IA 1120 Iowa Corporation Income Tax Return 42001 2018

What is the IA 1120 Iowa Corporation Income Tax Return 42001

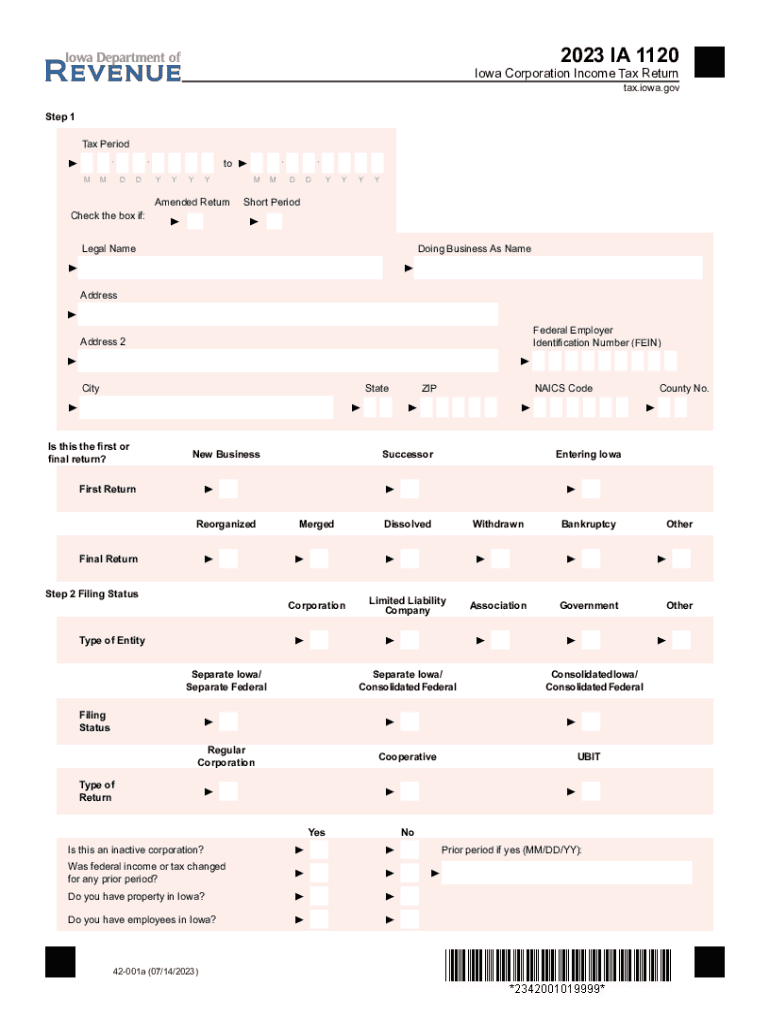

The IA 1120 Iowa Corporation Income Tax Return 42001 is a tax form specifically designed for corporations operating in Iowa. This form is used to report the income, deductions, and tax liability of corporations, ensuring compliance with state tax laws. It is essential for corporations to accurately complete this return to determine their tax obligations and maintain good standing with the Iowa Department of Revenue.

How to use the IA 1120 Iowa Corporation Income Tax Return 42001

To effectively use the IA 1120 Iowa Corporation Income Tax Return 42001, corporations must gather relevant financial information, including total income, allowable deductions, and credits. The form requires detailed reporting of income sources and expenses. After filling out the form, it should be reviewed for accuracy before submission to avoid potential penalties. The completed form can be filed electronically or mailed to the appropriate state tax authority.

Steps to complete the IA 1120 Iowa Corporation Income Tax Return 42001

Completing the IA 1120 involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the form by entering total income and applicable deductions.

- Calculate the corporation's tax liability based on the provided information.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail to the Iowa Department of Revenue.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines for the IA 1120 Iowa Corporation Income Tax Return 42001. Typically, the return is due on the first day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year basis, this means the return is due by April 1. It is crucial to meet these deadlines to avoid late fees and penalties.

