IA W 4 Employee Withholding Allowance Certificate Tax Iowa Gov 2017

Understanding the IA 4 Employee Withholding Allowance Certificate

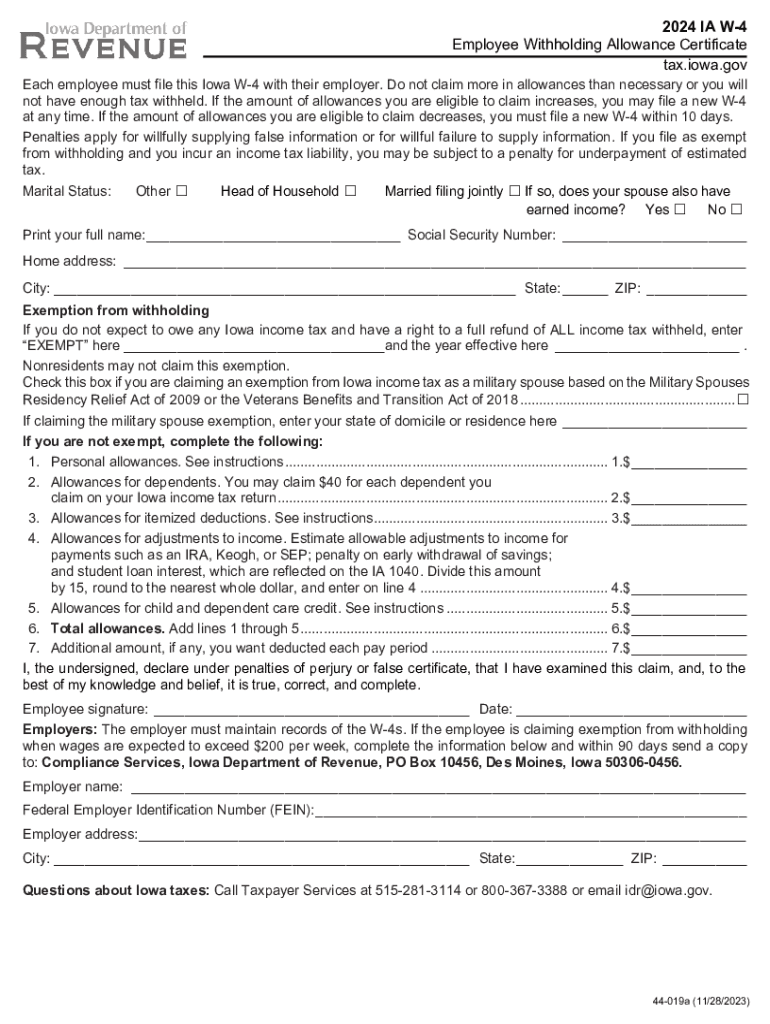

The IA 4 form, officially known as the Iowa Employee Withholding Allowance Certificate, is essential for employees in Iowa. It allows individuals to declare their withholding allowances, which directly affects the amount of state income tax withheld from their paychecks. This form is crucial for ensuring that the correct amount of tax is deducted, helping to avoid underpayment or overpayment of taxes throughout the year.

Steps to Complete the IA 4 Form

Completing the IA 4 form involves several straightforward steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Allowances: Calculate the number of allowances you are claiming based on your personal situation, including dependents and other factors.

- Additional Withholding: If you wish to have an additional amount withheld, specify this in the designated section.

- Signature: Sign and date the form to validate your submission.

After completing the form, submit it to your employer for processing.

Legal Use of the IA 4 Form

The IA 4 form is legally recognized by the state of Iowa for determining state income tax withholding. Employers are required to maintain accurate records of the forms submitted by their employees. It is important for employees to complete this form accurately to comply with state tax laws and to ensure proper withholding amounts are calculated.

Eligibility Criteria for the IA 4 Form

Any employee working in Iowa is eligible to complete the IA 4 form. This includes full-time, part-time, and seasonal workers. It is important to note that the form must be filled out whenever there are changes in personal circumstances, such as marital status or the number of dependents, to ensure accurate withholding.

Examples of Using the IA 4 Form

Consider the following scenarios where the IA 4 form is applicable:

- An employee who recently got married may want to adjust their withholding allowances to reflect their new filing status.

- A parent who has recently had a child can claim additional allowances based on their new dependent.

- Someone who has multiple jobs may need to complete the IA 4 for each employer to ensure correct withholding across all income sources.

Filing Deadlines and Important Dates

It is important to submit the IA 4 form to your employer as soon as you start a new job or experience a change in your personal situation. While there are no specific state deadlines for submitting this form, timely submission ensures that your withholding is adjusted correctly for the upcoming pay periods.

Quick guide on how to complete ia w 4 employee withholding allowance certificate tax iowa gov

Easily Prepare IA W 4 Employee Withholding Allowance Certificate Tax iowa gov on Any Device

Managing documents online has gained popularity among both businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the essential tools to create, modify, and eSign your documents quickly and without delays. Manage IA W 4 Employee Withholding Allowance Certificate Tax iowa gov on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

Edit and eSign IA W 4 Employee Withholding Allowance Certificate Tax iowa gov Effortlessly

- Find IA W 4 Employee Withholding Allowance Certificate Tax iowa gov and click Get Form to begin.

- Utilize the tools available to complete your form.

- Identify key sections of your documents or obscure private information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information carefully and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate reprinting documents. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign IA W 4 Employee Withholding Allowance Certificate Tax iowa gov and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia w 4 employee withholding allowance certificate tax iowa gov

Create this form in 5 minutes!

How to create an eSignature for the ia w 4 employee withholding allowance certificate tax iowa gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ia 4 in the context of airSlate SignNow?

ia 4 refers to the fourth version of our intelligent automation tools integrated within airSlate SignNow. This version enhances the document eSigning process by streamlining workflows and improving user experience, making it simpler for businesses to manage agreements electronically.

-

How does the pricing for ia 4 compare to other eSignature solutions?

ia 4 offers a competitive pricing model designed to fit various business needs. Our cost-effective solution provides powerful features at a lower cost than many other eSignature platforms, ensuring you get maximum value for your investment without compromising on functionality.

-

What features does ia 4 include to facilitate document signing?

ia 4 includes a range of features such as customizable templates, bulk sending options, and advanced security measures. These features empower users to create, send, and sign documents seamlessly, enhancing the efficiency of your document workflow.

-

What are the benefits of using ia 4 for my business?

By utilizing ia 4, businesses can improve efficiency, reduce paper usage, and enhance collaboration. The automated workflows and fast eSignature capabilities help in speeding up the completion of agreements, leading to faster decision-making and improved customer satisfaction.

-

Can ia 4 integrate with other software applications?

Yes, ia 4 supports integrations with various third-party applications including popular CRM and productivity tools. This flexibility allows businesses to streamline their processes further and enables a more cohesive workflow across different platforms.

-

Is ia 4 secure for handling sensitive documents?

Absolutely, ia 4 prioritizes the security of your documents. We implement stringent encryption protocols and comply with industry standards to ensure that all eSigned documents are protected against unauthorized access and tampering.

-

How can I get started with ia 4 on airSlate SignNow?

Getting started with ia 4 is straightforward. Simply sign up for an account on airSlate SignNow, choose the plan that fits your needs, and you can immediately begin utilizing the powerful eSignature features of ia 4 in your document workflows.

Get more for IA W 4 Employee Withholding Allowance Certificate Tax iowa gov

- Twu immunization form

- Managing office form

- Excess andor subrogation statement of facts form

- Patient medical history improvemyagilitycom form

- All forms below are required before activation of an accountregistry

- Claim formsamerican fidelity

- St michaels vascular surgery clinic referral form

- Medical history statement long form indiana new hampshire 16126pdf gr 89914

Find out other IA W 4 Employee Withholding Allowance Certificate Tax iowa gov

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast