Tax Code DeclarationIR330July 2022Use This Form If 2022

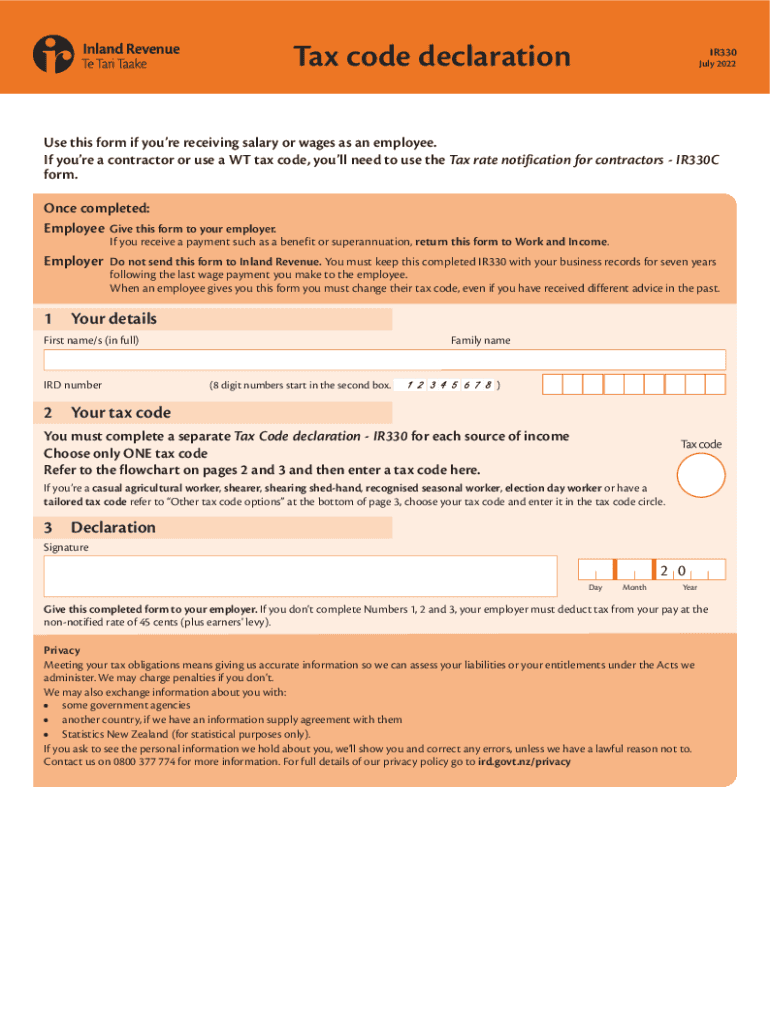

What is the Tax Code Declaration IR330?

The Tax Code Declaration IR330 is a crucial form used in the United States for tax purposes. This form allows employees to declare their tax code to their employer, ensuring that the correct amount of tax is withheld from their paychecks. The IR330 form is particularly important for individuals who may have multiple sources of income or who have recently changed their tax circumstances. By accurately completing this form, taxpayers can avoid overpaying or underpaying their taxes throughout the year.

Steps to Complete the Tax Code Declaration IR330

Completing the Tax Code Declaration IR330 involves several straightforward steps. Begin by gathering necessary personal information, including your Social Security number and details about your income sources. Next, indicate your tax code on the form, which can be found on your previous tax returns or obtained from the IRS. Ensure that you check the appropriate boxes regarding your tax situation, such as whether you are a new employee or have changed your tax status. Finally, review the completed form for accuracy before submitting it to your employer.

Legal Use of the Tax Code Declaration IR330

The Tax Code Declaration IR330 is legally binding when completed and submitted correctly. It complies with federal tax regulations, ensuring that employers withhold the correct amount of taxes from employee wages. To maintain the legal validity of the form, it is essential to provide accurate information and to update the form whenever there are changes in your tax situation. Failure to submit an accurate IR330 form may lead to incorrect tax withholding, resulting in potential penalties or unexpected tax liabilities.

Key Elements of the Tax Code Declaration IR330

Several key elements must be included in the Tax Code Declaration IR330 for it to be valid. These elements include:

- Personal Information: Full name, address, and Social Security number.

- Tax Code: The specific tax code that applies to your situation, which determines the withholding rate.

- Employment Status: Indicate if you are a new employee or if your tax situation has changed.

- Signature: A signature certifying that the information provided is true and correct.

How to Obtain the Tax Code Declaration IR330

The Tax Code Declaration IR330 can be easily obtained from several sources. Typically, employers provide this form during the onboarding process for new employees. Additionally, the form is available online through the IRS website or other tax-related resources. It is important to ensure that you are using the most current version of the form, as tax codes and regulations may change. If you are unsure about obtaining the form, consulting a tax professional can provide guidance.

Form Submission Methods

Submitting the Tax Code Declaration IR330 can be done through various methods, depending on your employer's preferences. Common submission methods include:

- Online Submission: Many employers now allow digital submission of the IR330 form through their payroll systems.

- Mail: You can print the completed form and send it to your employer's HR or payroll department.

- In-Person: Delivering the form directly to your employer can ensure that it is received promptly.

Quick guide on how to complete tax code declarationir330july 2022use this form if

Complete Tax Code DeclarationIR330July 2022Use This Form If effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Manage Tax Code DeclarationIR330July 2022Use This Form If on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to modify and electronically sign Tax Code DeclarationIR330July 2022Use This Form If with ease

- Obtain Tax Code DeclarationIR330July 2022Use This Form If and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Accent important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information carefully and click the Done button to save your modifications.

- Choose your preferred method for delivering your form, via email, text (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Tax Code DeclarationIR330July 2022Use This Form If to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax code declarationir330july 2022use this form if

Create this form in 5 minutes!

How to create an eSignature for the tax code declarationir330july 2022use this form if

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ir330 form and how can airSlate SignNow help?

The ir330 form is a New Zealand tax declaration form used by employers to calculate and withhold the correct amount of tax from employees' salaries. With airSlate SignNow, users can easily create, send, and eSign the ir330 form, ensuring compliance and accuracy in the submission process.

-

Is there a cost associated with using airSlate SignNow for the ir330 form?

Yes, while airSlate SignNow offers competitive pricing options, the cost of using the platform for the ir330 form varies based on the subscription plan you choose. Each plan provides different features beneficial for managing documents electronically, including the ir330 form.

-

What features does airSlate SignNow offer for the ir330 form?

airSlate SignNow offers features such as customizable templates, electronic signatures, and automated workflows specifically for forms like the ir330. This streamlines the process of getting documents signed and ensures that you can manage compliance more effectively.

-

Can I store my completed ir330 forms securely with airSlate SignNow?

Absolutely, airSlate SignNow provides secure cloud storage for all your documents, including completed ir330 forms. Your data is encrypted and backed up, ensuring that sensitive information is well protected.

-

Does airSlate SignNow integrate with other applications for the ir330 form?

Yes, airSlate SignNow seamlessly integrates with various applications including CRM systems and cloud storage services, making it easier to handle the ir330 form within your existing workflow. This enhances productivity and ensures that all relevant data is easily accessible.

-

How can airSlate SignNow assist in tracking the ir330 form status?

With airSlate SignNow, you can easily track the status of your ir330 forms in real-time. You'll receive notifications when a document is opened, signed, or completed, allowing for better management and follow-up actions if needed.

-

What benefits does airSlate SignNow provide for using the ir330 form?

Using airSlate SignNow for the ir330 form offers several benefits, including increased efficiency, reduced turnaround time, and enhanced accuracy. The platform simplifies the signing process and minimizes the potential for errors that can lead to compliance issues.

Get more for Tax Code DeclarationIR330July 2022Use This Form If

- Db2 ot medicare form

- Rugby union injury report form sports medicine australia

- Nat 3346 2012 2019 form

- Change of ownership form global micro animal

- Category a community impact statement form

- Pamd form 63 guarantee of title to buyer office of fair trading

- D2049 form

- Ablls social interactions tracking sheets trackingsheets form

Find out other Tax Code DeclarationIR330July 2022Use This Form If

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed