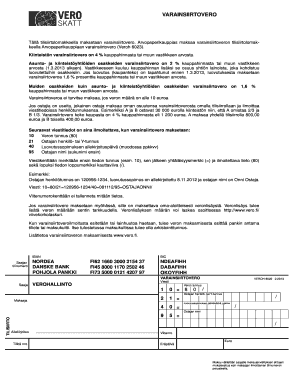

Varainsiirtovero Form

What is the Varainsiirtovero

The varainsiirtovero is a transfer tax applied to the transfer of ownership of real estate and certain property types. This tax is typically levied when a property is sold or transferred, ensuring that the government receives a portion of the transaction value. Understanding this tax is essential for both buyers and sellers in real estate transactions, as it can significantly impact the overall costs associated with property ownership transfers.

How to use the Varainsiirtovero

Using the varainsiirtovero involves understanding when it applies and how to calculate it. The tax is generally based on the purchase price of the property or the market value, whichever is higher. To utilize this tax effectively, parties involved in a transaction should ensure that they account for the varainsiirtovero in their financial planning and negotiations. This includes discussing who will bear the cost of the tax and ensuring that it is included in the closing statements.

Steps to complete the Varainsiirtovero

Completing the varainsiirtovero requires several key steps:

- Determine the applicable rate based on the property's value.

- Calculate the total tax amount due.

- Fill out the necessary forms, ensuring all information is accurate.

- Submit the completed forms along with the payment to the appropriate tax authority.

- Retain copies of all documents for your records.

Legal use of the Varainsiirtovero

The legal use of the varainsiirtovero is governed by state and local laws. It is crucial for individuals and businesses to comply with these regulations to avoid penalties. Proper documentation and timely payment of the tax are essential to ensure that the transfer of property is recognized legally. Failure to adhere to these legal requirements can result in fines or complications in property ownership.

Required Documents

To properly complete the varainsiirtovero process, certain documents are typically required. These may include:

- Proof of property ownership or purchase agreement.

- Tax identification numbers for all parties involved in the transaction.

- Completed varainsiirtovero form.

- Payment receipt for the tax.

Gathering these documents in advance can streamline the process and ensure compliance with legal requirements.

Penalties for Non-Compliance

Failing to comply with the varainsiirtovero regulations can lead to significant penalties. These may include fines, interest on unpaid taxes, or even legal action to recover owed amounts. It is essential for individuals and businesses to understand their obligations regarding this tax to avoid these consequences. Staying informed about filing deadlines and ensuring timely payment can mitigate the risk of non-compliance.

Quick guide on how to complete varainsiirtovero

Complete Varainsiirtovero effortlessly on any device

Online document management has become increasingly favorable among companies and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can acquire the correct format and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents promptly without delays. Manage Varainsiirtovero on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Varainsiirtovero without any strain

- Locate Varainsiirtovero and click Get Form to begin.

- Utilize the tools we provide to submit your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select how you would like to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Varainsiirtovero and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the varainsiirtovero

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is varainsiirtovero and how does it affect my business?

Varainsiirtovero is a transfer tax imposed on real estate transactions. It can signNowly impact your business's finances if you're involved in buying or selling properties. Understanding varainsiirtovero helps you plan your budget and ensures compliance with local tax laws.

-

How can airSlate SignNow help me manage varainsiirtovero documents?

With airSlate SignNow, you can easily prepare, sign, and store documents related to varainsiirtovero transactions. Our platform simplifies the eSigning process, ensuring that all parties involved can sign necessary documents digitally, which speeds up the transaction process.

-

What features does airSlate SignNow offer for handling varainsiirtovero agreements?

AirSlate SignNow includes features such as templates, reminders, and secure storage specifically for varainsiirtovero agreements. These tools streamline the documentation process and help ensure that you don’t miss important deadlines associated with the varainsiirtovero tax.

-

Is there a cost for using airSlate SignNow for varainsiirtovero-related paperwork?

Yes, airSlate SignNow offers various pricing plans to accommodate your needs, including options for handling varainsiirtovero paperwork. Our plans are competitively priced, allowing you to choose the right option for your business without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for tracking varainsiirtovero?

Absolutely! AirSlate SignNow offers integrations with various applications, enabling you to track and manage varainsiirtovero paperwork alongside your other business tools. These integrations help you maintain smooth workflows and keep all relevant information in one place.

-

What are the benefits of using airSlate SignNow for varainsiirtovero tasks?

Using airSlate SignNow for varainsiirtovero tasks comes with several benefits, including increased efficiency, reduced paper usage, and enhanced collaboration. Our platform ensures all stakeholders can access and sign documents quickly, which helps expedite the administrative aspect of real estate transactions.

-

How secure is airSlate SignNow for managing varainsiirtovero documentation?

AirSlate SignNow prioritizes security, employing industry-leading measures to protect your varainsiirtovero documentation. We use end-to-end encryption and comply with regulatory standards to ensure that your documents remain confidential and secure throughout the signing process.

Get more for Varainsiirtovero

- Form 621 400449543

- Delaware single member llc operating agreement form

- Health benefits buy out waiver program form

- Texas residency affadavit form

- Pennsylvania e file signature authorization for pa s corporationpartnership information return pa 20spa 65 directory of 771656748

- Gross premiums tax foreign casualty or foreign fire insurance companies rct 121c form

- Pay rise agreement template form

- Pay for access retainer agreement template form

Find out other Varainsiirtovero

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe