Taxable Distribution Reports Fuels Tax State of Oregon 2024-2026

Understanding the Oregon Fuel User Tax Report

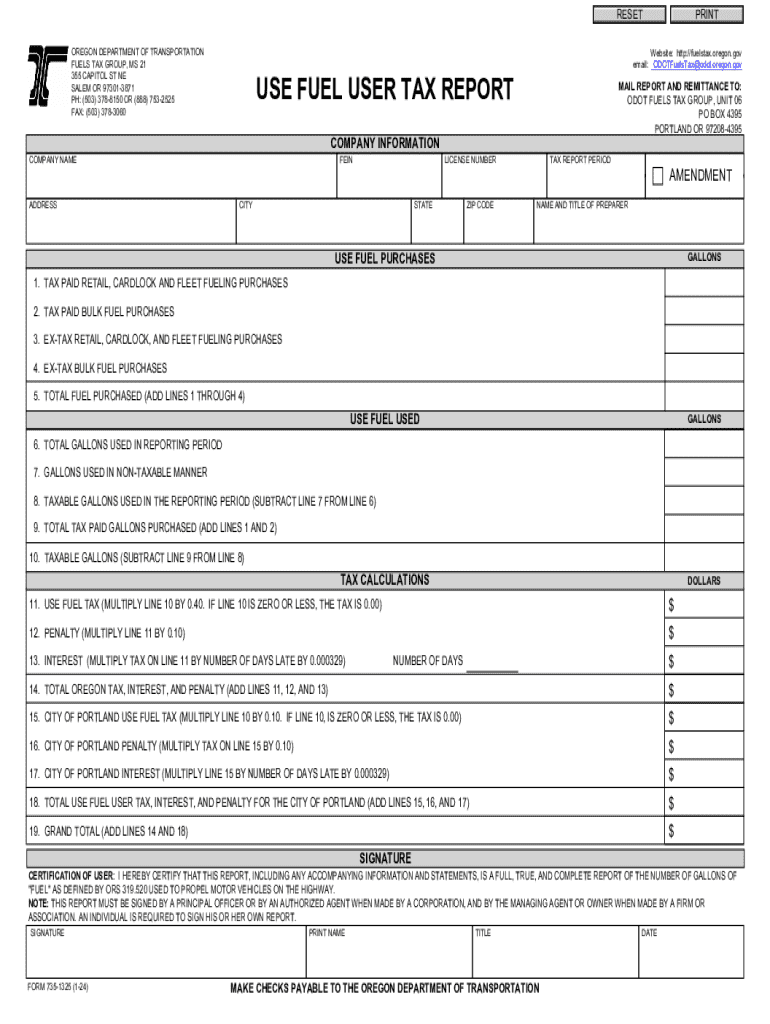

The Oregon Fuel User Tax Report is a crucial document for businesses and individuals who utilize fuel in the state of Oregon. This report is designed to account for the fuel consumed by vehicles that do not pay the standard fuel tax at the pump. It is particularly important for commercial entities and those operating vehicles that are exempt from fuel taxes. The report helps ensure compliance with state regulations and contributes to the maintenance of Oregon's transportation infrastructure.

Steps to Complete the Oregon Fuel User Tax Report

Completing the Oregon Fuel User Tax Report involves several key steps:

- Gather necessary information, including vehicle details, fuel usage records, and any applicable exemptions.

- Obtain the appropriate form, known as Form, from the Oregon Department of Transportation (ODOT).

- Fill out the form accurately, ensuring all required fields are completed, such as fuel type and total gallons used.

- Review the completed form for accuracy and completeness before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Required Documents for the Oregon Fuel User Tax Report

To successfully file the Oregon Fuel User Tax Report, you will need to prepare several documents:

- Records of fuel purchases, including receipts and invoices.

- Vehicle registration details for all vehicles covered by the report.

- Any documentation supporting exemptions, if applicable.

- Previous tax reports, if available, to ensure consistency and accuracy in reporting.

Filing Deadlines for the Oregon Fuel User Tax Report

Timely filing of the Oregon Fuel User Tax Report is essential to avoid penalties. The filing deadlines typically occur quarterly, with specific dates set by the Oregon Department of Transportation. It is crucial to stay informed about these deadlines to ensure compliance and avoid any late fees.

Form Submission Methods for the Oregon Fuel User Tax Report

The Oregon Fuel User Tax Report can be submitted through various methods:

- Online submission via the ODOT website, which offers a convenient and efficient way to file.

- Mailing the completed Form to the appropriate ODOT address.

- In-person submission at designated ODOT offices, allowing for direct assistance if needed.

Penalties for Non-Compliance with the Oregon Fuel User Tax Report

Failure to file the Oregon Fuel User Tax Report on time or inaccuracies in reporting can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is essential to understand these consequences to maintain compliance and avoid financial repercussions.

Quick guide on how to complete taxable distribution reports fuels tax state of oregon

Complete Taxable Distribution Reports Fuels Tax State Of Oregon effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a suitable eco-friendly alternative to traditional printed and signed papers, as you can access the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Taxable Distribution Reports Fuels Tax State Of Oregon on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Taxable Distribution Reports Fuels Tax State Of Oregon with ease

- Obtain Taxable Distribution Reports Fuels Tax State Of Oregon and then click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Modify and eSign Taxable Distribution Reports Fuels Tax State Of Oregon and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxable distribution reports fuels tax state of oregon

Create this form in 5 minutes!

How to create an eSignature for the taxable distribution reports fuels tax state of oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon fuel user tax report?

The Oregon fuel user tax report is a document that businesses must file to report fuel usage and pay the associated taxes. This report is essential for compliance with state regulations and helps ensure that businesses are accurately accounting for their fuel consumption.

-

How can airSlate SignNow help with the Oregon fuel user tax report?

airSlate SignNow simplifies the process of preparing and submitting the Oregon fuel user tax report by providing an easy-to-use platform for eSigning and managing documents. With our solution, you can quickly gather necessary signatures and ensure that your reports are filed on time.

-

What features does airSlate SignNow offer for tax reporting?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are all beneficial for preparing the Oregon fuel user tax report. These features streamline the reporting process, making it more efficient and less prone to errors.

-

Is there a cost associated with using airSlate SignNow for the Oregon fuel user tax report?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage your Oregon fuel user tax report without breaking the bank, providing excellent value for your investment.

-

Can I integrate airSlate SignNow with other software for tax reporting?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your Oregon fuel user tax report alongside your other financial documents. This integration helps streamline your workflow and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the Oregon fuel user tax report, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are safely stored and easily accessible whenever you need them.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive tax information. When preparing your Oregon fuel user tax report, you can trust that your data is secure and handled with the utmost care.

Get more for Taxable Distribution Reports Fuels Tax State Of Oregon

- Tax ohio govstaticforms2021 ohio it 1041 ohio department of taxation

- Ohio universal usetax return tax ohio form

- 40es form

- Alabama department of revenue sales and use tax form

- Withholding requirements for sales or transfers of real property by form

- Sales use lease tax form city of helena alabama

- Sales and excise sales use tax forms tax ri gov

- Schedule reg 1 o form

Find out other Taxable Distribution Reports Fuels Tax State Of Oregon

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter