Itr 1 Form No Download Needed

What is the Itr 1 Form No Download Needed

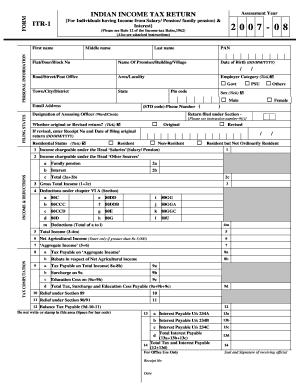

The Itr 1 form, also known as the ITR1, is a simplified income tax return form used by individual taxpayers in the United States. This form is specifically designed for individuals with income from salaries, one house property, and other sources such as interest income. The Itr 1 form no download needed allows users to fill out and submit their tax information electronically, streamlining the filing process and reducing the need for paper documentation.

Steps to Complete the Itr 1 Form No Download Needed

Completing the Itr 1 form no download needed is a straightforward process. Follow these steps to ensure accurate submission:

- Access the form online through a secure platform.

- Enter your personal information, including your name, address, and Social Security number.

- Provide details about your income sources, such as salary and interest earnings.

- Include any deductions you may qualify for, such as standard deductions or specific credits.

- Review all information for accuracy before submission.

- Submit the form electronically, ensuring you receive confirmation of your submission.

Legal Use of the Itr 1 Form No Download Needed

The Itr 1 form no download needed is legally recognized as a valid method for filing income tax returns in the United States. To ensure its legal standing, it must be completed accurately and submitted within the prescribed deadlines. Compliance with IRS regulations is essential, as it protects taxpayers from potential penalties and ensures that their tax obligations are met appropriately.

Key Elements of the Itr 1 Form No Download Needed

Understanding the key elements of the Itr 1 form no download needed is crucial for accurate completion. Important components include:

- Personal Information: Name, address, and Social Security number.

- Income Details: Sources of income, including salary and interest.

- Deductions: Applicable deductions that reduce taxable income.

- Tax Calculation: Total tax liability based on reported income.

- Signature: Digital signature to validate the submission.

Filing Deadlines / Important Dates

Timely submission of the Itr 1 form no download needed is critical to avoid penalties. The IRS typically sets specific deadlines for filing income tax returns, which usually fall on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these deadlines to ensure compliance.

Form Submission Methods

The Itr 1 form no download needed can be submitted through various methods. The most common submission methods include:

- Online Submission: Directly through a secure platform, allowing for immediate processing.

- Mail: Printing the completed form and sending it to the appropriate IRS address.

- In-Person: Submitting the form at designated IRS offices, if necessary.

Quick guide on how to complete itr 1 form no download needed

Prepare Itr 1 Form No Download Needed effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can obtain the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without delay. Manage Itr 1 Form No Download Needed on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Itr 1 Form No Download Needed with ease

- Find Itr 1 Form No Download Needed and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your edits.

- Select how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, and errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign Itr 1 Form No Download Needed and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the itr 1 form no download needed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the itr 1 form no download needed feature in airSlate SignNow?

The itr 1 form no download needed feature allows users to complete and eSign the income tax return form directly online. This eliminates the hassle of downloads and streamlines the filing process. Users can fill out the form and submit it securely in just a few clicks.

-

How does airSlate SignNow ensure the security of my itr 1 form no download needed submissions?

airSlate SignNow takes your security seriously. All submissions, including the itr 1 form no download needed, are protected through encryption and secure data handling practices. This means your sensitive information is safe while you complete your tax filings online.

-

Can I customize the itr 1 form no download needed for my specific needs?

Yes, airSlate SignNow allows for customization of the itr 1 form no download needed, enabling users to add fields, notes, and checkboxes as required. This flexibility ensures that the form meets individual taxpayer needs while remaining compliant with tax regulations.

-

What are the pricing options for using the itr 1 form no download needed feature?

airSlate SignNow offers various pricing plans to accommodate different user needs. The itr 1 form no download needed feature is included in our standard package, ensuring that all users have access to this essential service at an affordable cost.

-

How can I integrate the itr 1 form no download needed with my accounting software?

Integrating the itr 1 form no download needed with your accounting software is seamless with airSlate SignNow. The platform offers various integrations with popular accounting tools, allowing you to streamline your document workflows and maintain financial accuracy effortlessly.

-

What benefits can I expect from using the itr 1 form no download needed feature?

Using the itr 1 form no download needed feature provides multiple benefits, including time savings and increased efficiency. You can quickly fill out and eSign your tax return without worrying about software installations, making your tax preparation easier than ever.

-

Is technical support available for issues related to the itr 1 form no download needed?

Yes, airSlate SignNow offers comprehensive technical support for all users facing issues with the itr 1 form no download needed feature. Our dedicated support team is available via chat, email, and phone to assist you promptly with any queries or challenges.

Get more for Itr 1 Form No Download Needed

Find out other Itr 1 Form No Download Needed

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy