Irs Form T2125

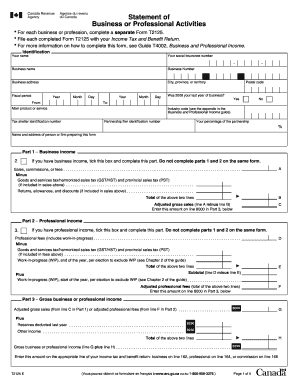

What is the IRS Form T2125

The IRS Form T2125, also known as the Statement of Business Activities, is a tax form used by self-employed individuals in the United States to report their business income and expenses. This form is essential for calculating net income from business activities, which is then reported on the individual's income tax return. The T2125 helps ensure that self-employed taxpayers accurately disclose their earnings and claim eligible deductions, thereby reducing their overall tax liability.

How to use the IRS Form T2125

Using the IRS Form T2125 involves several steps. First, gather all necessary financial records, including income statements, receipts for expenses, and any relevant documentation related to your business activities. Next, complete the form by entering your gross income, followed by detailed listings of your business expenses. This includes categories such as advertising, supplies, and travel expenses. After filling out the form, review it for accuracy before submitting it with your tax return.

Steps to complete the IRS Form T2125

Completing the IRS Form T2125 requires careful attention to detail. Here are the key steps:

- Begin by entering your business name and address at the top of the form.

- Report your gross income from all business activities.

- List your business expenses in the appropriate categories, ensuring you include all eligible deductions.

- Calculate your net income by subtracting total expenses from gross income.

- Sign and date the form before submitting it with your tax return.

Legal use of the IRS Form T2125

The IRS Form T2125 is legally binding when completed accurately and submitted as part of your tax return. To ensure its legal validity, it must be filled out in compliance with IRS guidelines. This includes providing truthful information regarding income and expenses. Additionally, retaining copies of the form and supporting documents is crucial in case of an audit or request for verification from the IRS.

Filing Deadlines / Important Dates

Filing the IRS Form T2125 is typically due on April 15 each year, aligning with the standard tax return deadline for individuals. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Self-employed individuals may also consider filing for an extension, which allows additional time to submit their tax return, but any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

To complete the IRS Form T2125, several documents are required. These include:

- Income records, such as invoices and bank statements.

- Receipts for business expenses, categorized by type.

- Previous year’s tax return for reference.

- Any relevant contracts or agreements related to your business activities.

Examples of using the IRS Form T2125

Self-employed individuals in various industries utilize the IRS Form T2125 to report their income. For instance, a freelance graphic designer would report earnings from client projects and list expenses like software subscriptions and office supplies. Similarly, a small business owner would detail sales revenue and operational costs, ensuring they maximize their deductions. Each example underscores the importance of accurately reporting income and expenses to comply with tax regulations.

Quick guide on how to complete irs form t2125

Prepare Irs Form T2125 effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Irs Form T2125 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Irs Form T2125 with ease

- Obtain Irs Form T2125 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to retain your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Edit and eSign Irs Form T2125 to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form t2125

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the IRS Form T2125?

The IRS Form T2125 is used by self-employed individuals to report their business income and expenses. Completing this form accurately is crucial for ensuring proper tax reporting, and airSlate SignNow can help facilitate the eSigning process for this document.

-

How can airSlate SignNow assist with IRS Form T2125?

airSlate SignNow provides an easy-to-use platform that allows users to create, send, and eSign IRS Form T2125 digitally. This streamlines the process, ensuring that the form is submitted timely and efficiently, without the hassle of printing and faxing.

-

Is airSlate SignNow cost-effective for my business needs?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business requirements, making it a cost-effective solution for managing documents like the IRS Form T2125. With its affordable pricing, businesses can efficiently manage their documentation without overspending.

-

What features does airSlate SignNow offer for IRS Form T2125?

airSlate SignNow offers essential features such as customizable templates, secure cloud storage, and real-time tracking for documents like the IRS Form T2125. These features enhance workflow efficiency and ensure that all parties can easily access and sign the necessary forms.

-

Can I integrate airSlate SignNow with other software for IRS Form T2125?

Yes, airSlate SignNow seamlessly integrates with various software solutions, including accounting and management tools. This means you can streamline the submission of IRS Form T2125 by connecting it to your business processes for improved efficiency.

-

What are the benefits of using airSlate SignNow for my IRS Form T2125?

Using airSlate SignNow for your IRS Form T2125 allows for faster turnaround times, enhanced security, and improved organization of your documents. Convenient eSigning features eliminate the need for physical signatures, making the tax filing process simpler and more efficient.

-

How secure is my information when using airSlate SignNow for IRS Form T2125?

airSlate SignNow prioritizes the security of your information, utilizing encryption and industry-standard security protocols. Your IRS Form T2125 and sensitive data remain protected throughout the document management process, ensuring confidentiality and reliability.

Get more for Irs Form T2125

- Student agreement form

- Utah duplicate title online 65549190 form

- Cbp form i 94 0508

- Encroachment permit city of grand rapids grcity form

- Request for pre authorized payments registration form

- Form absa 3740 ex fill out printable pdf forms online

- Hr supervisor01 twyfordtile com form

- To all suppliers seeking registration as an elangeni form

Find out other Irs Form T2125

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document