Tax Code DeclarationIR330March 2025Use This Form I 2025-2026

What is the Tax Code Declaration IR330?

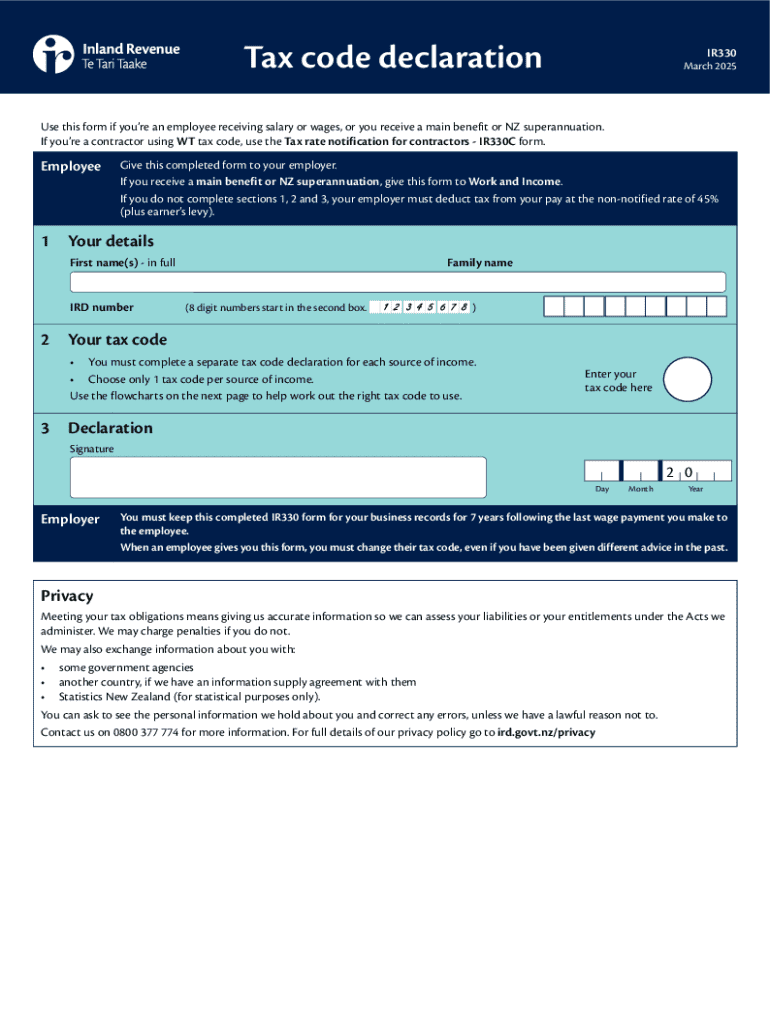

The Tax Code Declaration IR330 is a crucial form used in the United States for individuals to declare their tax code status. This form is essential for employers to determine the correct amount of tax to withhold from employees' wages. By accurately completing the IR330, individuals can ensure that they are taxed at the appropriate rate, which can help avoid underpayment or overpayment of taxes throughout the year.

Steps to Complete the Tax Code Declaration IR330

Completing the Tax Code Declaration IR330 involves several straightforward steps:

- Begin by downloading the form from an official source or obtaining a physical copy from your employer.

- Fill in your personal details, including your name, address, and Social Security number.

- Indicate your tax code status based on your employment situation and any applicable deductions.

- Review the completed form for accuracy to ensure all information is correct.

- Submit the form to your employer or the relevant tax authority as instructed.

How to Obtain the Tax Code Declaration IR330

The Tax Code Declaration IR330 can be obtained through various means. Individuals can download the form from official government websites or request it directly from their employer. It's important to ensure that you are using the most current version of the form, as tax codes and regulations can change. If you have difficulty accessing the form online, consider visiting local tax offices or libraries where printed copies may be available.

Legal Use of the Tax Code Declaration IR330

The legal use of the Tax Code Declaration IR330 is primarily for tax withholding purposes. Employers are required to collect this information to comply with federal tax laws. Providing accurate information on this form helps ensure that employees are taxed correctly according to their financial situation. Misuse or inaccurate completion of the form can lead to penalties for both the employee and the employer.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Code Declaration IR330 are typically aligned with the start of employment or when there are changes in personal circumstances that affect tax withholding. It is advisable to submit the form as soon as possible to ensure that the correct withholding begins with the first paycheck. Additionally, employees should review and, if necessary, update their declaration annually or when significant life events occur, such as marriage or the birth of a child.

Required Documents

When completing the Tax Code Declaration IR330, individuals may need to provide certain documents to support their claims. These documents can include:

- Proof of identity, such as a driver's license or passport.

- Social Security card for verification.

- Any relevant tax documents that indicate previous tax codes or deductions.

Having these documents on hand can facilitate a smoother completion process and ensure accuracy.

Handy tips for filling out Tax Code DeclarationIR330March 2025Use This Form I online

Quick steps to complete and e-sign Tax Code DeclarationIR330March 2025Use This Form I online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Obtain access to a HIPAA and GDPR compliant solution for optimum simpleness. Use signNow to e-sign and send Tax Code DeclarationIR330March 2025Use This Form I for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct tax code declarationir330march 2025use this form i

Create this form in 5 minutes!

How to create an eSignature for the tax code declarationir330march 2025use this form i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Code DeclarationIR330March 2025Use This Form I?

The Tax Code DeclarationIR330March 2025Use This Form I is a crucial document for employees in New Zealand to declare their tax code to their employer. This form ensures that the correct amount of tax is deducted from your earnings. Using airSlate SignNow, you can easily fill out and eSign this form, streamlining the process.

-

How can airSlate SignNow help with the Tax Code DeclarationIR330March 2025Use This Form I?

airSlate SignNow simplifies the process of completing the Tax Code DeclarationIR330March 2025Use This Form I by providing an intuitive platform for document management. You can quickly fill out the form, eSign it, and send it directly to your employer, ensuring compliance and accuracy in your tax declarations.

-

Is there a cost associated with using airSlate SignNow for the Tax Code DeclarationIR330March 2025Use This Form I?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost-effective solution allows you to manage documents like the Tax Code DeclarationIR330March 2025Use This Form I without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Tax Code DeclarationIR330March 2025Use This Form I?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the Tax Code DeclarationIR330March 2025Use This Form I. These tools enhance efficiency and ensure that your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for the Tax Code DeclarationIR330March 2025Use This Form I?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Tax Code DeclarationIR330March 2025Use This Form I alongside your existing tools. This seamless integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the Tax Code DeclarationIR330March 2025Use This Form I?

Using airSlate SignNow for the Tax Code DeclarationIR330March 2025Use This Form I provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are processed quickly and securely, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling the Tax Code DeclarationIR330March 2025Use This Form I?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the Tax Code DeclarationIR330March 2025Use This Form I. The platform employs advanced encryption and security protocols to protect your sensitive information throughout the signing process.

Get more for Tax Code DeclarationIR330March 2025Use This Form I

- Form 7 serious illnessutility

- Drug control program complaint form mass gov mass

- Adult health history form for new patients boston medical center bmc

- Outside mammogram films to dma radiology release form

- North shore pediatrics form

- Reimbursement transmittal claim form ww2 mapfrepr net

- Pediatric patient information the ultrawellness center of mark

- County disposition personal property form

Find out other Tax Code DeclarationIR330March 2025Use This Form I

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document