Trec Owner Financing Addendum Form

What is the Trec Owner Financing Addendum

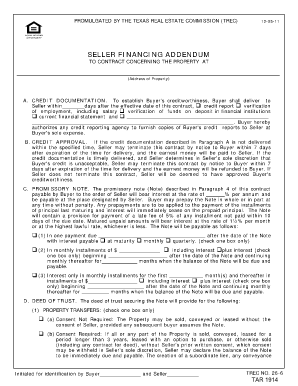

The Trec Owner Financing Addendum is a legal document used in real estate transactions in Texas. It allows sellers to provide financing directly to buyers, rather than requiring them to secure a mortgage from a traditional lender. This addendum outlines the terms of the financing arrangement, including interest rates, payment schedules, and any contingencies that may apply. It is essential for both parties to understand the implications of this addendum, as it can significantly affect the financial responsibilities of the buyer and the seller.

How to use the Trec Owner Financing Addendum

Using the Trec Owner Financing Addendum involves several steps to ensure that both parties are protected and informed. First, the seller should fill out the addendum with accurate details regarding the financing terms. This includes specifying the loan amount, interest rate, and repayment schedule. Once completed, both the seller and buyer must review the document thoroughly to ensure mutual understanding. It is advisable to consult with a real estate attorney to confirm that the addendum complies with Texas laws and adequately protects both parties' interests.

Steps to complete the Trec Owner Financing Addendum

Completing the Trec Owner Financing Addendum requires careful attention to detail. Here are the key steps:

- Obtain the addendum form from a reliable source or real estate professional.

- Fill in the necessary information, including the names of the parties involved, property details, and financing terms.

- Specify any contingencies or special conditions that apply to the financing agreement.

- Review the completed addendum with all parties to ensure clarity and agreement.

- Sign the document in the presence of a witness or notary, if required.

Key elements of the Trec Owner Financing Addendum

The Trec Owner Financing Addendum includes several key elements that are crucial for a clear understanding of the financing arrangement. These elements typically consist of:

- Loan Amount: The total amount being financed by the seller.

- Interest Rate: The percentage charged on the financed amount.

- Payment Schedule: Details on how often payments are due and the duration of the loan.

- Default Terms: Conditions that outline what happens if the buyer fails to make payments.

- Prepayment Penalties: Any fees associated with paying off the loan early.

Legal use of the Trec Owner Financing Addendum

The legal use of the Trec Owner Financing Addendum is governed by Texas real estate laws. It is important that both parties understand their rights and obligations under the addendum. The document must be executed properly, with all necessary signatures and dates, to be legally binding. Additionally, the terms outlined in the addendum should comply with state regulations regarding owner financing, including limits on interest rates and disclosure requirements. Failure to adhere to these laws can result in legal complications for both the seller and buyer.

Examples of using the Trec Owner Financing Addendum

Examples of using the Trec Owner Financing Addendum can help clarify its application in real estate transactions. For instance, if a seller is offering a property at $200,000 and agrees to finance $150,000 of that amount at a five percent interest rate over 30 years, the addendum would detail these terms. Another example could involve a seller offering a lower interest rate in exchange for a larger down payment. Each scenario illustrates how the addendum can be tailored to meet the needs of both parties while ensuring compliance with legal standards.

Quick guide on how to complete trec owner financing addendum

Effortlessly Complete Trec Owner Financing Addendum on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without complications. Handle Trec Owner Financing Addendum on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Edit and eSign Trec Owner Financing Addendum with Ease

- Find Trec Owner Financing Addendum and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any chosen device. Modify and electronically sign Trec Owner Financing Addendum to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the trec owner financing addendum

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the financing addendum in the TREC One to Four Family Residential Contract?

The financing addendum outlines the financial agreements made between the parties involved in a real estate transaction. Understanding which financing addendum is not included in paragraph 3b of the TREC One to Four Family Residential Contract is crucial for avoiding misunderstandings during the closing process.

-

How can airSlate SignNow help with eSigning the financing addendum?

airSlate SignNow provides a user-friendly platform that simplifies the eSigning process for important documents like the financing addendum. By utilizing airSlate SignNow, you can easily track document status and ensure that all parties have signed the addendum, streamlining your real estate transactions.

-

What features does airSlate SignNow offer for managing real estate contracts?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage to help you manage your real estate contracts efficiently. These features are particularly beneficial when dealing with financing addendums, including identifying which financing addendum is not included in paragraph 3b of the TREC One to Four Family Residential Contract.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow has a mobile app available for both iOS and Android devices. This allows you to access and manage your real estate documents, including financing addendums, on the go, ensuring that you never miss an opportunity to review which financing addendum is not included in paragraph 3b of the TREC One to Four Family Residential Contract.

-

What is the pricing structure for airSlate SignNow solutions?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, whether you're a solo agent or a large firm. By providing an affordable solution for managing financing addendums, you can ensure compliance with the terms defined such as which financing addendum is not included in paragraph 3b of the TREC One to Four Family Residential Contract.

-

How does airSlate SignNow ensure the security of my documents?

Document security is a top priority for airSlate SignNow. All documents, including financing addendums, are encrypted during transit and at rest, ensuring that sensitive information is protected, especially when determining which financing addendum is not included in paragraph 3b of the TREC One to Four Family Residential Contract.

-

Can airSlate SignNow integrate with other tools I am using?

Yes, airSlate SignNow provides integrations with popular tools and software to enhance your workflow. This is especially beneficial for those needing to review which financing addendum is not included in paragraph 3b of the TREC One to Four Family Residential Contract and keep everything organized within their existing systems.

Get more for Trec Owner Financing Addendum

- Cytogenetic requisition patient information other than

- Parental consent form for under 18 years children

- Inurl view index visa cvv form

- Tax return fillable form

- Membership application 2 15 ymca of the inland northwest form

- East allen township volunteer fire department northampton pa form

- Program agreement template form

- Project completion agreement template form

Find out other Trec Owner Financing Addendum

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms