land And Buildings New Buildings ? Exclusion From An Option To Tax Use This Form To Opt To Tax Land And B on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The easiest method to edit and eSign VAT1614F Opting To Tax Land And Buildings New Buildings ? Exclusion From An Option To Tax Use This Form To Opt To Tax Land And B seamlessly

- Find VAT1614F Opting To Tax Land And Buildings New Buildings ? Exclusion From An Option To Tax Use This Form To Opt To Tax Land And B and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks, from any device of your preference. Edit and eSign VAT1614F Opting To Tax Land And Buildings New Buildings ? Exclusion From An Option To Tax Use This Form To Opt To Tax Land And B and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat1614f opting to tax land and buildings new buildings exclusion from an option to tax use this form to opt to tax land and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VAT1614F Opting To Tax Land And Buildings New Buildings form?

The VAT1614F form is utilized for opting to tax land and buildings, specifically new buildings that are excluded from an option to tax. This form allows property owners to apply for VAT relief under the Hmrc Gov guidelines. By using this form, you can ensure compliance while maximizing your VAT recovery options.

-

Who should use the VAT1614F Opting To Tax Land And Buildings New Buildings form?

Property developers and investors in new buildings that are excluded from an option to tax should utilize the VAT1614F form. This ensures that they can claim VAT on their expenses related to these properties. It's essential for effective tax planning and management of VAT obligations.

-

What are the benefits of opting to tax with the VAT1614F form?

Opting to tax using the VAT1614F form provides a signNow benefit of allowing businesses to reclaim VAT on their costs. This can greatly enhance cash flow for businesses involving new buildings. The form ensures that you are compliant with regulations set by Hmrc Gov while maximizing tax efficiency.

-

Are there any fees associated with submitting the VAT1614F form?

There are no specific fees associated with submitting the VAT1614F Opting To Tax Land And Buildings New Buildings form to Hmrc Gov. However, businesses may incur costs related to obtaining professional advice or assistance in completing the form. It's advisable to assess any potential costs to ensure compliance.

-

How can I integrate VAT1614F Opting To Tax Land And Buildings New Buildings into my business process?

Integrating the VAT1614F form into your business process can be done smoothly by developing a standard operating procedure for completing and submitting the form. Leveraging eSignature solutions such as airSlate SignNow can streamline approvals and ensure timely submissions. This optimization facilitates better compliance with Hmrc Gov requirements.

-

What information do I need to fill out the VAT1614F form?

To complete the VAT1614F Opting To Tax Land And Buildings New Buildings form, you will need details about the property, including its address, relevant dates, and confirmation of your property’s exemption status. This information is crucial for accurate completion and compliance with Hmrc Gov guidelines.

-

What happens if I make a mistake on the VAT1614F form?

If you make a mistake on the VAT1614F form, it is important to rectify it as soon as possible. You may need to submit a corrected version or consult with HMRC for guidance on how to proceed. Ensuring accuracy is vital to maintain compliance with Hmrc Gov requirements and avoid any potential penalties.

Get more for VAT1614F Opting To Tax Land And Buildings New Buildings ? Exclusion From An Option To Tax Use This Form To Opt To Tax Land And B

- Dopl california form

- Stavros fiscal intermediary 100474189 form

- Form 101 crsng nserc crsng gc

- Application for transfer of federally forfeited property form

- Middle school musical audition form photo schechterwestchester

- Lawrence kestenbaum form

- Medical clearance for dental treatment drs allison amp hulihan form

- Caffeine consumption questionnaire revised pdf form

Find out other VAT1614F Opting To Tax Land And Buildings New Buildings ? Exclusion From An Option To Tax Use This Form To Opt To Tax Land And B

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free