Form 735 1325 Odot 2010

What is the Form Odot

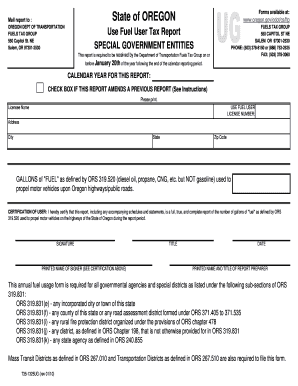

The Form, known as the Use Fuel User Tax Report, is a document issued by the Oregon Department of Transportation (ODOT). It is specifically designed for reporting the use of fuel by individuals and businesses that operate vehicles not subject to the standard fuel tax. This form helps ensure compliance with Oregon's fuel tax regulations and allows users to accurately report their fuel usage for tax purposes.

How to use the Form Odot

To effectively use the Form, individuals and businesses must first gather all necessary information regarding their fuel usage. This includes details about the types of fuel consumed, the total gallons used, and the specific vehicles that utilized the fuel. Once the information is compiled, users can fill out the form, ensuring all fields are completed accurately to avoid issues with compliance. After completion, the form can be submitted electronically or via traditional mail, depending on the preferences of the user.

Steps to complete the Form Odot

Completing the Form involves several key steps:

- Gather all relevant fuel usage data, including vehicle information and fuel types.

- Access the Form from the Oregon Department of Transportation website or other official sources.

- Fill out the form, ensuring that all required fields are accurately completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or by mail, as per your preference.

Legal use of the Form Odot

The legal use of the Form is governed by the regulations set forth by the Oregon Department of Transportation. It is essential that users comply with all applicable laws when completing and submitting this form. An electronically signed form is considered legally binding if it meets the requirements outlined in the ESIGN Act and other relevant legislation. Users should ensure that they utilize a reliable electronic signature solution to maintain compliance and validate their submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Form are crucial for compliance with Oregon tax regulations. Typically, users must submit their reports on a quarterly basis, with specific deadlines set by the Oregon Department of Transportation. It is important to stay informed about these dates to avoid penalties for late submissions. Users should check the ODOT website or contact their office for the most current deadlines and any changes that may occur.

Form Submission Methods (Online / Mail / In-Person)

The Form can be submitted through various methods, providing flexibility for users. The available submission methods include:

- Online: Users can submit the form electronically through the ODOT online portal.

- Mail: Completed forms can be printed and mailed to the designated ODOT address.

- In-Person: Users may also have the option to submit the form in person at specific ODOT locations.

Quick guide on how to complete form 735 1325 odot

Prepare Form 735 1325 Odot effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly and without delays. Manage Form 735 1325 Odot on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 735 1325 Odot with ease

- Obtain Form 735 1325 Odot and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 735 1325 Odot and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 735 1325 odot

Create this form in 5 minutes!

How to create an eSignature for the form 735 1325 odot

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the fuel user tax report form in Oregon?

The fuel user tax report form in Oregon is designed to help businesses accurately report and pay their fuel taxes. By using the fuel user tax report form Oregon, companies can ensure compliance with state regulations while maximizing their tax deductions.

-

How can I use the fuel user tax report form Oregon effectively?

To use the fuel user tax report form Oregon effectively, first gather all necessary data regarding your fuel usage and purchases. Then, complete the form accurately, ensuring you follow the submission deadlines to avoid penalties.

-

What features does airSlate SignNow offer for filling out the fuel user tax report form Oregon?

airSlate SignNow provides a user-friendly platform for filling out the fuel user tax report form Oregon. Features like templates, eSignature capabilities, and document tracking streamline the process and help you manage your submissions efficiently.

-

Is there a cost associated with using airSlate SignNow for the fuel user tax report form Oregon?

Yes, there is a subscription fee for using airSlate SignNow, but it is a cost-effective solution for businesses. The pricing plans are designed to cater to various needs, ensuring you can access the necessary tools to manage your fuel user tax report form Oregon.

-

What benefits will my business gain from using airSlate SignNow with the fuel user tax report form Oregon?

By using airSlate SignNow, your business will benefit from enhanced efficiency and accuracy when processing the fuel user tax report form Oregon. Additionally, the ease of eSigning and document management helps save time, allowing you to focus on your core operations.

-

Can airSlate SignNow integrate with other accounting software for fuel tax reporting?

Yes, airSlate SignNow can integrate with various accounting software solutions to streamline your fuel tax reporting, including the fuel user tax report form Oregon. This integration helps in synchronizing data, reducing manual entry, and improving overall accuracy.

-

What happens if I make a mistake on my fuel user tax report form Oregon?

If you make a mistake on your fuel user tax report form Oregon, it is important to correct it as soon as possible. Contact the state tax authority for guidance on the amendment process to avoid potential penalties for inaccuracies in your filing.

Get more for Form 735 1325 Odot

- Washington legal last will and testament form for divorced person not remarried with adult children 3194554

- Psta td recert form

- 401k application for retirement benefits pdf eib form

- Domestic incident report nyc form

- Go kart waiver form powerplay

- Antifoam a msds form

- Armed forces medley lyrics form

- Form 3cf of income tax act

Find out other Form 735 1325 Odot

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple