Stax 1 Illinois Form

What is the Stax 1 Illinois

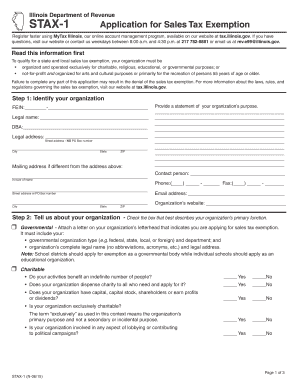

The Stax 1 form, also known as the Stax 1 Illinois, is a critical document used for various administrative purposes within the state of Illinois. It is primarily designed for individuals and businesses to submit specific information required by state authorities. This form plays a vital role in ensuring compliance with local regulations and maintaining accurate records for taxation and other legal matters.

How to use the Stax 1 Illinois

Using the Stax 1 form involves several straightforward steps. First, ensure you have all necessary information at hand, such as identification details and any relevant financial data. Next, fill out the form accurately, making sure to follow the provided instructions closely. After completing the form, you can submit it either electronically or via traditional mail, depending on your preference and the requirements set forth by the issuing authority.

Steps to complete the Stax 1 Illinois

Completing the Stax 1 form involves a systematic approach to ensure accuracy and compliance. Here are the essential steps:

- Gather all required information, including personal identification and financial details.

- Carefully read the instructions accompanying the form to understand the requirements.

- Fill out the form, ensuring all fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, either online or by mail.

Legal use of the Stax 1 Illinois

The Stax 1 form is legally binding when completed and submitted in accordance with the relevant state laws. To ensure its legal validity, it is essential to comply with all instructions and requirements outlined by the state. This includes providing accurate information and adhering to deadlines for submission. Failure to comply may result in penalties or delays in processing.

Key elements of the Stax 1 Illinois

Several key elements make up the Stax 1 form, which are crucial for its proper completion. These include:

- Identification Information: Personal details such as name, address, and Social Security number.

- Financial Data: Relevant financial information necessary for the form's purpose.

- Signature: A required signature to validate the form.

- Date of Submission: The date when the form is filled out and submitted.

Form Submission Methods (Online / Mail / In-Person)

The Stax 1 Illinois can be submitted through various methods, depending on the preferences of the user and the guidelines set by the state. Common submission methods include:

- Online Submission: Many users prefer to submit the form electronically for convenience and speed.

- Mail Submission: Users can also print the completed form and send it via postal mail to the appropriate office.

- In-Person Submission: For those who prefer direct interaction, submitting the form in person at designated offices is an option.

Quick guide on how to complete stax 1 illinois

Effortlessly Prepare Stax 1 Illinois on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers a perfect environmentally-friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without any setbacks. Manage Stax 1 Illinois on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Effortlessly Modify and eSign Stax 1 Illinois

- Acquire Stax 1 Illinois and then select Get Form to begin.

- Employ the tools we provide to complete your document.

- Select relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Stax 1 Illinois to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stax 1 illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is stax 1 registration?

Stax 1 registration is an essential process that ensures businesses comply with necessary legal requirements when using airSlate SignNow. It involves providing necessary information about your organization to access all the features of our eSignature platform effectively.

-

How much does stax 1 registration cost?

The stax 1 registration fee is included in the overall pricing packages offered by airSlate SignNow. We aim to provide a cost-effective solution that allows businesses to manage their document signing processes without unexpected fees.

-

What are the key features of stax 1 registration?

Stax 1 registration provides access to a host of features, including customizable templates, team collaboration, and secure document management. These functionalities enhance the user experience, enabling organizations to streamline their eSignature workflows.

-

How does stax 1 registration benefit small businesses?

For small businesses, stax 1 registration simplifies document management while ensuring compliance with legal standards. This enables them to focus on growth and enhance efficiency through faster document processing and reduced administrative burdens.

-

Is stax 1 registration easy to complete?

Yes, completing stax 1 registration is designed to be a user-friendly process. With clear instructions and support available, businesses can quickly set up their accounts and start utilizing airSlate SignNow's features without hassle.

-

Can stax 1 registration integrate with other software?

Absolutely! Stax 1 registration allows for seamless integration with various platforms, enhancing your workflow. Businesses can connect with CRM systems, cloud storage, and productivity tools to streamline operations further.

-

How long does stax 1 registration take?

The time taken for stax 1 registration can vary, but most users complete the process within a few minutes. Once your registration is submitted, you will receive confirmation shortly, enabling you to begin using airSlate SignNow effectively.

Get more for Stax 1 Illinois

- Fin 579s sample special property transfer tax return this is a sample version of a special property transfer tax return rev gov form

- Pilot history form 76284218

- Section 112 terms of settlement ontario form

- Tm 4 fdny form

- E conveyancing error resolution form revenue nsw

- Credit application 400112208 form

- Belltown antique car club membership renewalapplication form

- Contractor confidentiality agreement template form

Find out other Stax 1 Illinois

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template