G7 Quarterly Return for Monthly Payer Form

What is the G7 Quarterly Return For Monthly Payer Form

The G7 Quarterly Return for Monthly Payer Form is a crucial document used by businesses to report their tax obligations on a quarterly basis. This form is specifically designed for entities that make monthly payments, ensuring compliance with federal tax regulations. By accurately completing this form, businesses can provide the necessary information regarding their income, deductions, and tax liabilities to the Internal Revenue Service (IRS).

Steps to complete the G7 Quarterly Return For Monthly Payer Form

Completing the G7 Quarterly Return for Monthly Payer Form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements and expense records. Next, fill in the required fields on the form, which typically include your business name, address, and taxpayer identification number. It is essential to report all income accurately and claim any allowable deductions. After completing the form, review it for any errors before submitting it to the IRS.

Legal use of the G7 Quarterly Return For Monthly Payer Form

The G7 Quarterly Return for Monthly Payer Form is legally binding when completed and submitted correctly. To ensure its legal validity, it must adhere to the requirements set forth by the IRS and comply with relevant tax laws. Utilizing a reliable eSignature platform can enhance the legal standing of the document by providing a digital certificate and ensuring compliance with the ESIGN Act and UETA. This makes the electronic submission of the form just as valid as a paper version.

Filing Deadlines / Important Dates

Filing deadlines for the G7 Quarterly Return for Monthly Payer Form are critical to avoid penalties. Generally, the form must be submitted within a specific timeframe after the end of each quarter. For instance, if a quarter ends on March 31, the form is typically due by April 30. It is important to stay informed about these dates to ensure timely submission and compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The G7 Quarterly Return for Monthly Payer Form can be submitted through various methods. Businesses may choose to file online using the IRS e-filing system, which provides a secure and efficient way to submit forms. Alternatively, the form can be mailed to the appropriate IRS address or submitted in person at designated IRS offices. Each method has its advantages, and businesses should select the one that best suits their needs.

Key elements of the G7 Quarterly Return For Monthly Payer Form

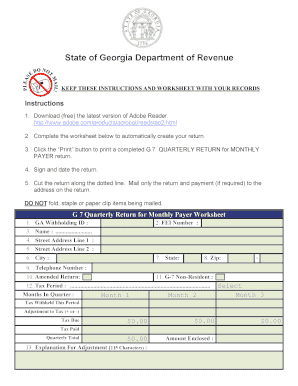

Understanding the key elements of the G7 Quarterly Return for Monthly Payer Form is essential for accurate completion. The form typically includes sections for reporting gross income, deductions, and the total tax liability. Additionally, it may require information about previous payments made and any credits that can be claimed. Familiarity with these components helps ensure that all necessary information is provided, reducing the risk of errors or omissions.

Quick guide on how to complete g7 quarterly return for monthly payer form

Accomplish G7 Quarterly Return For Monthly Payer Form smoothly on any device

Digital document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without hindrances. Manage G7 Quarterly Return For Monthly Payer Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to adjust and electronically sign G7 Quarterly Return For Monthly Payer Form without any hassle

- Find G7 Quarterly Return For Monthly Payer Form and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign G7 Quarterly Return For Monthly Payer Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the g7 quarterly return for monthly payer form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the G 7 quarterly return for monthly payer form?

The G 7 quarterly return for monthly payer form is a financial document that helps businesses report their monthly payroll deductions efficiently. By utilizing this form, companies ensure compliance with tax regulations while simplifying their filing process. airSlate SignNow makes it easy to eSign and send this form, ensuring you stay organized and compliant.

-

How does airSlate SignNow help with the G 7 quarterly return for monthly payer form?

AirSlate SignNow streamlines the process of completing and submitting the G 7 quarterly return for monthly payer form. With our user-friendly interface, businesses can easily fill out the form, sign it electronically, and send it securely to the relevant authorities. This not only saves time but also reduces the chances of errors in your submission.

-

Is there a cost associated with using airSlate SignNow for G 7 quarterly return for monthly payer form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to provide an affordable solution for managing documents, including the G 7 quarterly return for monthly payer form. You can choose a plan that best suits your business size and requirements.

-

What features does airSlate SignNow offer for the G 7 quarterly return for monthly payer form?

airSlate SignNow provides several features to enhance the completion of the G 7 quarterly return for monthly payer form. These include customizable templates, secure eSigning capabilities, and robust tracking options. Our tools help you manage your documents efficiently while ensuring compliance with legal standards.

-

Can I integrate airSlate SignNow with my existing payroll software for the G 7 quarterly return for monthly payer form?

Absolutely! AirSlate SignNow offers seamless integrations with a variety of payroll software applications. This allows you to manage the G 7 quarterly return for monthly payer form and your payroll processes in one place, improving efficiency and reducing administrative burdens.

-

What are the benefits of using airSlate SignNow for the G 7 quarterly return for monthly payer form?

Using airSlate SignNow for the G 7 quarterly return for monthly payer form provides numerous benefits, including enhanced efficiency and reduced paperwork. Our electronic signature solution makes filing your returns faster and more secure, while our compliance features ensure that you meet all necessary regulations without hassle.

-

How secure is my information when using airSlate SignNow for the G 7 quarterly return for monthly payer form?

Security is a top priority at airSlate SignNow. When using our platform for the G 7 quarterly return for monthly payer form, your data is protected through strong encryption protocols and secure cloud storage. You can trust that your sensitive information will remain confidential and safe throughout the signing process.

Get more for G7 Quarterly Return For Monthly Payer Form

- Bapplicationb for metals incumbent worker training northerntier form

- Workers compensation information form

- Sample police chief contract police chief contract aele form

- Patient and family advisory council pfac application form

- Phw direct deposit authorization ilife financial management form

- Apwu legal plan form

- Position title group fitness instructor scottcountyfamilyy form

- Charitable trust scholarship program form

Find out other G7 Quarterly Return For Monthly Payer Form

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now