Required Documents

To complete the IA 1120, corporations need to prepare several documents, including:

- Financial statements, such as income statements and balance sheets.

- Records of all income sources and expenses.

- Documentation for any tax credits or deductions claimed.

- Prior year tax returns for reference, if applicable.

Form Submission Methods

The IA 1120 Iowa Corporation Income Tax Return 42001 can be submitted using various methods. Corporations can file electronically through the Iowa Department of Revenue's online portal, which offers a streamlined process. Alternatively, the form can be printed and mailed to the appropriate address, or submitted in person at designated tax offices. Each method has its advantages, and corporations should choose the one that best suits their needs.

Quick guide on how to complete ia 1120 iowa corporation income tax return 42001

Complete IA 1120 Iowa Corporation Income Tax Return 42001 effortlessly on any gadget

Managing documents online has become increasingly popular among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without any holdups. Handle IA 1120 Iowa Corporation Income Tax Return 42001 on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

The easiest way to modify and eSign IA 1120 Iowa Corporation Income Tax Return 42001 without hassle

- Acquire IA 1120 Iowa Corporation Income Tax Return 42001 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign IA 1120 Iowa Corporation Income Tax Return 42001 and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia 1120 iowa corporation income tax return 42001

Create this form in 5 minutes!

How to create an eSignature for the ia 1120 iowa corporation income tax return 42001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa return short form?

The Iowa return short form is a simplified tax form that residents of Iowa can use to file their state income taxes if they meet certain criteria. It streamlines the process by allowing eligible taxpayers to report their income and deductions in a more concise manner. Using the Iowa return short form can save you time and make tax filing more efficient.

-

How can airSlate SignNow assist with the Iowa return short form?

airSlate SignNow provides an efficient way to electronically sign and send documents related to your Iowa return short form. Our platform ensures that all files are securely managed and that signatures are legally binding. With airSlate SignNow, you can streamline your tax filing process and increase productivity.

-

Is there a cost to use airSlate SignNow for the Iowa return short form?

Yes, airSlate SignNow offers various pricing plans to fit different needs, including options for individuals and businesses. Our cost-effective solutions can help you manage the signing and sending of your Iowa return short form without breaking the bank. Check our website for current pricing details and features included in each plan.

-

What features does airSlate SignNow offer for eSigning documents related to the Iowa return short form?

airSlate SignNow offers a range of features to facilitate eSigning, including customizable templates, real-time notifications, and comprehensive audit trails. These features ensure that your Iowa return short form is handled efficiently while maintaining legal compliance. Additionally, users can easily track the signing process for enhanced transparency.

-

Can I collaborate with others on the Iowa return short form using airSlate SignNow?

Absolutely! airSlate SignNow allows for easy collaboration on documents, including the Iowa return short form. You can invite others to review and sign the document, ensuring that all necessary parties have access and can contribute to the final submission. This simplifies the process and reduces the chances of errors.

-

Does airSlate SignNow integrate with other tools for processing the Iowa return short form?

Yes, airSlate SignNow integrates seamlessly with numerous applications and platforms, enabling you to streamline your workflow. This is particularly beneficial for managing documents related to the Iowa return short form alongside financial software or CRM systems. Check our integrations page for a complete list of supported tools.

-

Are my documents safe when using airSlate SignNow for the Iowa return short form?

Security is a top priority at airSlate SignNow. We leverage industry-leading encryption and secure access controls to ensure your documents, including the Iowa return short form, remain confidential and protected. Our platform is designed to meet compliance standards, giving you peace of mind when using our services.

Get more for IA 1120 Iowa Corporation Income Tax Return 42001

- Mabel morris family home visit program referral form

- 90 day rx solution waiver request form1199seiu funds

- File online claim india network health insurance form

- Pentegra form withdrawal

- Exam results and certification verification form nccaom

- Blood request form

- Health clearance form 529867480

- Weekly reading log 5th grade msjhs form

Find out other IA 1120 Iowa Corporation Income Tax Return 42001

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney