Nebraska Form 10 Instructions

What is the Nebraska Form 10?

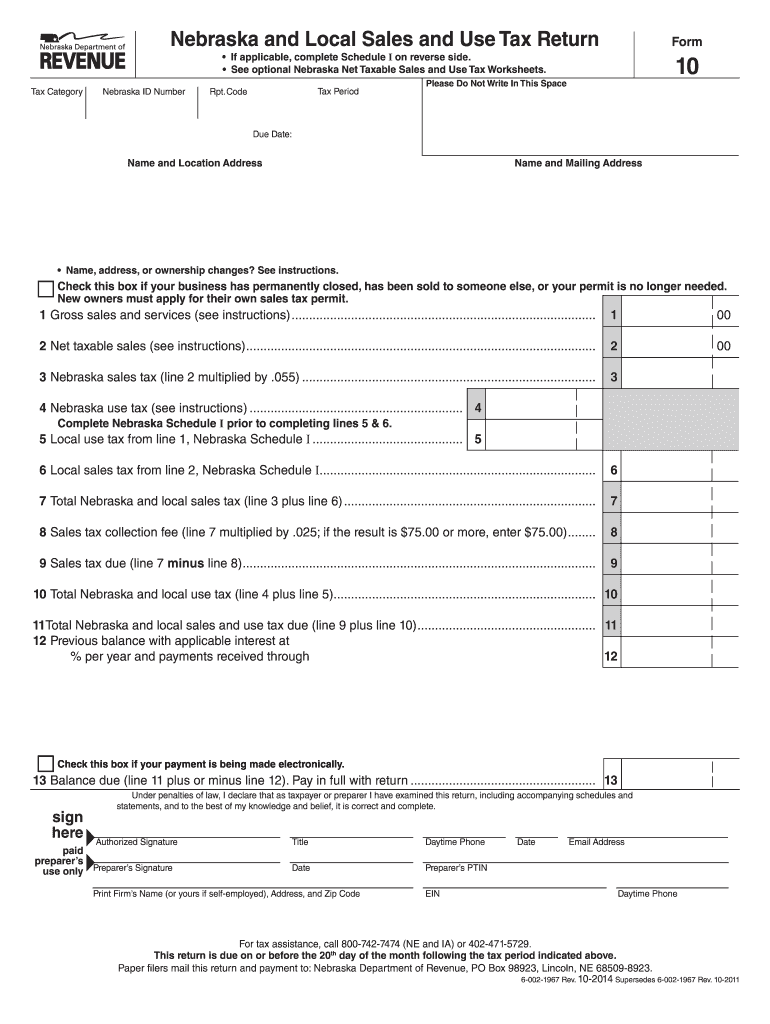

The Nebraska sales tax form 10, officially known as the Nebraska and local sales and use tax return form 10, is a crucial document used by businesses to report sales and use tax collected during a specific period. This form is essential for ensuring compliance with state tax regulations. It provides a detailed account of taxable sales, exempt sales, and the amount of tax due to the state of Nebraska and local jurisdictions.

Steps to Complete the Nebraska Form 10

Completing the Nebraska sales tax form 10 involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records, including invoices and receipts. Next, fill out the form by entering total sales, exempt sales, and calculating the tax due. It is important to double-check all figures for accuracy. Finally, sign and date the form before submission. If filing electronically, ensure that all required fields are completed and that you follow the specific e-filing procedures outlined by the Nebraska Department of Revenue.

Legal Use of the Nebraska Form 10

The Nebraska sales tax form 10 is legally binding when filled out correctly and submitted in accordance with state regulations. To ensure its legal standing, the form must be signed by an authorized individual within the business. Additionally, compliance with eSignature laws, such as the ESIGN and UETA acts, is essential when submitting the form electronically. This guarantees that the electronic submission holds the same legal weight as a paper submission with a handwritten signature.

Filing Deadlines for the Nebraska Form 10

Timely submission of the Nebraska sales tax form 10 is critical to avoid penalties. The filing deadlines typically align with the reporting period, which can be monthly, quarterly, or annually, depending on the volume of sales. Businesses should check the Nebraska Department of Revenue’s official schedule for specific due dates. Late submissions may incur interest and penalties, emphasizing the importance of adhering to these deadlines.

Form Submission Methods for the Nebraska Form 10

Businesses have several options for submitting the Nebraska sales tax form 10. The form can be filed electronically through the Nebraska Department of Revenue’s online portal, which is often the fastest method. Alternatively, businesses may choose to submit the form by mail or in person at designated tax offices. Each method has its own guidelines, so it is essential to follow the instructions provided for the chosen submission method to ensure proper processing.

Key Elements of the Nebraska Form 10

The Nebraska sales tax form 10 includes several key elements that must be accurately reported. These elements consist of total sales, taxable sales, exempt sales, and the calculated sales tax due. Additionally, businesses must provide their identification number and contact information. Each section of the form is designed to capture specific data necessary for tax calculation and compliance, making it vital to understand each component.

Who Issues the Nebraska Form 10?

The Nebraska sales tax form 10 is issued by the Nebraska Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Nebraska. The department provides resources and guidance for businesses to help them understand their tax obligations, including the proper use of the form 10.

Quick guide on how to complete nebraska form 10 instructions

Complete Nebraska Form 10 Instructions effortlessly on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Nebraska Form 10 Instructions on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Nebraska Form 10 Instructions without hassle

- Obtain Nebraska Form 10 Instructions and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Nebraska Form 10 Instructions and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska form 10 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska sales tax form 10?

The Nebraska sales tax form 10 is a state document used by businesses to report and remit sales tax collected during a specific period. It's crucial for maintaining compliance with state tax regulations. Accurate completion of this form ensures you meet your tax obligations effectively.

-

How can I fill out the Nebraska sales tax form 10 using airSlate SignNow?

You can easily fill out the Nebraska sales tax form 10 using airSlate SignNow's intuitive interface. The platform provides templates and eSignature capabilities, allowing you to complete and submit the form efficiently. Additionally, the document can be shared securely with relevant stakeholders.

-

Are there any costs associated with using airSlate SignNow for the Nebraska sales tax form 10?

Using airSlate SignNow comes with various pricing plans, which can accommodate different business needs for managing documents, including the Nebraska sales tax form 10. The cost is competitive, providing a cost-effective solution for businesses aiming to streamline their document management. You can find a plan that fits your budget and access all necessary features.

-

What features does airSlate SignNow offer for managing the Nebraska sales tax form 10?

airSlate SignNow offers a range of features for managing the Nebraska sales tax form 10, including electronic signatures, document templates, and secure sharing. These features make it simpler to gather necessary approvals and ensure compliance. Furthermore, integrations with various applications can enhance your workflow.

-

Can I integrate airSlate SignNow with my accounting software for the Nebraska sales tax form 10?

Yes, airSlate SignNow integrates seamlessly with numerous accounting software solutions, making it easy to pull data and complete the Nebraska sales tax form 10. This integration facilitates smoother record-keeping and helps ensure that your sales tax reporting is accurate and timely. This can signNowly enhance your operational efficiency.

-

What are the benefits of using airSlate SignNow for the Nebraska sales tax form 10?

Using airSlate SignNow for the Nebraska sales tax form 10 offers several benefits, including time savings, improved accuracy, and enhanced security. Automated workflows reduce the risk of errors, while eSignature capabilities expedite approvals and submissions. This streamlining allows you to focus more on core business activities.

-

How secure is airSlate SignNow when handling the Nebraska sales tax form 10?

AirSlate SignNow prioritizes security, employing industry-standard encryption and compliance protocols when handling the Nebraska sales tax form 10. Your documents are kept confidential and secure throughout the signing process. This focus on security helps protect sensitive business information from unauthorized access.

Get more for Nebraska Form 10 Instructions

Find out other Nebraska Form 10 Instructions

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free