Fatca Annexure Union Bank of India Form

What is the FATCA Annexure Union Bank of India?

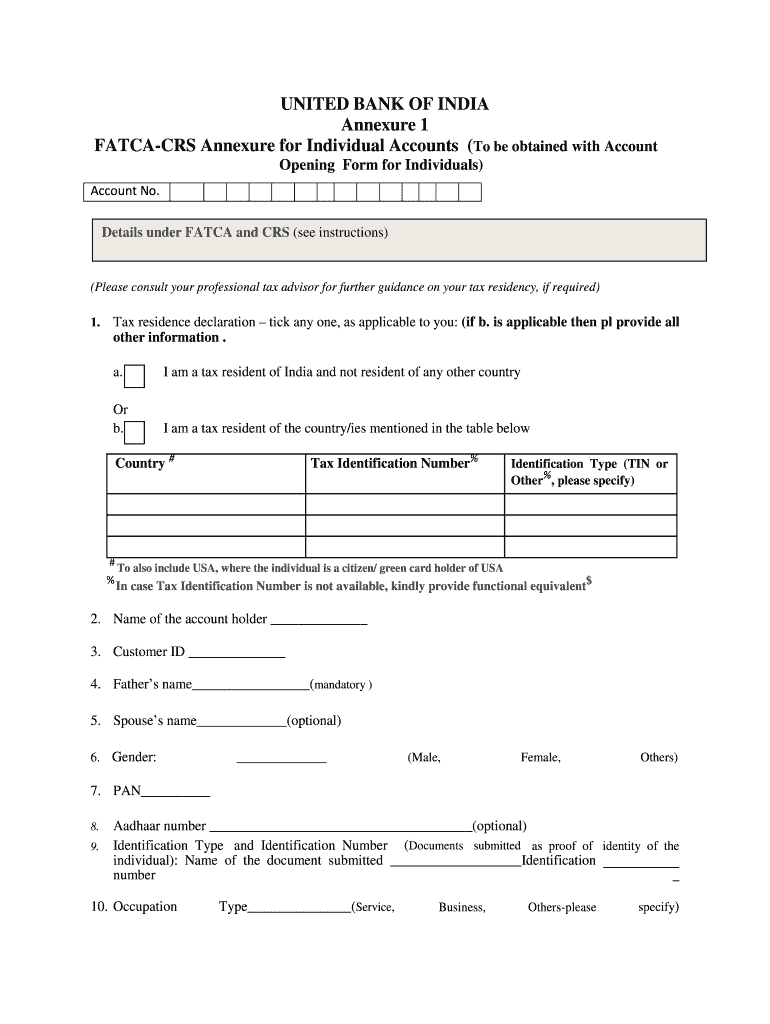

The FATCA Annexure for Union Bank of India is a specific form required for compliance with the Foreign Account Tax Compliance Act (FATCA). This form is designed to collect information from account holders who are U.S. taxpayers or have U.S. connections. The purpose of the annexure is to ensure that financial institutions report relevant information to the IRS, thereby preventing tax evasion by U.S. citizens and residents. It is essential for individuals and entities with accounts in Union Bank of India to understand the implications of this form and its role in international tax compliance.

Steps to Complete the FATCA Annexure Union Bank of India

Completing the FATCA Annexure for Union Bank of India involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect all relevant personal and financial details, including your tax identification number, account details, and citizenship status.

- Fill out the form: Accurately input the gathered information into the FATCA annexure. Ensure that all fields are completed to avoid delays.

- Review for accuracy: Double-check all entries for correctness. Inaccurate information can lead to penalties or delays in processing.

- Submit the form: Follow the submission guidelines provided by Union Bank of India, whether online, by mail, or in person.

Legal Use of the FATCA Annexure Union Bank of India

The FATCA Annexure is legally binding and must be filled out truthfully. Providing false information can result in severe penalties, including fines and potential criminal charges. It is crucial for account holders to understand that this form is part of a broader compliance framework aimed at ensuring transparency in international banking and tax matters. Adhering to the legal requirements associated with this form protects both the individual and the bank from legal repercussions.

Required Documents for the FATCA Annexure Union Bank of India

When completing the FATCA Annexure for Union Bank of India, certain documents are typically required to support your application. These may include:

- Proof of identity: A government-issued ID such as a passport or driver's license.

- Tax identification number: Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Financial statements: Recent bank statements or account summaries that provide insight into your financial activities.

- Residency proof: Documents that demonstrate your residency status, such as utility bills or lease agreements.

Form Submission Methods for the FATCA Annexure Union Bank of India

The FATCA Annexure can be submitted through various methods, depending on the preferences and capabilities of the account holder. Common submission methods include:

- Online submission: Many banks, including Union Bank of India, offer secure online portals for form submission.

- Mail: You can send the completed form via postal mail to the designated address provided by the bank.

- In-person submission: Visit a local branch of Union Bank of India to submit the form directly to a bank representative.

Penalties for Non-Compliance with the FATCA Annexure Union Bank of India

Failure to comply with the requirements of the FATCA Annexure can lead to significant penalties. These may include:

- Fines: Monetary penalties may be imposed for inaccurate or incomplete information.

- Account restrictions: Non-compliance may result in restrictions on your bank accounts or services.

- Legal action: In severe cases, individuals may face legal action, including criminal charges for tax evasion.

Quick guide on how to complete union bank fatca pdf form

A concise guide on how to create your Fatca Annexure Union Bank Of India

Finding the right template can be difficult when you need to submit official international documents. Even if you possess the required form, it can be tedious to quickly prepare it according to all the specifications when using physical copies instead of handling everything online. airSlate SignNow is the web-based eSignature platform that assists you in overcoming these challenges. It allows you to obtain your Fatca Annexure Union Bank Of India and efficiently complete and sign it on-site without needing to reprint documents after making a mistake.

Here are the actions you should take to prepare your Fatca Annexure Union Bank Of India with airSlate SignNow:

- Click the Obtain Form button to upload your document to our editor promptly.

- Begin with the first vacant field, input the necessary information, and move on with the Next option.

- Complete the empty fields using the Cross and Check tools from the toolbar above.

- Select the Highlight or Line features to emphasize the most important details.

- Click on Image and upload one if your Fatca Annexure Union Bank Of India requires it.

- Utilize the panel on the right to add extra fields for you or others to complete if necessary.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Complete your modifications by hitting the Done button and choosing your file-sharing options.

Once your Fatca Annexure Union Bank Of India is prepared, you can distribute it as you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, sorted in folders based on your preferences. Avoid wasting time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

Create this form in 5 minutes!

How to create an eSignature for the union bank fatca pdf form

How to make an eSignature for your Union Bank Fatca Pdf Form online

How to generate an eSignature for your Union Bank Fatca Pdf Form in Google Chrome

How to create an electronic signature for putting it on the Union Bank Fatca Pdf Form in Gmail

How to make an eSignature for the Union Bank Fatca Pdf Form from your smart phone

How to make an electronic signature for the Union Bank Fatca Pdf Form on iOS

How to make an electronic signature for the Union Bank Fatca Pdf Form on Android devices

People also ask

-

What is the FATCA declaration form for Union Bank of India?

The FATCA declaration form for Union Bank of India is a crucial document required to ensure compliance with U.S. tax regulations. It collects information from account holders regarding their tax residency and other relevant details. Submitting this form helps the bank report necessary information to the IRS.

-

How can I access the FATCA declaration form for Union Bank of India?

You can access the FATCA declaration form for Union Bank of India through the bank's official website or by visiting a local branch. Additionally, airSlate SignNow provides a seamless way to upload and eSign this form electronically, making the process hassle-free.

-

What are the benefits of using airSlate SignNow for the FATCA declaration form submission?

Using airSlate SignNow for your FATCA declaration form for Union Bank of India allows for quick and secure electronic signing. The platform enhances the document management process and reduces turnaround times, ensuring that your tax compliance needs are met efficiently and effectively.

-

Is there a fee associated with filing the FATCA declaration form for Union Bank of India?

Typically, there is no fee for submitting the FATCA declaration form for Union Bank of India itself. However, if you're using services like airSlate SignNow for document signing and management, you may encounter subscription options that allow for more comprehensive features.

-

Can I integrate airSlate SignNow with my existing systems for the FATCA declaration form?

Yes, airSlate SignNow offers various integrations with popular CRM and document management systems. This allows businesses to streamline their processes and efficiently handle the FATCA declaration form for Union Bank of India within their existing workflows.

-

What features does airSlate SignNow offer for managing the FATCA declaration form?

airSlate SignNow provides features such as eSigning, secure document storage, and automated reminders for the FATCA declaration form for Union Bank of India. These tools facilitate compliance and ensure that important deadlines are met without the hassle of manual tracking.

-

Are there any security measures in place when using airSlate SignNow for the FATCA declaration form?

Absolutely! airSlate SignNow implements top-tier security protocols, such as encryption and multi-factor authentication. This ensures that your information, including the FATCA declaration form for Union Bank of India, is protected throughout the signing and submission process.

Get more for Fatca Annexure Union Bank Of India

Find out other Fatca Annexure Union Bank Of India

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer