Tax Calendar WV State Tax Department Form

What is the Tax Calendar WV State Tax Department

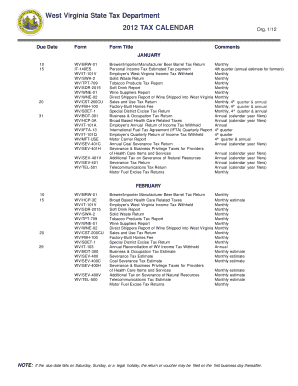

The Tax Calendar from the West Virginia State Tax Department serves as a crucial resource for individuals and businesses to track important tax deadlines throughout the year. It outlines key dates for filing returns, making payments, and other tax-related obligations. This calendar is designed to help taxpayers stay compliant with state tax laws and avoid penalties. It includes various types of taxes such as income, sales, and property taxes, ensuring that all relevant deadlines are clearly communicated.

How to use the Tax Calendar WV State Tax Department

Utilizing the Tax Calendar effectively involves regularly checking it for upcoming deadlines that pertain to your specific tax situation. Taxpayers should mark important dates on their personal or business calendars to ensure timely compliance. The calendar can also be used to plan for tax payments and to prepare necessary documentation in advance. By aligning your financial activities with the calendar, you can minimize last-minute stress and potential errors in your tax submissions.

Filing Deadlines / Important Dates

The Tax Calendar includes critical filing deadlines and important dates that taxpayers must adhere to. These dates vary based on the type of tax and the taxpayer's specific situation. For instance, personal income tax returns typically have a filing deadline of April 15, while corporate tax returns may have different dates. Additionally, estimated tax payment deadlines are also specified, helping taxpayers manage their cash flow effectively throughout the year.

Steps to complete the Tax Calendar WV State Tax Department

Completing the Tax Calendar involves several straightforward steps. First, identify the relevant tax types that apply to you or your business. Next, review the calendar for all important dates associated with those taxes. Mark these dates clearly on your calendar. Prepare any necessary documents ahead of time, ensuring you have everything needed for filing. Finally, stay informed about any changes to deadlines or tax laws that may affect your obligations.

Key elements of the Tax Calendar WV State Tax Department

Key elements of the Tax Calendar include specific deadlines for various tax types, payment schedules, and instructions for filing. Each entry typically includes the date, the type of tax due, and any additional notes that may be relevant for compliance. Understanding these elements is essential for taxpayers to ensure they meet their obligations and avoid any penalties associated with late filings or payments.

Legal use of the Tax Calendar WV State Tax Department

The legal use of the Tax Calendar is paramount for ensuring compliance with state tax laws. By adhering to the deadlines and guidelines outlined in the calendar, taxpayers can protect themselves from potential legal repercussions. This includes avoiding fines, interest on late payments, and other penalties that may arise from non-compliance. The calendar serves as an official reference point for taxpayers to understand their rights and responsibilities under West Virginia tax law.

Quick guide on how to complete tax calendar wv state tax department

Effortlessly Prepare Tax Calendar WV State Tax Department on Any Device

Managing documents online has gained signNow popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Tax Calendar WV State Tax Department seamlessly on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Method to Modify and eSign Tax Calendar WV State Tax Department Effortlessly

- Obtain Tax Calendar WV State Tax Department and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Calendar WV State Tax Department while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax calendar wv state tax department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Calendar WV State Tax Department?

The Tax Calendar WV State Tax Department is a comprehensive guide that outlines important tax deadlines and filing dates for individuals and businesses in West Virginia. It serves as an essential resource for ensuring timely compliance with state tax regulations.

-

How can airSlate SignNow help me manage the Tax Calendar WV State Tax Department?

airSlate SignNow enables users to easily manage their Tax Calendar WV State Tax Department by allowing them to electronically sign and send important tax documents. This streamlines the process, eliminating the need for physical paperwork and reducing the risk of missed deadlines.

-

What are the benefits of using airSlate SignNow for my Tax Calendar WV State Tax Department needs?

By using airSlate SignNow for your Tax Calendar WV State Tax Department needs, you gain access to a user-friendly interface, effective document management, and secure eSigning options. This helps ensure that your tax documents are filed correctly and on time, reducing stress and potential penalties.

-

Is airSlate SignNow cost-effective for managing the Tax Calendar WV State Tax Department?

Yes, airSlate SignNow is a cost-effective solution for managing the Tax Calendar WV State Tax Department. Its pricing plans are designed to fit various business needs, making it accessible for both individuals and organizations looking to simplify their tax filing process.

-

Does airSlate SignNow integrate with other tools for tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax management tools to enhance your experience managing the Tax Calendar WV State Tax Department. This allows for seamless data transfer and improved efficiency in handling tax-related documents.

-

Can I access the Tax Calendar WV State Tax Department on mobile devices with airSlate SignNow?

Yes, airSlate SignNow allows you to access the Tax Calendar WV State Tax Department from your mobile devices. This feature provides you with the flexibility to review, sign, and send documents anytime and anywhere, ensuring you never miss an important deadline.

-

What features does airSlate SignNow offer to assist with the Tax Calendar WV State Tax Department?

airSlate SignNow offers a variety of features tailored to assist with the Tax Calendar WV State Tax Department, including customizable templates, automated reminders for important deadlines, and secure eSignature capabilities. These features help streamline your tax processes and keep you organized.

Get more for Tax Calendar WV State Tax Department

- Green roof declaration form green roof declaration form

- Voluntary disclosure agreement for use tax and form

- Classification and compensation denvergov form

- Commercial water meter sizing form colorado springs

- Volleyball tournament form pdf

- Business questionnaire business questionnaire form

- To denver city council from brandon shaver senior city form

- Certificate of taxes due for business personal property and form

Find out other Tax Calendar WV State Tax Department

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement