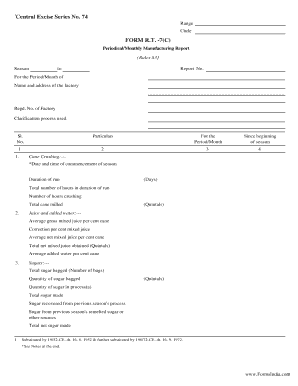

Central Excise Series No 74 FORM R T 7C

What is the Central Excise Series No 74 FORM R T 7C

The Central Excise Series No 74 FORM R T 7C is a specific document utilized in the context of excise duty compliance in the United States. This form is primarily used by businesses to report and pay excise taxes on certain goods manufactured or imported into the country. It serves as a crucial tool for ensuring that businesses adhere to federal regulations regarding excise duties, which can apply to a variety of products, including alcohol, tobacco, and fuel.

How to use the Central Excise Series No 74 FORM R T 7C

Using the Central Excise Series No 74 FORM R T 7C involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding the excise goods, including quantities and applicable rates. Next, accurately fill out the form, ensuring that all required fields are completed. After completion, the form can be submitted electronically or via traditional mail, depending on the preferred method of the business. It is essential to retain a copy of the submitted form for record-keeping purposes.

Steps to complete the Central Excise Series No 74 FORM R T 7C

Completing the Central Excise Series No 74 FORM R T 7C requires careful attention to detail. Follow these steps:

- Collect all relevant data on the excise goods, including product descriptions and quantities.

- Access the form through the appropriate government website or obtain a physical copy.

- Fill in the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or by mail, as per your preference.

Legal use of the Central Excise Series No 74 FORM R T 7C

The Central Excise Series No 74 FORM R T 7C must be used in accordance with federal regulations governing excise taxes. To be legally binding, the form must be completed accurately and submitted within the specified deadlines. Additionally, businesses should ensure compliance with any state-specific regulations that may apply. Proper use of this form helps avoid penalties and ensures that businesses remain in good standing with tax authorities.

Key elements of the Central Excise Series No 74 FORM R T 7C

Several key elements are essential to the Central Excise Series No 74 FORM R T 7C, including:

- Taxpayer Identification Number (TIN): Required for identifying the business submitting the form.

- Product Information: Detailed descriptions of the goods subject to excise tax.

- Tax Calculation: Accurate calculations of the excise tax owed based on current rates.

- Signature: A signature is required to certify the accuracy of the information provided.

Form Submission Methods

The Central Excise Series No 74 FORM R T 7C can be submitted through various methods. Businesses may choose to submit the form electronically via a secure online platform, which often provides immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate tax authority. When mailing, it is advisable to use certified mail to ensure that the submission is tracked and confirmed.

Quick guide on how to complete central excise series no 74 form r t 7c

Complete Central Excise Series No 74 FORM R T 7C effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents rapidly without any holdups. Manage Central Excise Series No 74 FORM R T 7C from any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to edit and eSign Central Excise Series No 74 FORM R T 7C with ease

- Find Central Excise Series No 74 FORM R T 7C and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or downloading it to your PC.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Central Excise Series No 74 FORM R T 7C and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the central excise series no 74 form r t 7c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Central Excise Series No 74 FORM R T 7C?

The Central Excise Series No 74 FORM R T 7C is a crucial document used in the excise process for taxpayers in India. It serves to ensure compliance with Central Excise regulations by documenting relevant taxpayer information. Using airSlate SignNow, you can easily manage and eSign this form, streamlining your compliance efforts.

-

How can airSlate SignNow help with the Central Excise Series No 74 FORM R T 7C?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the Central Excise Series No 74 FORM R T 7C. With its user-friendly interface, users can quickly customize templates to meet their needs. The solution not only saves time but also enhances accuracy in managing essential documents.

-

Is there a cost associated with using airSlate SignNow for the Central Excise Series No 74 FORM R T 7C?

Yes, there are costs associated with using airSlate SignNow; however, it offers various pricing plans to suit different business needs. These plans provide access to features that simplify the handling of Central Excise Series No 74 FORM R T 7C and other documents. You can choose a plan that fits your budget while still benefiting from an easy-to-use solution.

-

What features does airSlate SignNow offer for managing the Central Excise Series No 74 FORM R T 7C?

airSlate SignNow offers multiple features for managing the Central Excise Series No 74 FORM R T 7C, including customizable templates, automated workflows, and secure eSignature capabilities. Users can track the status of documents and ensure they are completed swiftly and accurately. These features empower organizations to maintain compliance and efficiency.

-

Can I integrate airSlate SignNow with other software to manage the Central Excise Series No 74 FORM R T 7C?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing seamless management of the Central Excise Series No 74 FORM R T 7C. This integration simplifies data transfer between platforms, helping you maintain organized records and improve overall workflow efficiency. Popular integrations include CRM and accounting software.

-

What are the benefits of using airSlate SignNow for the Central Excise Series No 74 FORM R T 7C?

Using airSlate SignNow for the Central Excise Series No 74 FORM R T 7C provides numerous benefits, including enhanced document security, reduced processing time, and increased accuracy. Furthermore, the solution is cost-effective, ensuring businesses can comply with regulatory requirements without extensive expenses. It ultimately empowers teams to work more efficiently.

-

Is it easy to learn how to use airSlate SignNow for the Central Excise Series No 74 FORM R T 7C?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to learn how to handle the Central Excise Series No 74 FORM R T 7C. With a simple and intuitive interface, users can quickly navigate the platform and utilize its features without extensive training. Support resources are also available to assist users.

Get more for Central Excise Series No 74 FORM R T 7C

Find out other Central Excise Series No 74 FORM R T 7C

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure